Bitcoin [BTC] is gaining momentum as its price reaches an all-time high. Despite a 4% dip over the past two days, it has successfully tested the $69k support level. Technical indicators remain optimistic. Accumulation continues rapidly, even though the price stagnated throughout April and the first half of May.

A recent report highlighted data suggesting that Bitcoin might be poised for a 300-day bull run. Current evidence further reinforces this bullish trend. This momentum indicator shows that the bulls need to maintain pressure to avoid a potential downturn.

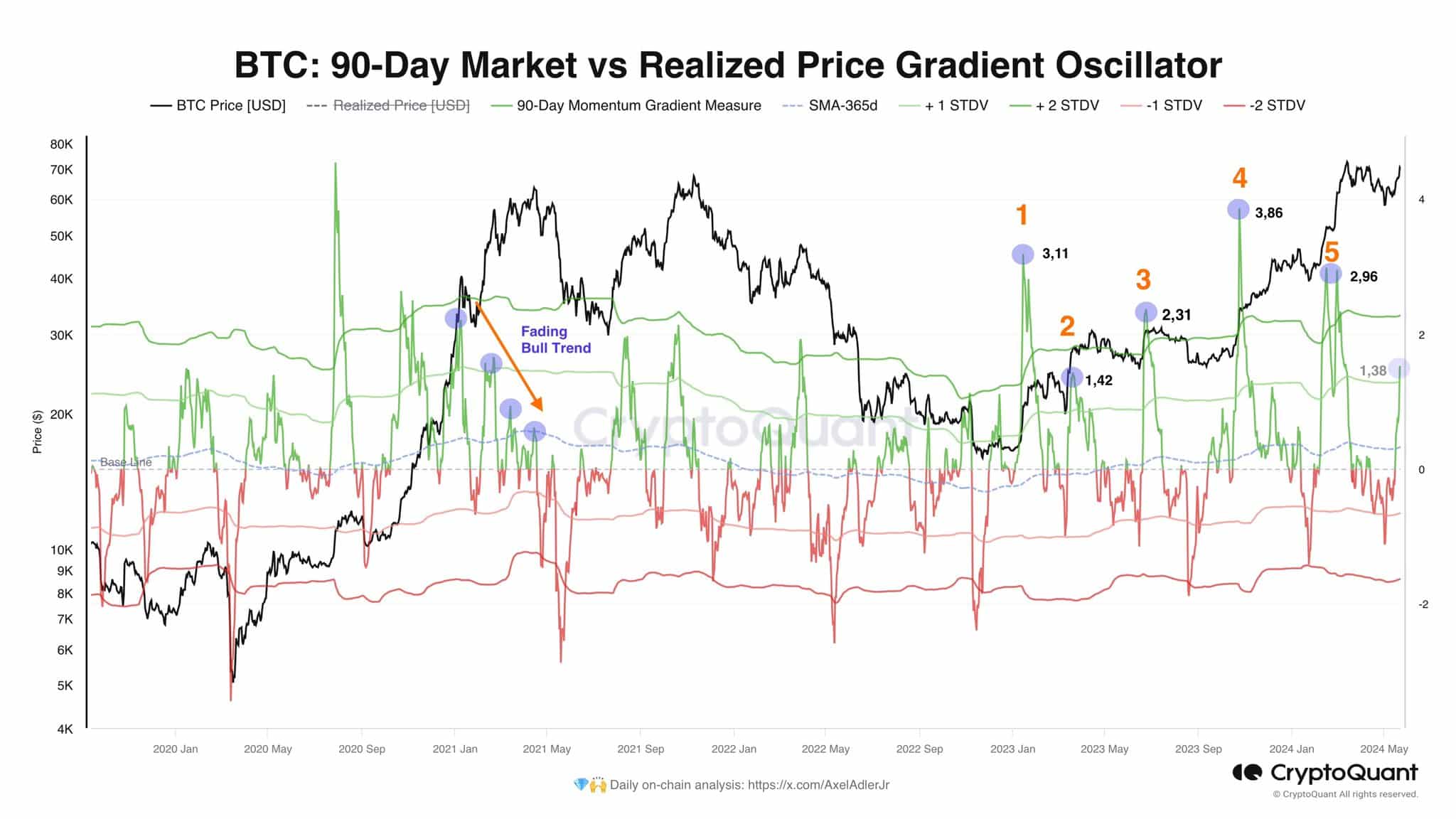

Cryptocurrency analyst Axel Adler shared an online analysis on X (formerly Twitter), highlighting Bitcoin’s current momentum and the values achieved over the past 18 months.

