Bitcoin is currently trading around $100,000, with signs that the bullish trend could continue.

The exchange whale ratio, a measure of whale activity, shows the proportion of large Bitcoins deposited onto exchanges. Over the past few weeks, the index has dropped sharply, suggesting that whales are no longer dumping Bitcoin and are instead holding on to their holdings.

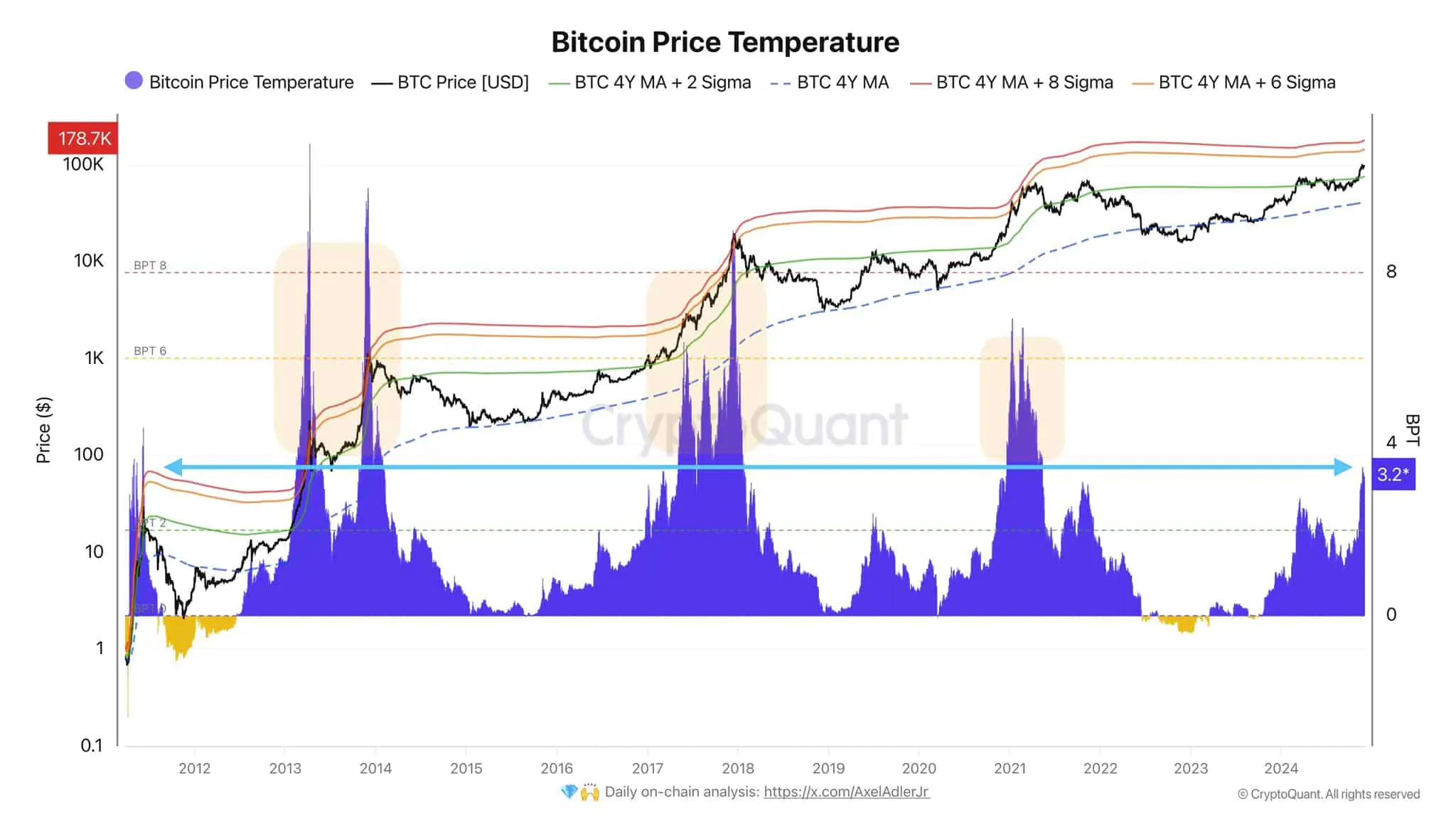

The Bitcoin Price Temperature, a key market indicator, is currently at 3.2 degrees – an early warning sign of impending sharp price swings. Historically, readings between 6 and 8 degrees have been associated with significant parabolic price increases.

Prominent analyst Axel Adler believes that if the Bitcoin Price Temperature hits 8 degrees, the Bitcoin price could reach $178,000 by 2025. Currently, at 3.2 degrees, the market is still in the early stages of the bull cycle.

