Bitcoin has recently seen a strong rally, pushing it to its highest level in nearly three months. The rally has brought Bitcoin closer to its all-time high (ATH), reigniting optimism among traders and investors.

However, while the rally continues, the emergence of large whale transactions and significant profits could be a sign of a potential price drop, shaking up Bitcoin’s growth prospects.

Bitcoin in the spotlight

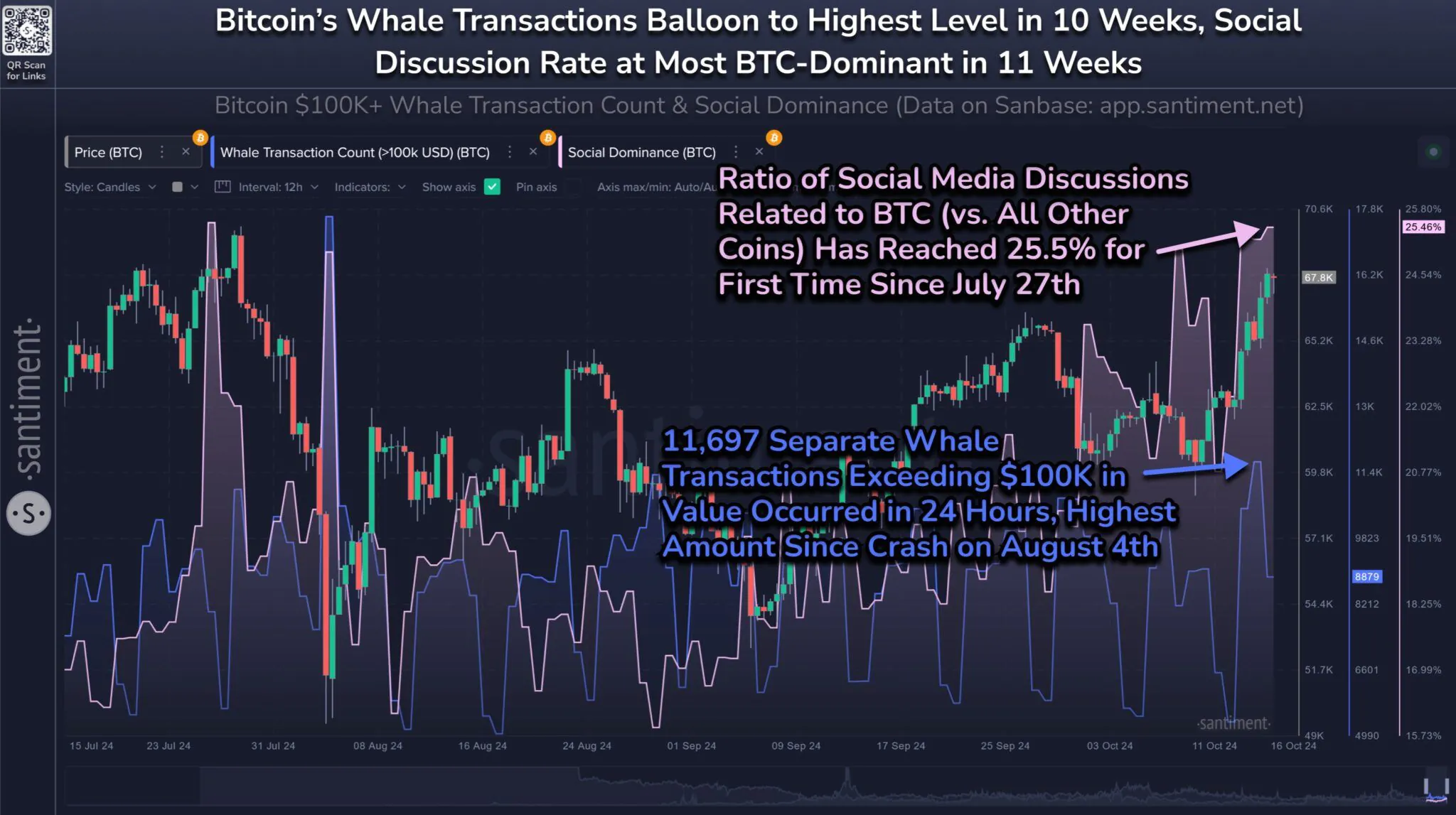

The latest data from Santiment shows a significant increase in whale transactions, with Bitcoin transactions worth over $100,000 reaching a 10-week high. Increased whale activity is often a sign of a change in market behavior, as these large holders have the ability to influence prices by accumulating or dumping their assets. Currently, the high whale trading volume is raising concerns about a possible price correction.

At the same time, Bitcoin’s dominance in social media discussions has increased significantly, accounting for 25% of all crypto-related discussions. This trend suggests that attention is gradually shifting away from altcoins, as more traders focus on Bitcoin’s performance. History shows that when Bitcoin dominates such a large portion of the market’s attention, it often signals price volatility, increasing the likelihood of a price drop.

“Both of these signs suggest that the rally may be pausing as large investors take profits and FOMO (fear of missing out) spreads in the community. However, with medium- and long-term indicators still showing positive trends, any price correction is likely to be short-term,” Santiment noted.

Bitcoin’s macro dynamics paint a similarly cautious picture. Currently, 95% of Bitcoin’s circulating supply is in profit, a statistic that has accompanied past market tops.

When a majority of holders are in profit, selling pressure typically increases, leading to a price correction. This scenario has played out in previous market cycles and appears to be repeating itself, suggesting that Bitcoin may be approaching a short-term top.

With such a large proportion of the supply in profit, the current market environment is reminiscent of conditions that have led to previous corrections. The high profitability encourages many investors to take profits, thereby putting downward pressure on Bitcoin’s price. If these conditions persist, a market top could form, leading to a price decline.

OMN

OMN  BTC

BTC  ETH

ETH  USDT

USDT  XRP

XRP  BNB

BNB  SOL

SOL  USDC

USDC  TRX

TRX  DOGE

DOGE