Source: AxelAdlerJr on X

The price gradient oscillator above measures the growth rate of the market cap relative to the realized cap. During the 2021 bull run, as BTC approached its final peak, the oscillator formed lower highs, indicating a weakening bullish trend.

In 2024, the oscillator has formed a lower high at 2.96. Therefore, surpassing the 3 mark is crucial for bulls to prevent a repeat of the 2021 pattern, which signaled a fading bullish trend. At the time of writing, the oscillator stands at 1.38.

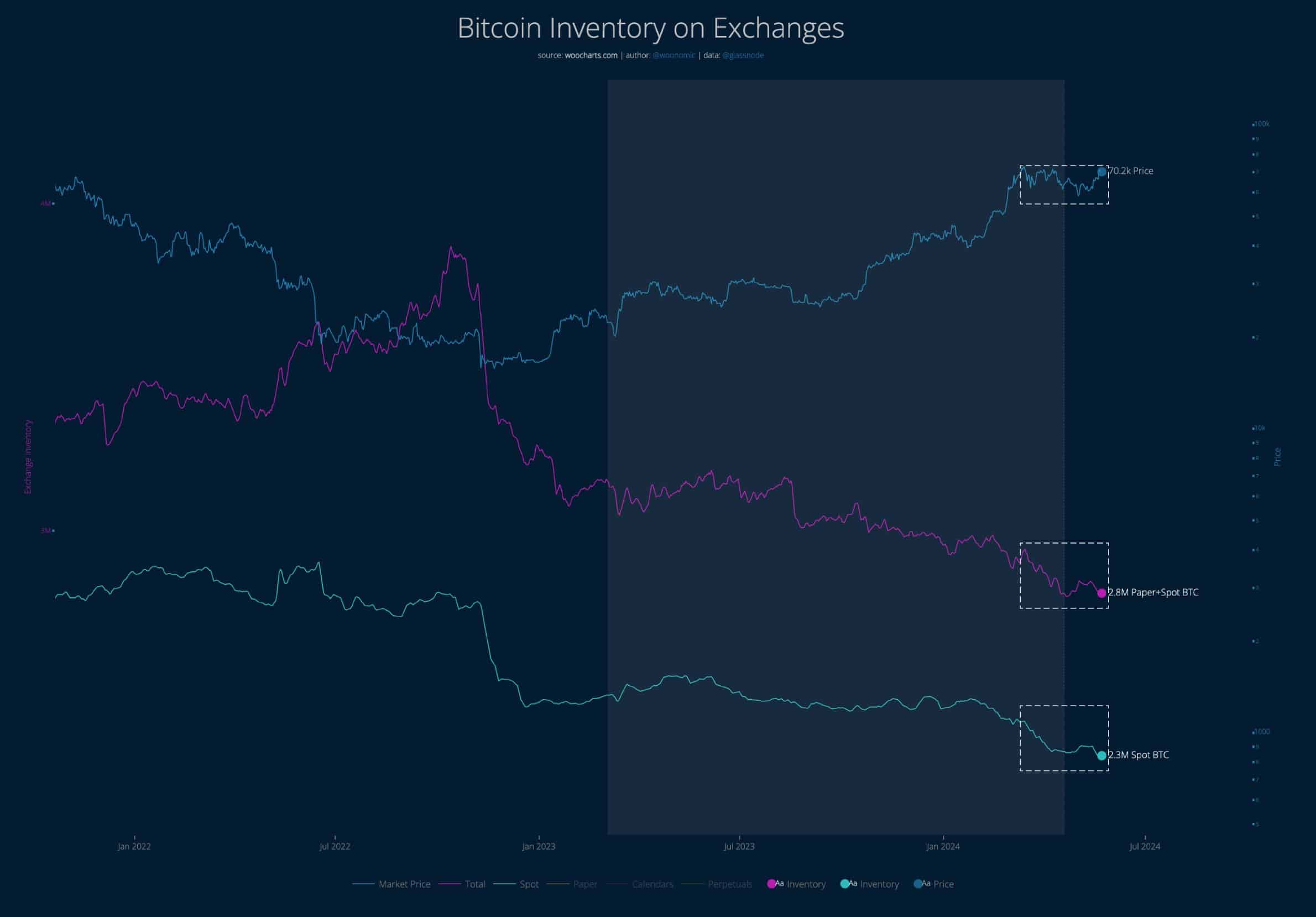

Bitcoin reaching an all-time high is “just a matter of time.” Analyst Willy Woo has noted that available Bitcoin has been steadily accumulating over the past two months, despite a lack of significant upward movement in higher time frames.

Source: Woonomic on X

This situation has caused panic among retail holders, but the demand for spot BTC remains robust. Woo believes that surpassing the all-time high against the US Dollar is inevitable.

