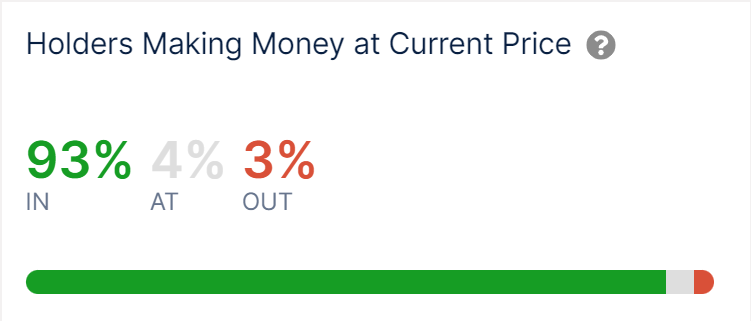

93% of Bitcoin Addresses Are Profitable

As of July 22, Bitcoin remains steady, down about 8% from its all-time high of approximately $74,000. Data from IntoTheBlock indicates that 93% of all addresses are in the green at the current spot rate.

This signifies a robust recovery, especially following the significant sell-off in June and early July 2024, when prices plunged to a low of $53,500 before rebounding.

At the current valuation, a few BTC holders are experiencing losses. These entities likely purchased at around $72,000 or the all-time high, anticipating a surge to $100,000.

In reality, Bitcoin had dropped by as much as 21% from its peak to its lowest point in July 2024 before finding support. The sell-off also forced some holders to exit at a loss.

The rebound above $67,000 has restored confidence among Bitcoin holders, particularly short-term holders (STH). STH refers to entities that have purchased BTC within the last 155 days. Once prices surpassed $63,000, holders in this category began to profit, thereby reducing selling pressure.

Miners Accumulate BTC as Uptrend Solidifies

Interestingly, as Bitcoin’s price surged, miners also refrained from selling.

Throughout July, data from IntoTheBlock revealed that miners have been actively accumulating BTC. Leading mining farms like Mara Digital and Riot Blockchain amassed over 4,500 BTC in just the past three weeks.

This positive sentiment and the expectation of further BTC price increases have influenced their stock prices. Last week, IntoTheBlock’s data showed that shares of MARA and RIOT surged by more than 30%. Investors have affirmed these publicly traded mining companies, indicating that they will continue to expand in the coming weeks.

Simultaneously, entities holding at least 1,000 BTC have been rapidly accumulating. By July 19, the amount of BTC held by this group reached a two-year high.

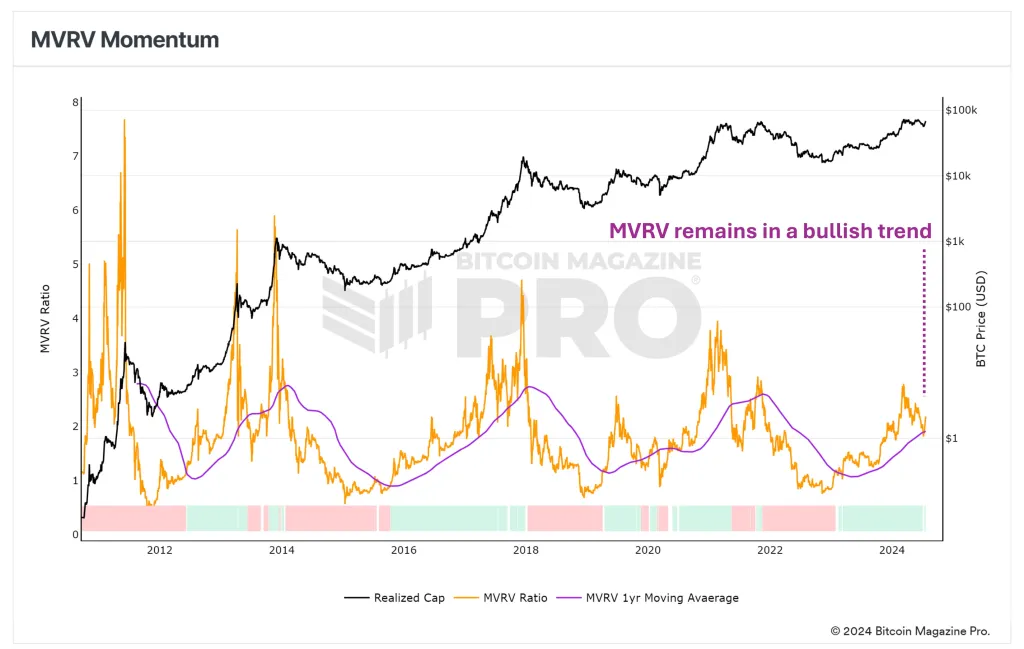

In this context, Bitcoin’s Market Value to Realized Value (MVRV) ratio, used to measure profitability, is on the rise. An analyst noted that as of July 22, the MVRV had bounced off its one-year moving average, confirming the validity of BTC’s upward trend.

OMN

OMN  BTC

BTC  ETH

ETH  USDT

USDT  XRP

XRP  BNB

BNB  SOL

SOL  USDC

USDC  DOGE

DOGE  TRX

TRX