Bitcoin dropped to as low as $67,700 yesterday before rebounding and is currently trading at $70,500. As the cryptocurrency industry anticipates the next halving event, market analysts and investors are closely observing the potential impacts on Bitcoin’s price.

Bitcoin Remains Bullish Before the Halving

The halving, a reward reduction program for miners, is expected to occur on April 20. It will cut the reward from 6.25 BTC to 3.125 BTC, effectively reducing Bitcoin’s inflation rate from 1.7% to 0.85% annually.

Historically, Bitcoin halvings have been associated with short-term volatility but tend to lead to long-term price appreciation. Vincent Maliepaard, Marketing Director at IntoTheBlock, noted that the 2016 and 2020 halving events saw significant price surges followed by short-term corrections, ultimately breaking previous all-time highs within a few months.

Bitcoin Price Performance by Halving. Source: IntoTheBlock

Bitcoin Price Performance by Halving. Source: IntoTheBlock

While short-term volatility may occur around halving events, the reduction in supply can positively impact prices over time.

Another notable trend is the diminishing rate of price increases after each halving. For instance, after the first halving, Bitcoin’s value surged by 4,802%, but this rate of growth has decreased with subsequent halvings.

Maliepaard stated, “With Bitcoin’s current market capitalization, achieving similar percentage increases would require significantly larger investments, indicating that future percentage increases may diminish.”

The momentum from Bitcoin ETF

The upcoming halving event also differs in some aspects. Indeed, Bitcoin has surpassed its all-time high, possibly due to significant institutional investment following the approval of Bitcoin ETFs. This institutional capital inflow, combined with consistent demand from ETFs and reduced supply, could further drive up Bitcoin’s value.

Furthermore, cryptocurrency “whales” are engaging in higher accumulation strategies and holding positions in anticipation of potential price increases. These actions demonstrate a blend of short-term speculation and long-term strategic moves to preserve Bitcoin as a scarce asset.

Generally, these models demonstrate deeper insights and adaptability to the impact of the halving cycle on Bitcoin’s value over time.

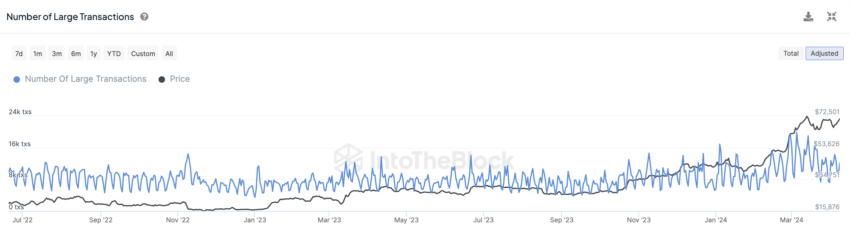

“In my view, there’s a clear trend towards larger transaction volumes, especially transactions worth over $100,000, particularly since the approval of the Bitcoin ETF. In previous halving cycles, these figures mainly started increasing towards the end of bull markets,” Maliepaard shared.

Number of Large Bitcoin Transactions. Source: IntoTheBlock

Number of Large Bitcoin Transactions. Source: IntoTheBlock

Another interesting observation by Maliepaard is the increase in the proportion of Mining Flow volume. Over the past year, the percentage of volume has increased from around 4% to over 12%, a 200% rise. This increase in the sharing of Mining Flow volume is crucial as it indicates significant changes in miner behavior, which could impact Bitcoin’s supply dynamics and liquidity.

Related: This Bitcoin Bull Run Is Unlike Previous Cycles

Although the anticipated Bitcoin halving is expected to bring short-term volatility, the long-term outlook remains optimistic, driven by reduced supply and ongoing institutional interest.

“Reducing emissions as planned is one of the important economic measures to differentiate Bitcoin from fiat currencies. During the periods before and after the Bitcoin halving cycle, market sentiment often shifts from anticipation to optimism as investors speculate on the impact of halving on Bitcoin scarcity and price,” Maliepaard concluded.

Investors should monitor key indicators such as transaction volumes and miner behavior to assess the impact of halving on the market.

BTC

BTC  ETH

ETH  USDT

USDT  XRP

XRP  SOL

SOL  BNB

BNB  DOGE

DOGE  USDC

USDC  ADA

ADA  TRX

TRX

good

V good

Good

Which date is the Bitcoin halving to start properly. Please 🙏 help out