After hitting an all-time high of $93,400 yesterday, Bitcoin corrected and fell to $86,200, before recovering to its current price. An analyst from CryptoQuant, who goes by the pseudonym Darkfost, highlighted an important trend that is occurring alongside Bitcoin’s new high.

Investors have been withdrawing large amounts of Bitcoin from Binance, with over 7,500 BTC being transferred from the exchange. This is also the second-largest Bitcoin withdrawal this year. The move could signal a shift in investor sentiment, indicating confidence in the long-term value of the asset as they move Bitcoin from exchanges to cold storage.

Bitcoin’s decline was also driven by the announcement by the US Federal Reserve, which hinted that it might not cut interest rates further, contrary to expectations from crypto investors.

“The economy is not sending any signals that we need to cut interest rates in a hurry,” Federal Reserve Chairman Jerome Powell said in a speech in Dallas, Texas, on November 14.

Powell’s statement came after two recent rate cuts in September and November, by 50 and 25 basis points, respectively. The Fed’s next interest rate decision is scheduled for December 18.

“The strength that we are seeing in the economy today gives us the ability to approach our decisions cautiously. Ultimately, the path of the policy rate will depend on how the incoming data and the economic outlook evolve,” Powell added.

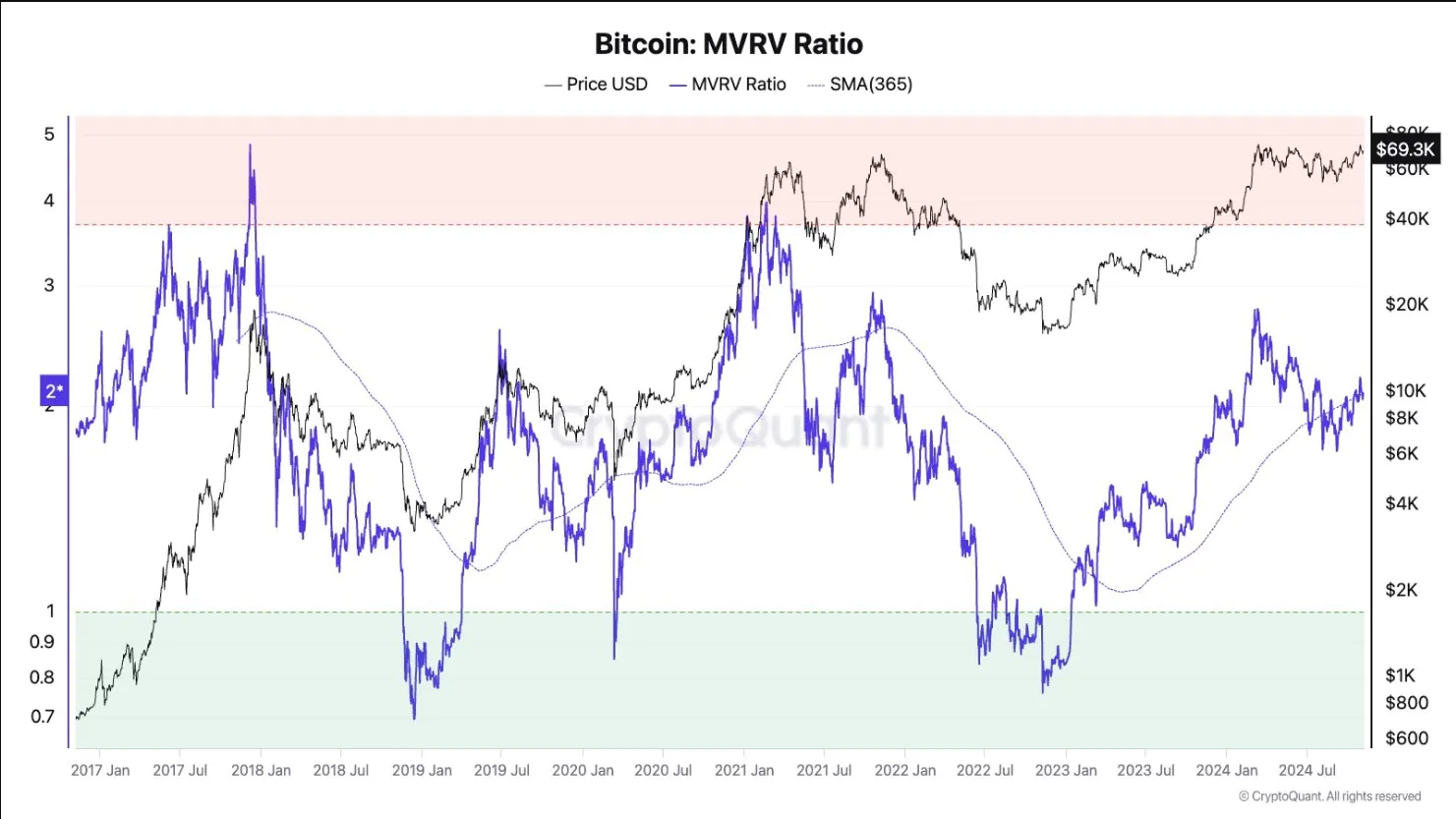

One measure of Bitcoin’s performance during this bull market is the Market Value to Realized Value (MVRV) ratio, which compares Bitcoin’s market capitalization to the actual value of its holdings. MVRV helps assess whether Bitcoin is overvalued or undervalued relative to its historical price trend. Currently, Bitcoin’s MVRV ratio has risen to 2.58, indicating that many investors are taking profits at current prices.

Read more: PEPE Surges 75% in 24 Hours Following Coinbase Listing

Historically, high MVRV levels have been associated with increased market interest, but can also lead to price corrections. High MVRV ratios represent significant profits, but require caution as profit-taking can occur at any time.

OMN

OMN  BTC

BTC  ETH

ETH  USDT

USDT  XRP

XRP  BNB

BNB  SOL

SOL  USDC

USDC  TRX

TRX  DOGE

DOGE