Bitcoin (BTC) price is once again surging, surpassing the $70k threshold. However, in the short term there may be a downward adjustment as the price of this cryptocurrency is fluctuating in a parallel price channel.

Let’s analyze the situation of BTC in more detail to forecast developments this week.

Bitcoin struggling at $71K

Bitcoin is currently aiming for a price of $71k. According to CoinMarketCap, over the past week, BTC has recorded an impressive growth of more than 6%, and in the past 24 hours alone, the price has increased by 2.4%.

This bullish momentum has helped Bitcoin remain stable above the key $70k mark. At the moment, Bitcoin is trading at $70,768.46 with a total market capitalization of over $1.39 trillion. However, investors need to be cautious and not rush to rejoice because there is a possibility that the price will soon adjust.

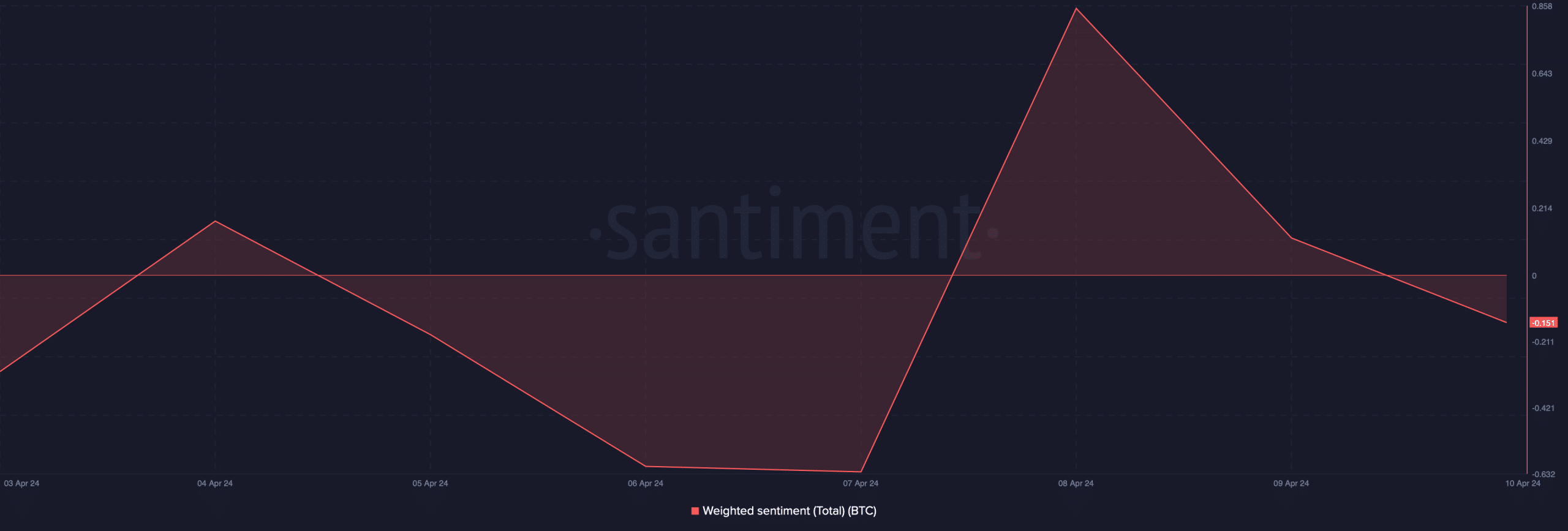

Source: Santiment

According to famous cryptocurrency analyst Crypto Tony, a recent post on his Twitter said that BTC price is in a parallel price channel. If this is accurate, Bitcoin may soon correct its price before starting a new bull cycle.

Based on this analysis, the price is likely to drop towards $63K in the upcoming correction.

Commenting on market sentiment, after the soaring period, data from Santiment shows that investor sentiment towards BTC has turned negative. Being cautious about upcoming fluctuations is essential for those investing in Bitcoin.

Important on-chain signals

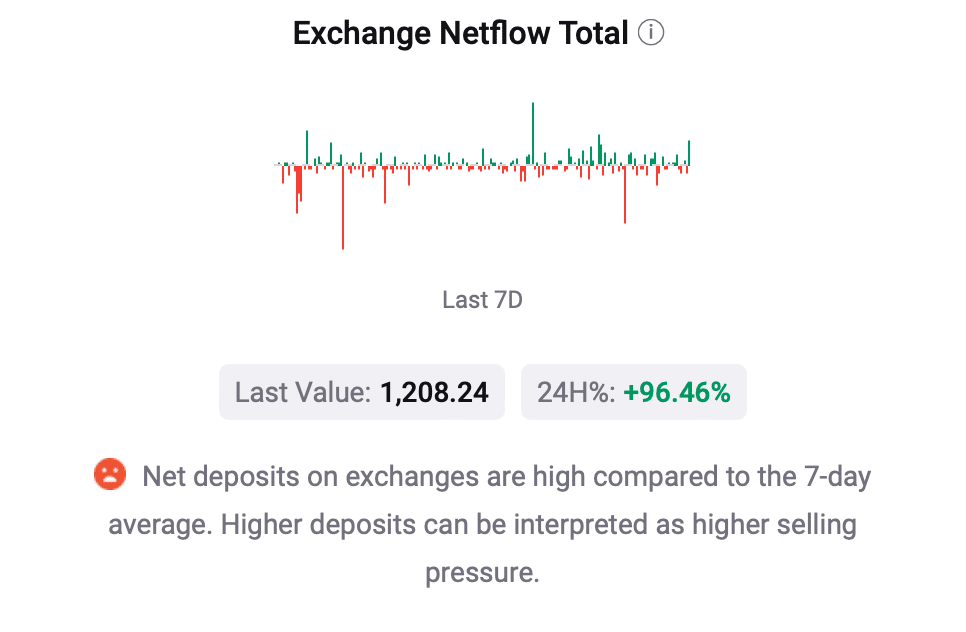

Source: CryptoQuant

To analyze the possibility that Bitcoin (BTC) price could return to a downtrend, looking at on-chain metrics is important. According to data from CryptoQuant, Bitcoin’s aSORP (Adjusted SOPR – Adjusted Seller’s Profit Ratio) index is in the red, indicating that many investors are selling to take profits. Amid a rising market, this could signal a temporary market top.

