Several factors have converged to push Bitcoin to $69,000 in just ten days, including the post-halving rally, the waning election cycle, the “Uptober” wave, and the Fed’s rate cut.

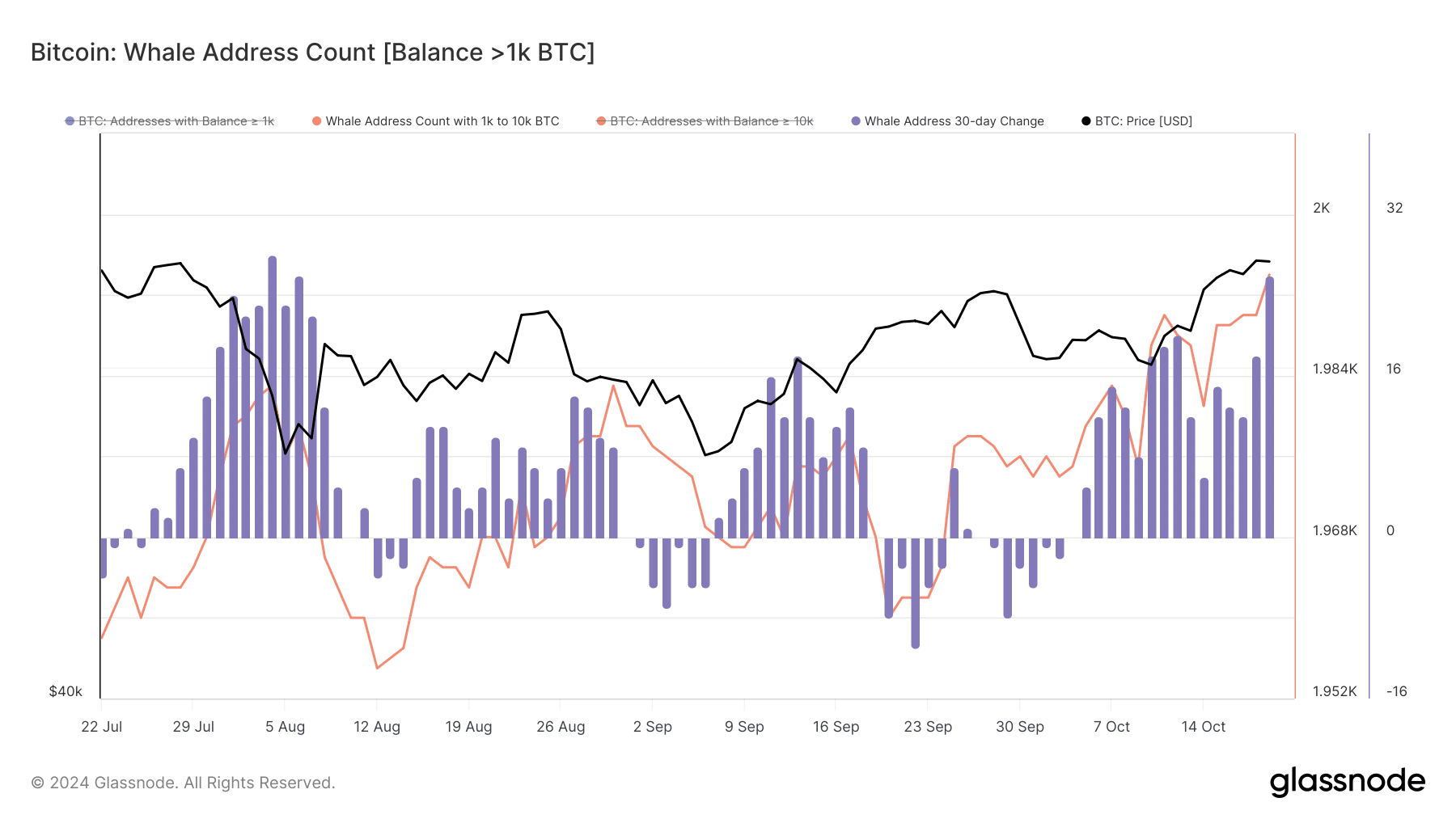

Whale activity has increased significantly, with addresses holding between 1,000 and 10,000 BTC reaching a 3-month high. These large investors have played a key role in maintaining Bitcoin’s price, countering downward pressure. Their activity has increased sharply since the beginning of October, indicating renewed interest from large investors.

Market sentiment is currently driving this cycle. Therefore, despite efforts to push Bitcoin prices down, the likelihood of a correction now is very low.

