Bitcoin (BTC) is currently trading at $66,000, marking an impressive 8% increase over the past week. Concerns about a potential sell-off during the halving period are diminishing.

Bitcoin ETFs have also seen significant inflows this week, indicating a clear rise in demand. This surge to new highs has alleviated selling pressure in recent weeks, but can the bulls sustain this momentum?

Assessing the Bulls’ Ammo

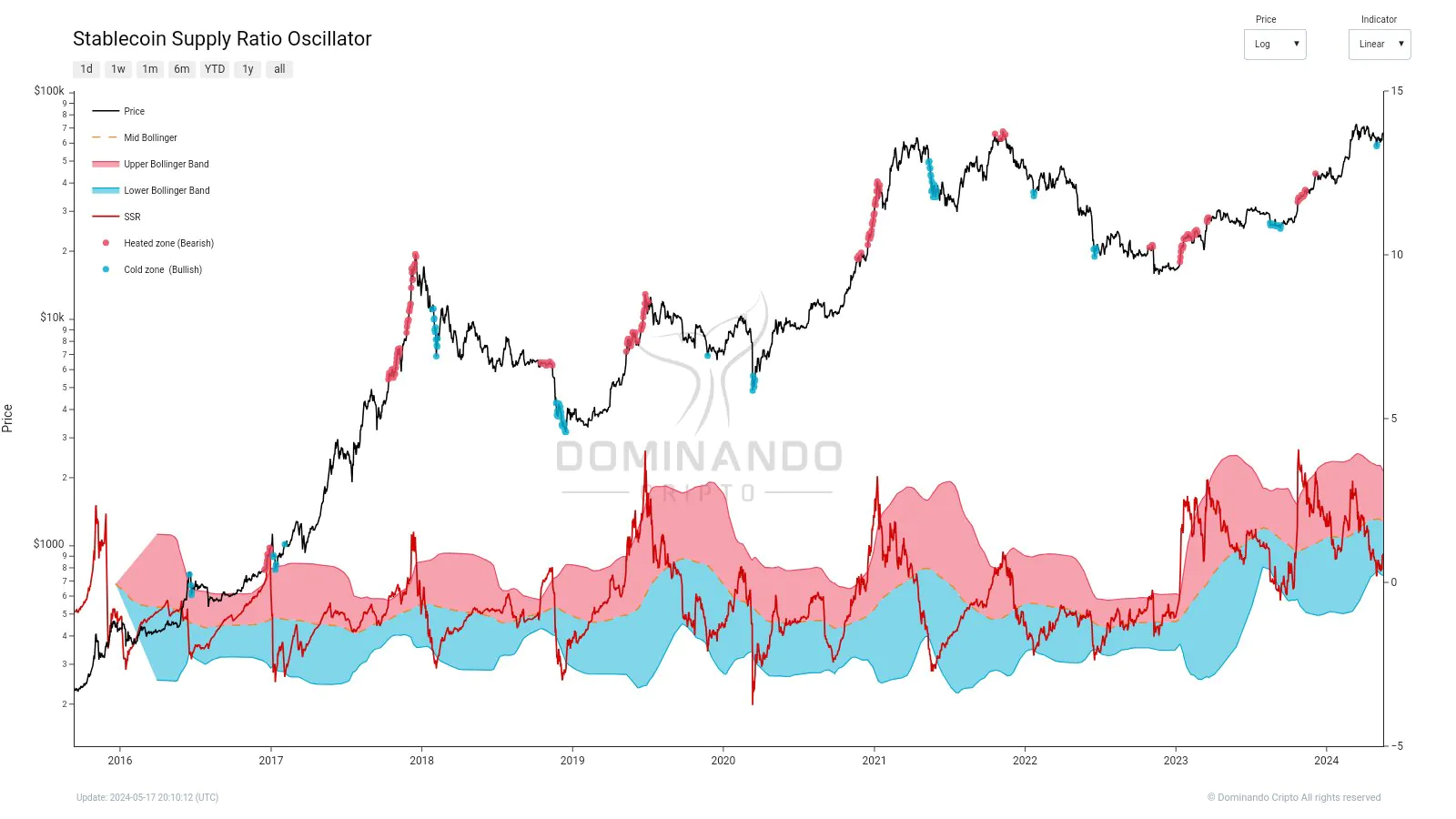

A crypto analyst highlighted in a post on X (formerly Twitter) that the Stablecoin Supply Ratio (SSR) oscillator indicates a bullish trend. This technical indicator evaluates the market sentiment of stablecoins versus Bitcoin over time.

It is calculated by taking the current SSR and its difference from the 200-period simple moving average. This value is then divided by its standard deviation over the same period to derive a set of Bollinger Bands (BB).

The current supply of stablecoins is plotted within these bands to provide traders with insights into market sentiment. When the SSR drops below the lower Bollinger Band, it signals low stablecoin dominance and potential bullish sentiment.