Another indicator is NULP (Net Unrealized Profit/Loss), which shows that investors are currently in a period of high confidence with the amount of unrealized profits being high. This could also suggest that the market could face selling pressure as these investors decide to take profits.

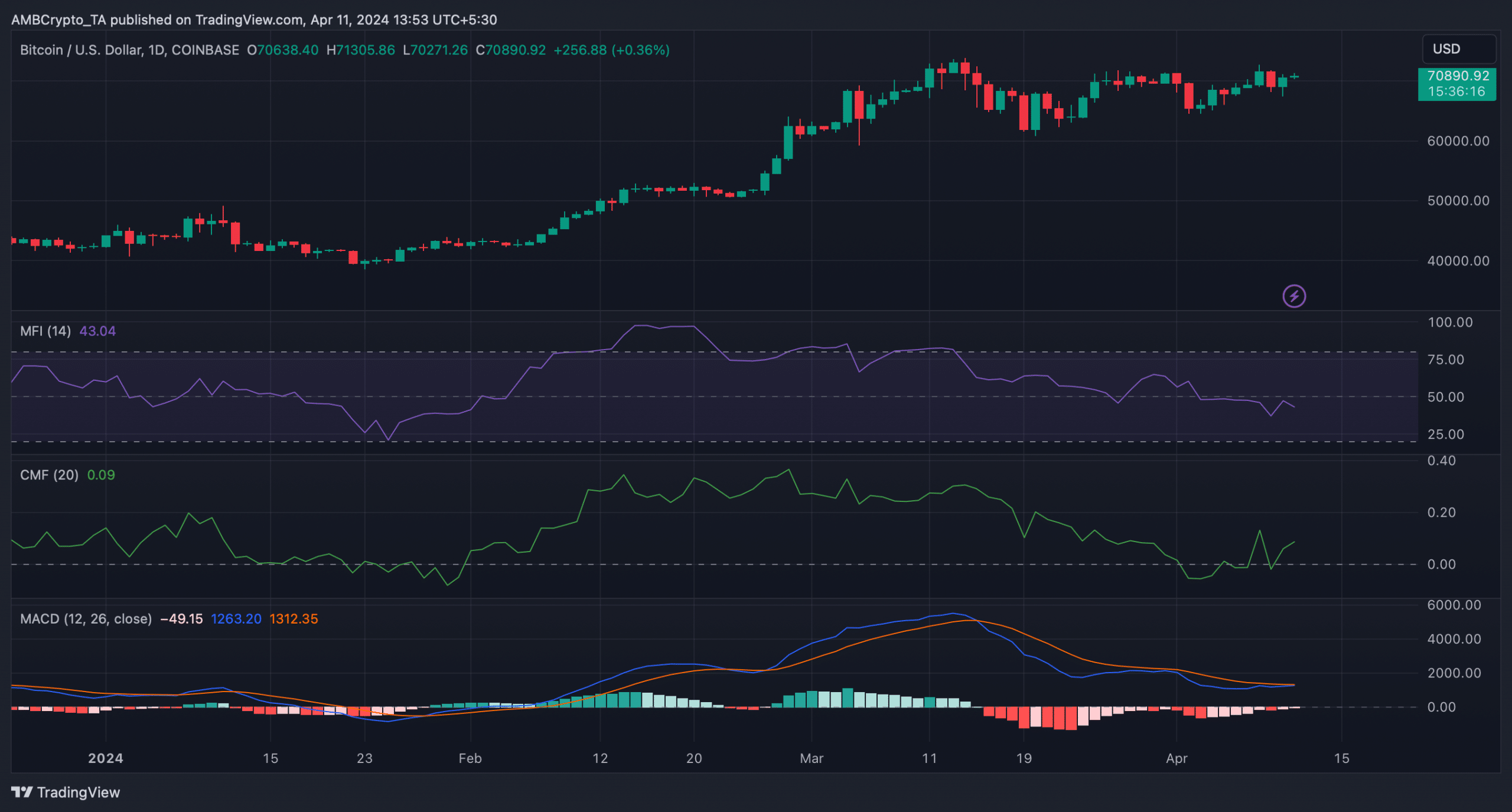

Source: TradingView

Additionally, the increase in net deposits on exchanges – above the average over the past seven days – also reflects increased selling pressure, which could lead to price declines.

Related: Bitcoin Rebounds Above $70,000 as Halving Event Approaches

BTC daily chart analysis also provides insight into the current trend. BTC’s Money Flow Index (MFI) has shown a decline in price, signaling a high possibility of a price correction. However, the MACD (Moving Average Convergence Divergence) indicator showed a positive bullish crossover, while the Chaikin Money Flow (CMF) also favored the buyers as the indicator moved north. These indicators show that although there are short-term bearish signs, the long-term signal remains positive.

These analyzes suggest that investors should closely monitor on-chain metrics and charts to make smart investment decisions amid the volatile Bitcoin market.