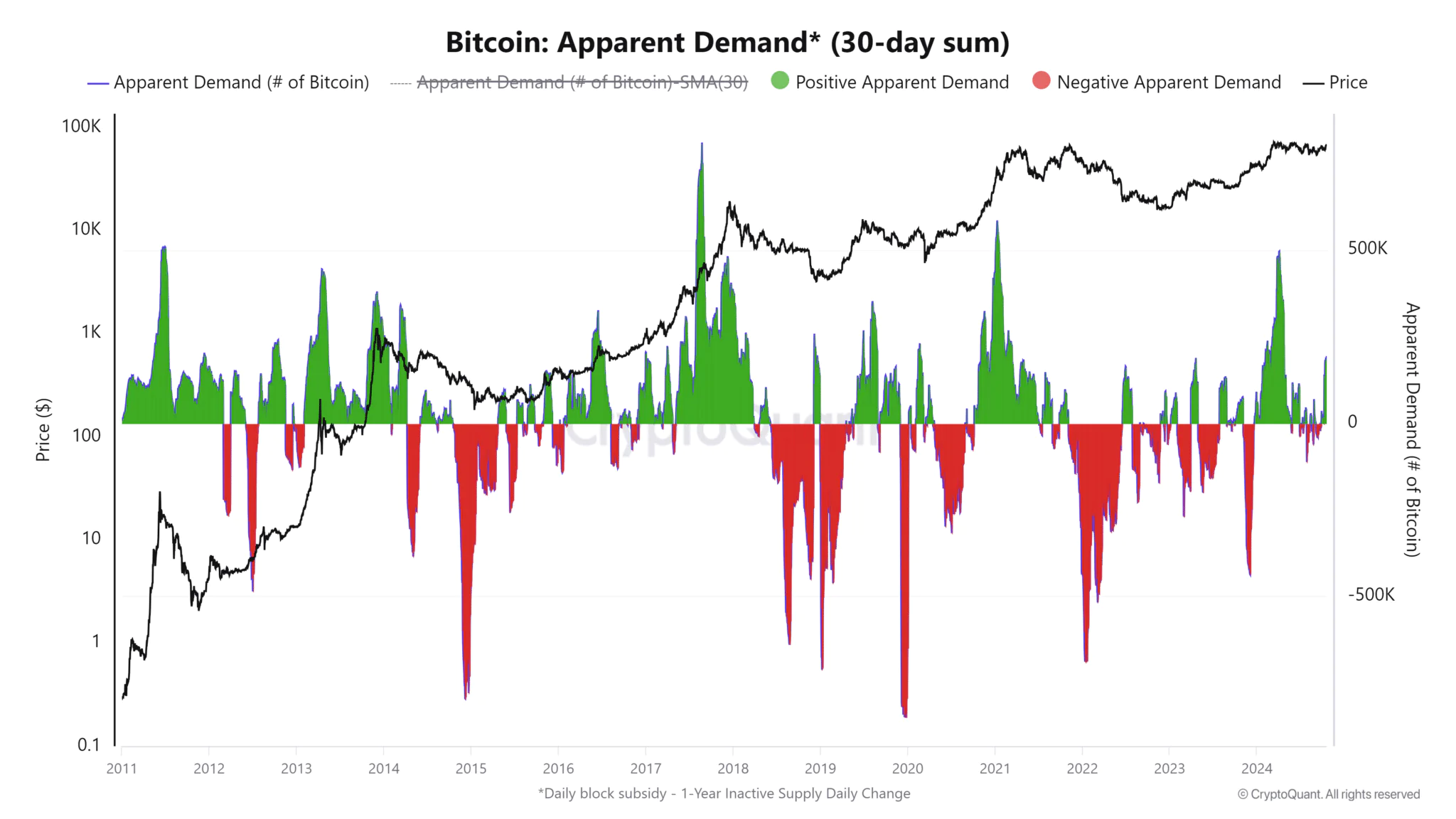

Halving years have traditionally been favorable for bull cycles. The spike in the 30-day average demand (marked in green) has always coincided with a reduction in Bitcoin supply during halvings.

The reduction in Bitcoin supply has often led to long-term price rallies, resulting in significant gains for market participants. It is worth noting that, even when fundamentals are not immediately present, widespread anticipation alone can create a price boom.

The current cycle is a clear example: the market has been buzzing with anticipation of a post-halving rally, and as a result, Bitcoin has quickly surged to $69,000 in an impressively short period of time.

If whale activity continues this bullish trend, Bitcoin could hit an all-time high of $73,000 before the end of Q4.

OMN

OMN  BTC

BTC  ETH

ETH  USDT

USDT  XRP

XRP  BNB

BNB  SOL

SOL  USDC

USDC  TRX

TRX  DOGE

DOGE