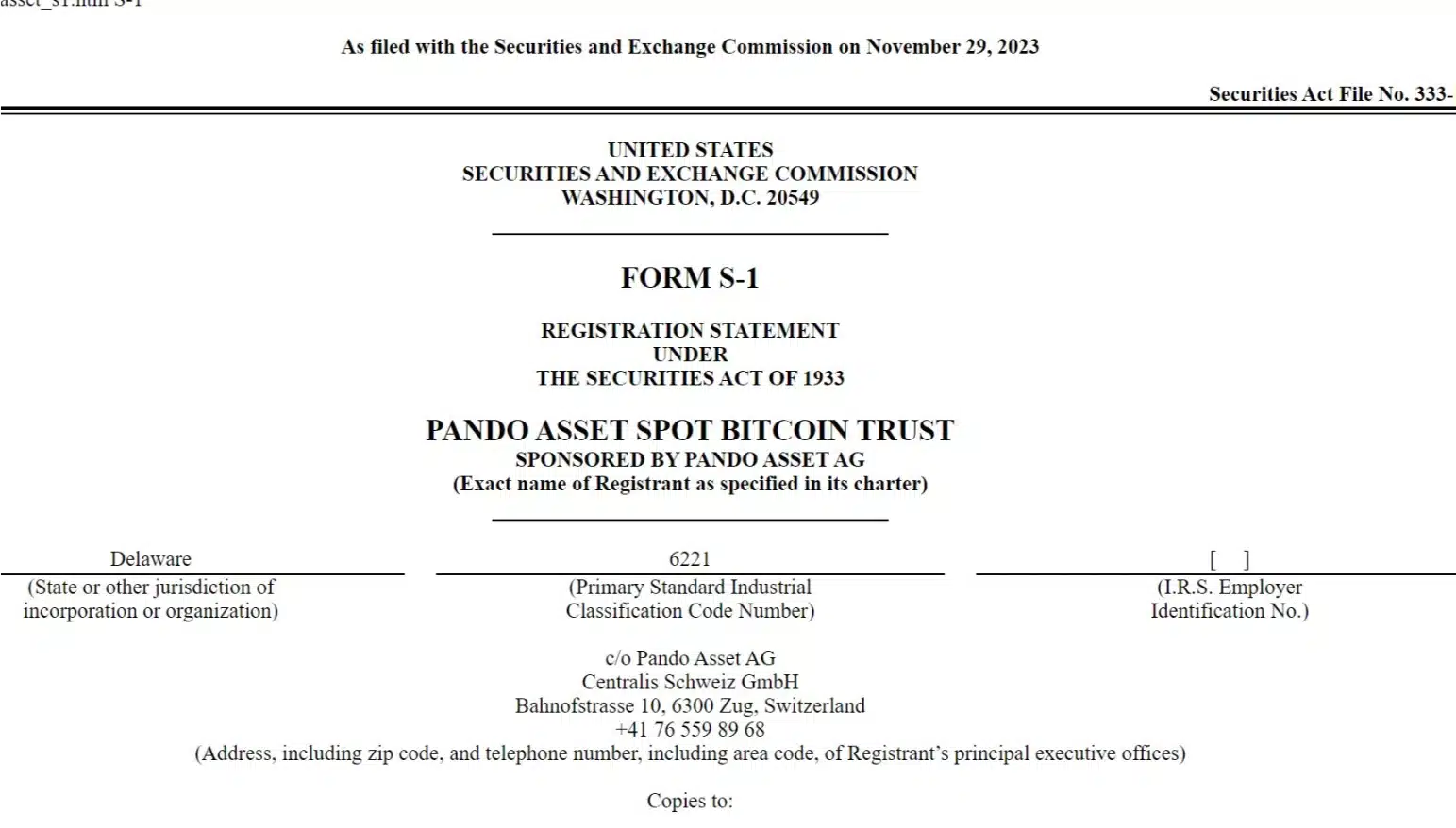

The company, renowned for its provision of crypto Exchange-Traded Products (ETPs) in the European market, has taken a significant step by submitting a fresh application to the US Securities and Exchange Commission (SEC), utilizing the S-1 form for this purpose.

In a strategic move, Pando Assets AG is set to introduce the Pando Asset Spot Bitcoin Trust on the Cboe BZX Exchange, with leading American cryptocurrency exchange Coinbase selected to act as the custodian for the proposed ETF. Notably, the firm plans to leverage the CME’s CF Bitcoin Reference Rate for accurate Bitcoin pricing, as stated on its official website.

Pando Assets AG has already established a presence in the European market, offering ETPs that mirror the performance of major cryptocurrencies to traders on the SIX Swiss Exchange.

As the influx of applications for spot Bitcoin ETFs continues, the SEC remains cautious in granting approvals, with no applications receiving the green light thus far. Despite this, a prevailing sentiment within the crypto community anticipates a mass approval spree once the regulator reaches a decision.

Notably, Bloomberg ETF analysts Eric Balchunas and James Seyffart express optimism, assigning a 90% probability of the SEC approving spot BTC ETFs. Balchunas goes on to predict that the coveted license for a spot Bitcoin ETF will be granted by January 10, 2024, underscoring the likelihood of additional applications being submitted to the SEC before the anticipated approval date.

I've gotten a lot of questions regarding my current view on Spot #Bitcoin ETFs over the last couple weeks. This is the first section of the note I put out yesterday with @EricBalchunas.

TLDR: Our view hasn't changed much https://t.co/dRAm5IsdQf pic.twitter.com/Htsi3n2XxV

— James Seyffart (@JSeyff) October 13, 2023

The recent filing by Pando Assets reaffirms the positive outlook expressed by Bloomberg ETF analysts regarding the expanding landscape of the ETF market and increased interest from asset managers. Notably, this sentiment aligns with ongoing developments, including pivotal meetings held between the SEC’s Trading and Markets division and several applicants vying for approval of spot Bitcoin ETFs. These interactions serve as a tangible indication that the regulatory body is actively engaged in evaluating and processing these applications.

Related: Futures Market Propels Bitcoin Price Surge to $40K USD

In a noteworthy instance, Grayscale engaged in discussions with the SEC just a week ago, delving into various aspects, including the implementation of a Transfer Agency and Service Agreement with BNY Mellon for its prospective spot Bitcoin ETF. Simultaneously, BlackRock, another key player in the ETF space, reportedly had discussions with the regulator. The agenda encompassed diverse topics, prominently featuring deliberations on the redemption models for the envisaged ETF.

It has been disclosed that BlackRock is opting for an in-kind redemption model rather than a cash create approach. However, in response to SEC requirements, the investment management giant has diligently submitted a revised version of its proposal. This move underscores the dynamic nature of the ongoing dialogue between applicants and the SEC, reflecting a concerted effort to address regulatory considerations and move closer to the eventual realization of spot Bitcoin ETFs in the market.

BTC

BTC  ETH

ETH  USDT

USDT  SOL

SOL  BNB

BNB  USDC

USDC  XRP

XRP  DOGE

DOGE  TON

TON  ADA

ADA