Bitcoin has surged to $68,000, dominating the entire cryptocurrency market. The altcoin market may reach a pivotal point this week as the US Ethereum [ETH] spot ETF starts trading. As the largest altcoin, ETH’s performance could set the pace for the altcoin sector.

However, renowned crypto analyst Benjamin Cowen suggests that the altcoin season might slow down, with Bitcoin [BTC] potentially maintaining market dominance amid the possibility of the Fed cutting interest rates in September.

According to Cowen, BTC’s current dominance mirrors the 2019 pattern, two months before the Fed reduced interest rates, during which altcoins lagged behind.

“BTC also experienced a significant surge then, and ALT couldn’t keep up. It seems similar today, potentially two months before the first rate cut.”

#BTC dominance monthly candle reminds me of May 2019, which was 2 months before the Fed cut rates last cycle.

BTC also had an explosive move back then too, and ALTs could just not keep up.

Similar candle today, potentially 2 months before the 1st rate cut. pic.twitter.com/4s831UbBAk

— Benjamin Cowen (@intocryptoverse) July 21, 2024

Will the Ethereum ETF trigger an altcoin season? This could spell bad news for cryptocurrency investors hoping for a rebound in the altcoin market, which saw a significant decline in June.

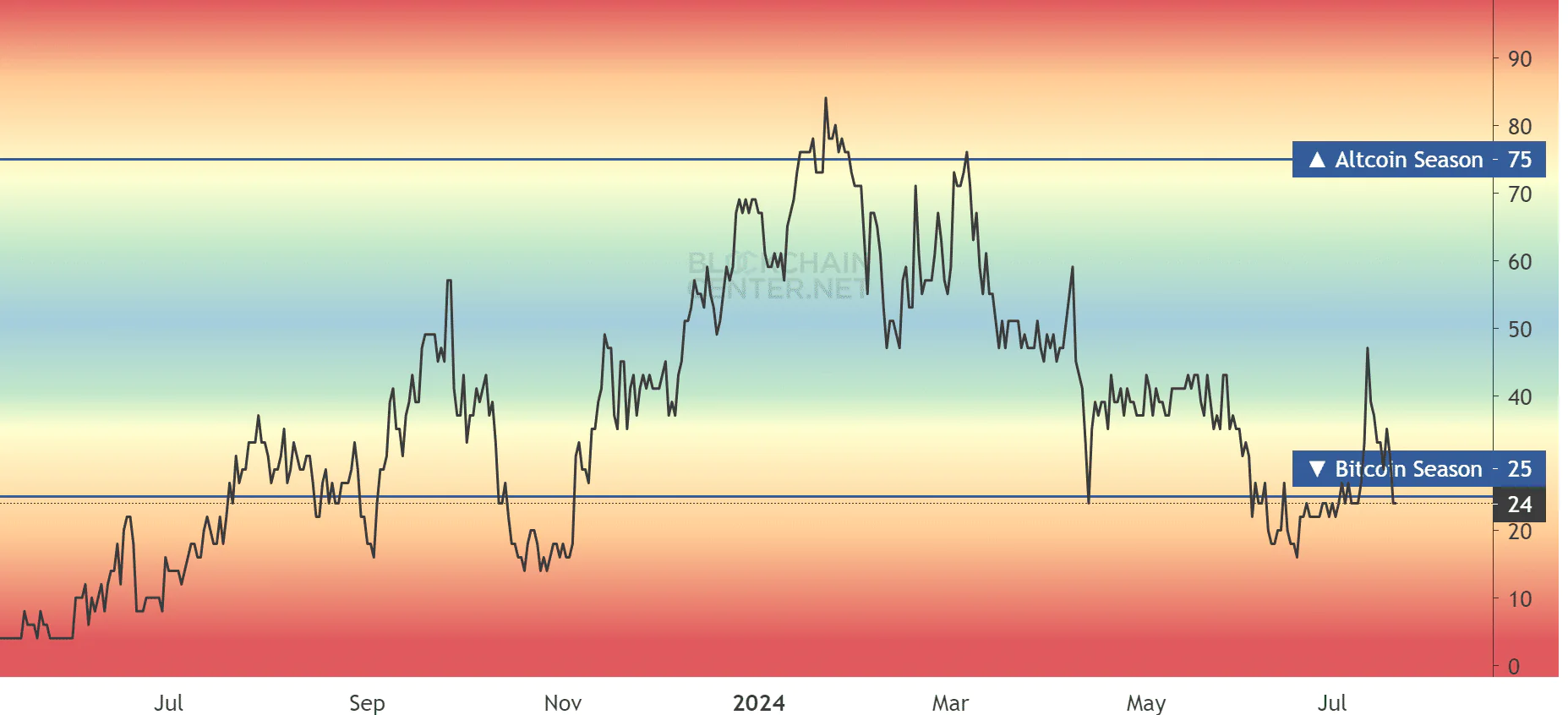

Additionally, the Altcoin Season Index indicates that the altcoin season has not yet begun at the time of writing. According to the index, the first half of 2024 has been a Bitcoin season. If Cowen’s predictions hold true, this pattern might persist.

However, BTC Dominance is just one way to assess the altcoin season. Some analysts, including the founders of Glassnode, suggest another method: the ETH/BTC ratio.

The ETH/BTC ratio tracks the performance of ETH relative to BTC. According to the Glassnode founders, who use the username Negentropic on X, this ratio is expected to inflate and potentially trigger an altcoin season if the US Ethereum spot ETF starts trading.

These products are anticipated to launch and begin trading this week.

An evaluation of the ETH/BTC ratio shows it surged following the partial approval of the ETH ETF in May. However, the ratio has not yet broken out of its downward trend, represented by a descending channel (in white). It remains to be seen how the ETH/BTC ratio will react and whether it can trigger an altcoin season. Thus, BTC Dominance and the ETH/BTC ratio are the key metrics to watch in assessing the potential impact on altcoins.

OMN

OMN  BTC

BTC  ETH

ETH  USDT

USDT  XRP

XRP  BNB

BNB  SOL

SOL  USDC

USDC  TRX

TRX  DOGE

DOGE