The chart highlights how the market tends to pull back when the oscillator overheats. Conversely, breaking below the lower bands often presents strong long-term buying opportunities. As with any technical indicator, the SSR oscillator isn’t foolproof, and each signal doesn’t guarantee the expected price movement.

Related: Market Volatility Ahead of $2.1 Billion BTC and ETH Options Expiry

We are still in a “buy” signal

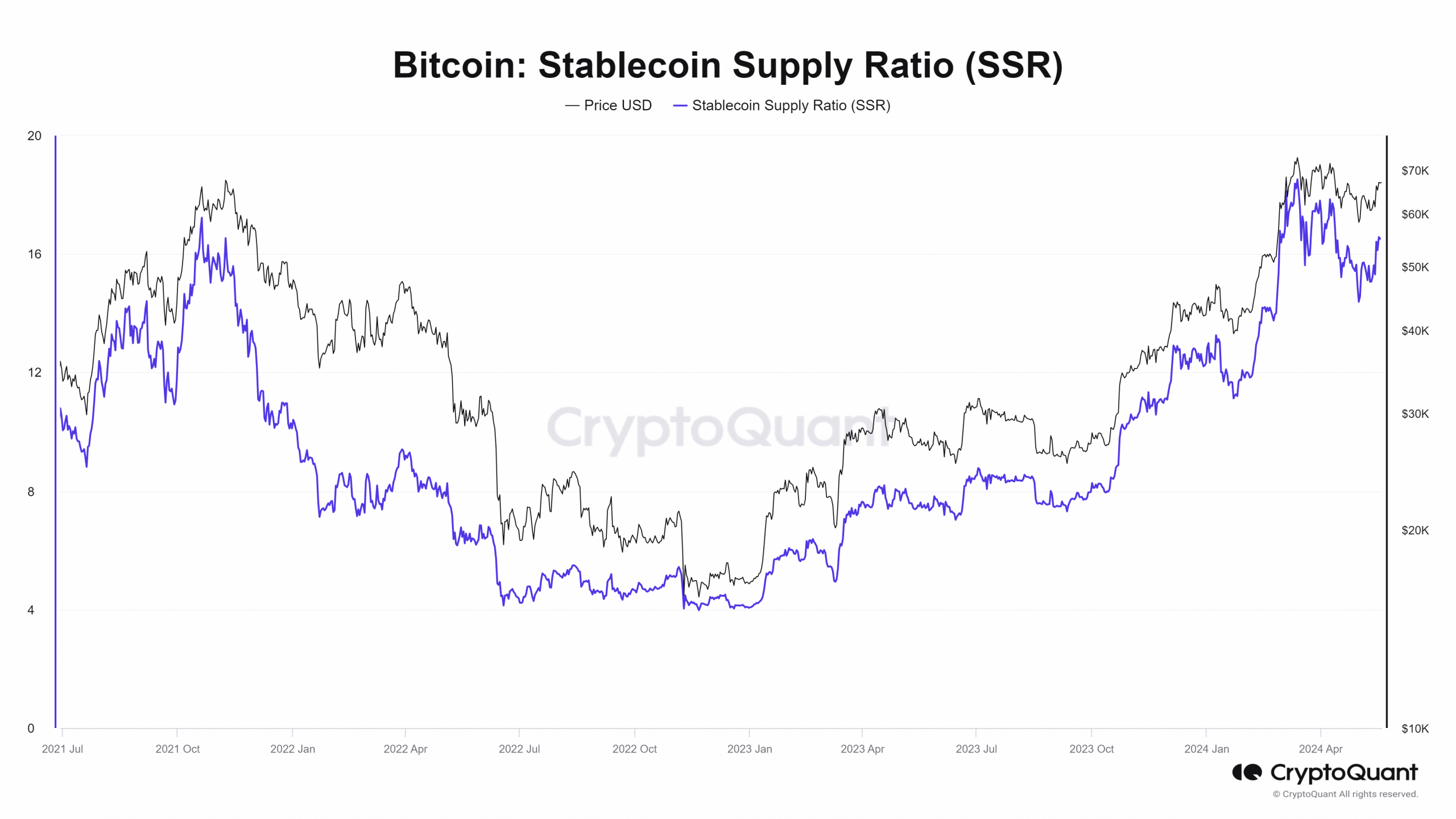

Source: CryptoQuant

The stablecoin supply ratio is below the 200-period SMA but above the lower BB. It dipped below this band in early May when Bitcoin was at $56,000, but the price quickly rebounded.

The oscillator remains near the lower BB, suggesting further upside potential. The SSR has also been trending downward over the past month. This indicator has been on a significant uptrend since October 2023, with periods of stagnation or pullbacks like those in early January and mid-May.

A month after the January pullback, Bitcoin’s price surged past the $46,000 resistance. In the next 2-4 weeks, we might see Bitcoin rally beyond the $73,000 resistance.

OMN

OMN  BTC

BTC  ETH

ETH  USDT

USDT  XRP

XRP  BNB

BNB  SOL

SOL  USDC

USDC  TRX

TRX  DOGE

DOGE

Nice one