Bitcoin is currently trading around $71,000, marking a nearly 9% increase in the past 24 hours.

Bitcoin futures market shows no signs of overheating so far

According to an analyst’s explanation in a CryptoQuant Quicktake post, BTC’s funding rate has remained relatively low recently. The “funding rate” refers to an indicator that tracks the periodic fees traders on the derivatives market are paying each other.

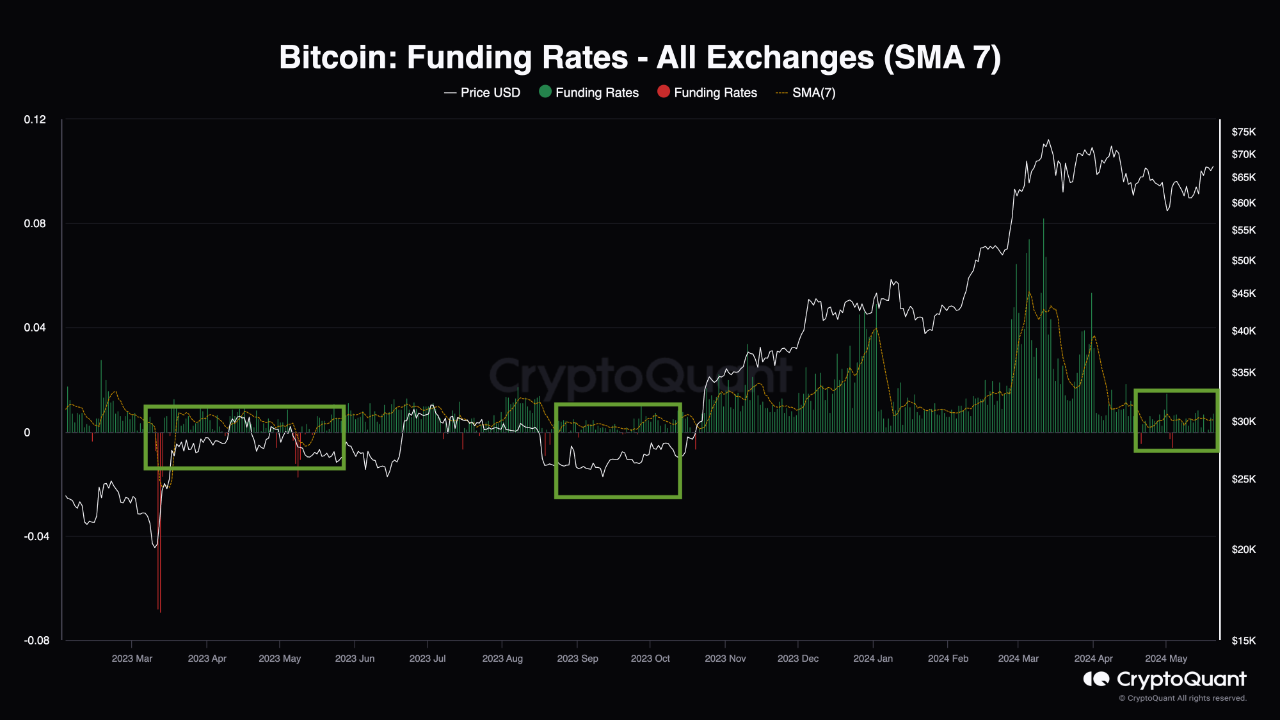

When this metric is positive, it means that long position holders are paying higher fees to short sellers to maintain their positions. Such a trend indicates a generally bullish sentiment in the market. Conversely, a negative value of this indicator suggests that short sellers dominate the market, indicating a bearish sentiment among derivative users. Now, here is a chart displaying the data on Bitcoin’s funding rate, along with its 7-day simple moving average (SMA) over the past year:

From the chart above, it is evident that Bitcoin’s funding rate has mostly stayed positive for a while. This makes sense as the asset’s price has been rising over the past few months, leading to an optimistic outlook among investors.

However, historically, very positive funding rates have been a bearish signal for cryptocurrency prices. This is because assets tend to move in the opposite direction of the majority’s expectations, and the likelihood of a reversal increases as this optimism becomes more pronounced.

At higher values of the indicator, there is a strong bullish sentiment, making peaks in the coin more likely. As evident from the chart, Bitcoin’s all-time high (ATH) in March was also set alongside a significant spike in this metric.

The initial sentiment remained considerably bullish during the consolidation phase following this peak, but recently, the metric has observed a cooling-off period. Bitcoin’s funding rate remains positive, but its magnitude is now much smaller. Specifically, the 7-day moving average (MA) of the indicator is currently fluctuating at just 0.45%, significantly lower than the 3% to 4% levels seen in March. So far, this metric hasn’t spiked in tandem with the cryptocurrency’s recovery past $68,000, potentially indicating that sentiment hasn’t overheated yet. As noted by the quant:

Related: Bitcoin Trades at $66,000, Repeating Historical Bullish Pattern

In previous “dead-cat-bounce” scenarios, the funding rate was higher, with the rate in March 2021 near 3% before a drop to $30,000, and the rate in November 2021 between 0.7% and 0.8% before the 2022 bear market.

OMN

OMN  BTC

BTC  ETH

ETH  USDT

USDT  XRP

XRP  BNB

BNB  SOL

SOL  USDC

USDC  TRX

TRX  DOGE

DOGE

Great job

Wow 😳, wonderful 👍