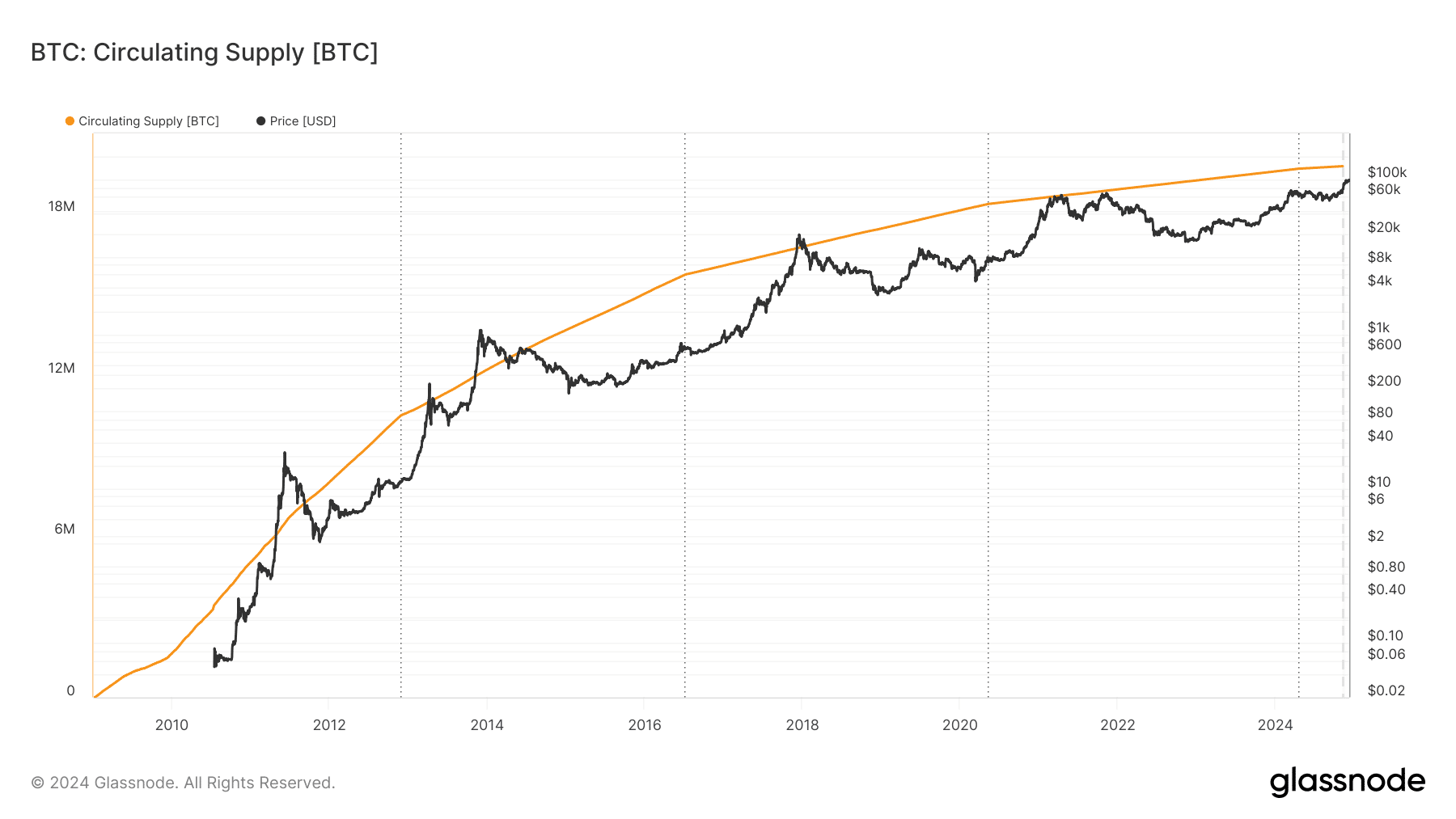

The halving event in 2024 will reduce the amount of Bitcoin issued to just 3.125 BTC per block, marking a major drop in new supply. Traditionally, this scarcity effect will be more pronounced 12–18 months after the halving event, as demand increases amid increasingly limited supply.

The data shows a consistent pattern: the years following halving events such as 2013, 2017, and 2021 all saw Bitcoin prices set new records as circulating supply peaked.

In 2024-2025, as the circulating supply approaches the 21 million Bitcoin cap, this supply scarcity is expected to fuel a strong price rally, especially as demand from institutional spot buyers continues to increase.

Bitcoin’s on-chain metrics are currently showing a clear accumulation trend. The illiquid supply – the amount of Bitcoin locked up and not circulating on the market – has reached an all-time high of 14.8 million BTC, accounting for 75% of the total circulating supply.

Read more: SEC Rejects Applications for Spot Solana ETFs

Notably, the illiquid supply has increased by 185,000 BTC in just 30 days, marking the second-largest accumulation increase in 2024. This reflects the dominance of long-term investors, further reinforcing the stability and growth potential of the market.

OMN

OMN  BTC

BTC  ETH

ETH  USDT

USDT  XRP

XRP  BNB

BNB  SOL

SOL  USDC

USDC  TRX

TRX  DOGE

DOGE