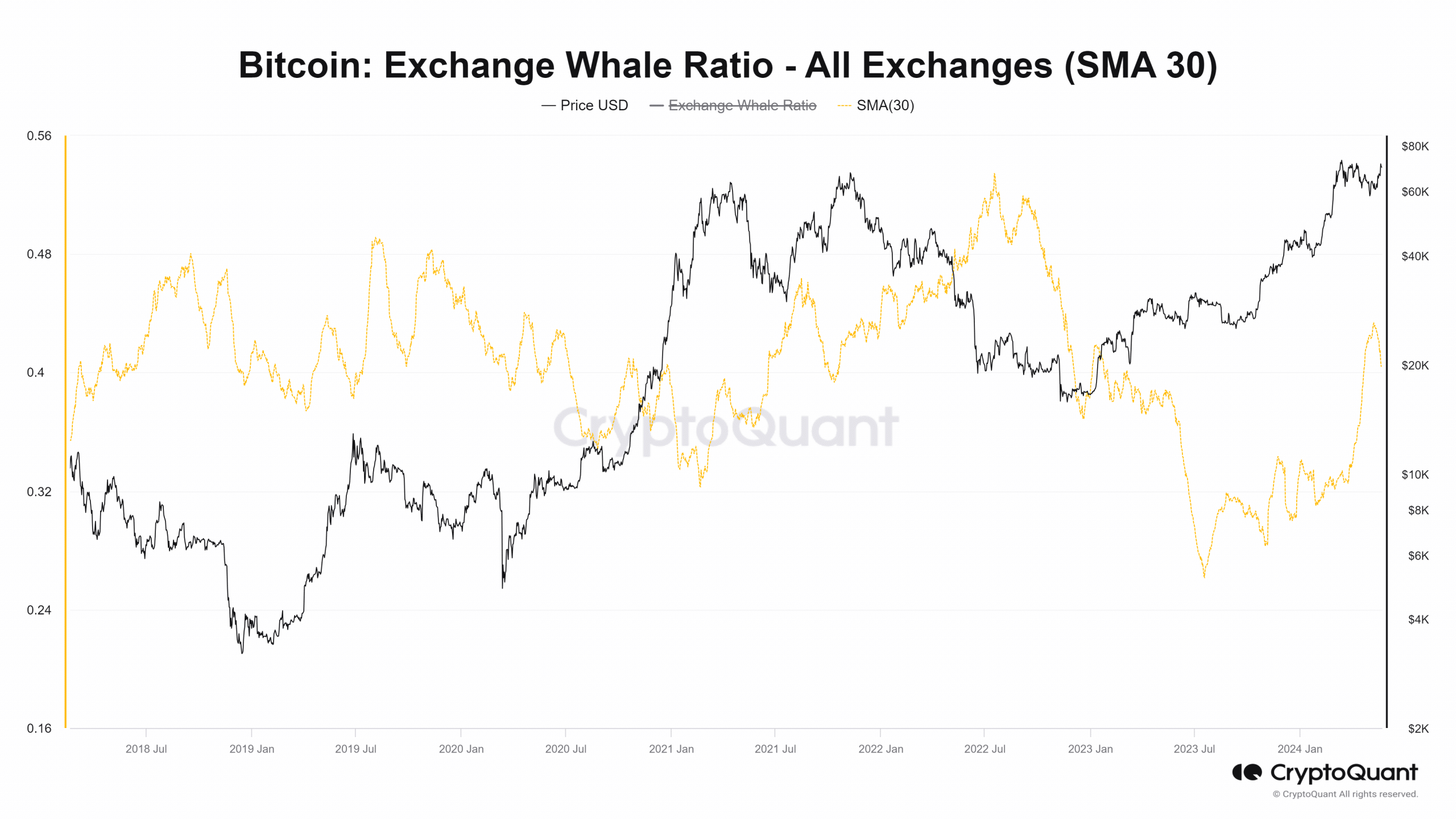

The exchange whale ratio has been trending upwards in April and May. This indicates increased whale activity, which is unusual during a bull run. Typically, whale activity is subdued during a long-term uptrend. It rises when peaks are reached and prices begin to decline.

Source: CryptoQuant

Capital outflows from exchanges, which Willy Woo previously highlighted, provide a compelling argument against top-tier involvement. However, the increased whale activity may give investors pause.

Nevertheless, the exchange whale ratio is not definitive, and current evidence suggests that this bull run still has a long way to go.

OMN

OMN  BTC

BTC  ETH

ETH  USDT

USDT  XRP

XRP  BNB

BNB  SOL

SOL  USDC

USDC  TRX

TRX  DOGE

DOGE

I like app, I also appreciate, but please let you upgrade your services