Bitcoin experienced a correction over the weekend and is currently trading at $69,600. In recent days, Bitcoin [BTC] has seen a surge in whale accumulation. Despite the price being close to its recent all-time high, many large investors remain confident in the leading cryptocurrency.

Bitcoin: Major Players Investing

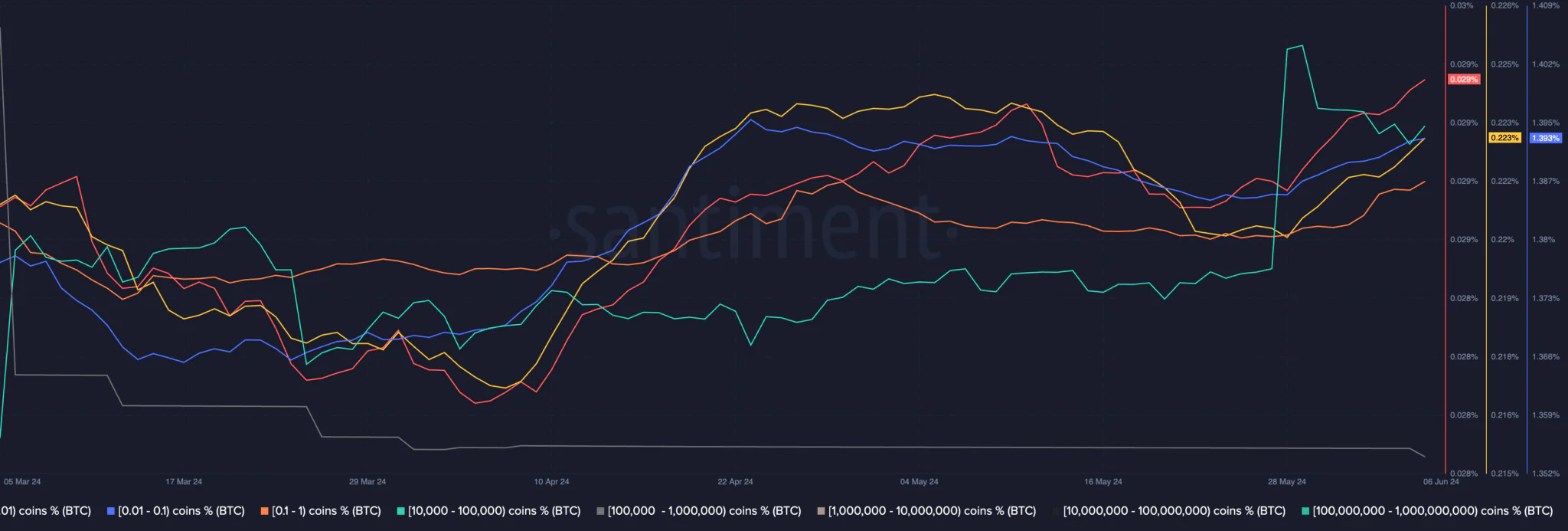

The growing appetite of whales indicates high expectations that BTC will surpass its current price level. The trend is similar among retail investors, who have also shown increased interest in BTC over the past few days.

The number of addresses holding between 0.01 and 1 BTC has significantly risen. This combined momentum from both whales and retail investors could help BTC break through previously established levels.

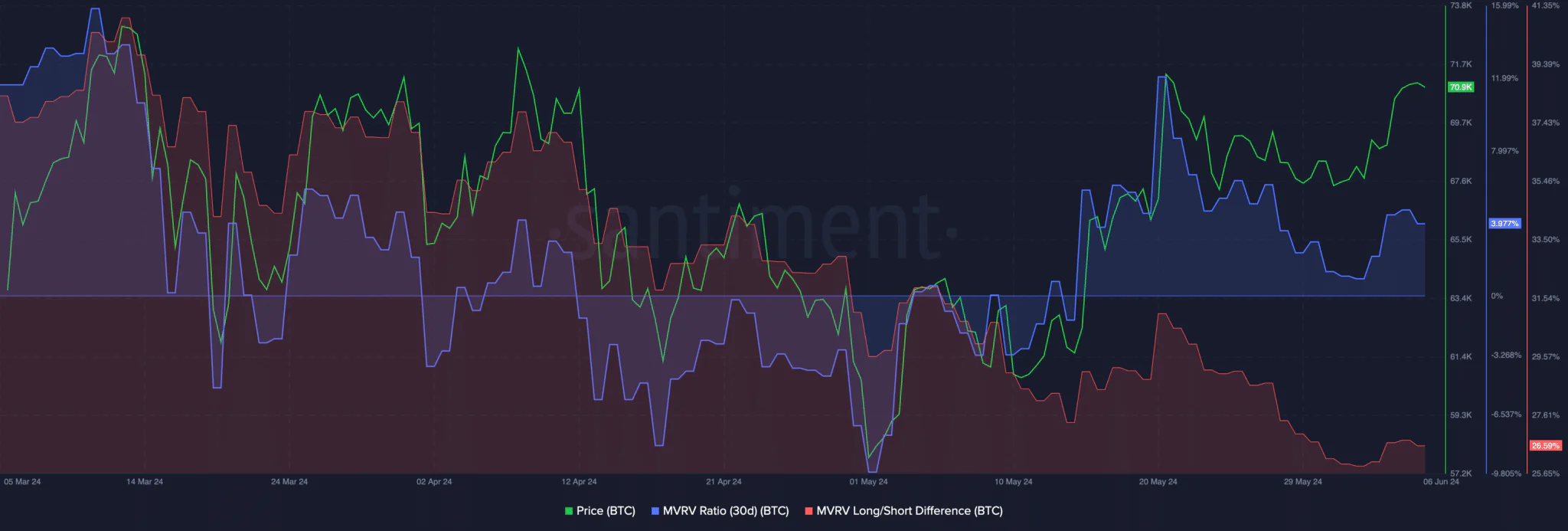

However, as BTC’s price rises, so does the MVRV ratio. Data from Santiment reveals that the MVRV ratio for BTC holders has increased considerably. This indicates that most holders are currently in profit. Consequently, their motivation to sell has also risen, which could add selling pressure to Bitcoin.

Additionally, the Bitcoin Long/Short ratio has decreased. This suggests an increase in the number of new addresses holding BTC, while the proportion of long-term holders has declined. Short-term holders are more likely to sell their shares amidst price volatility and uncertainty.

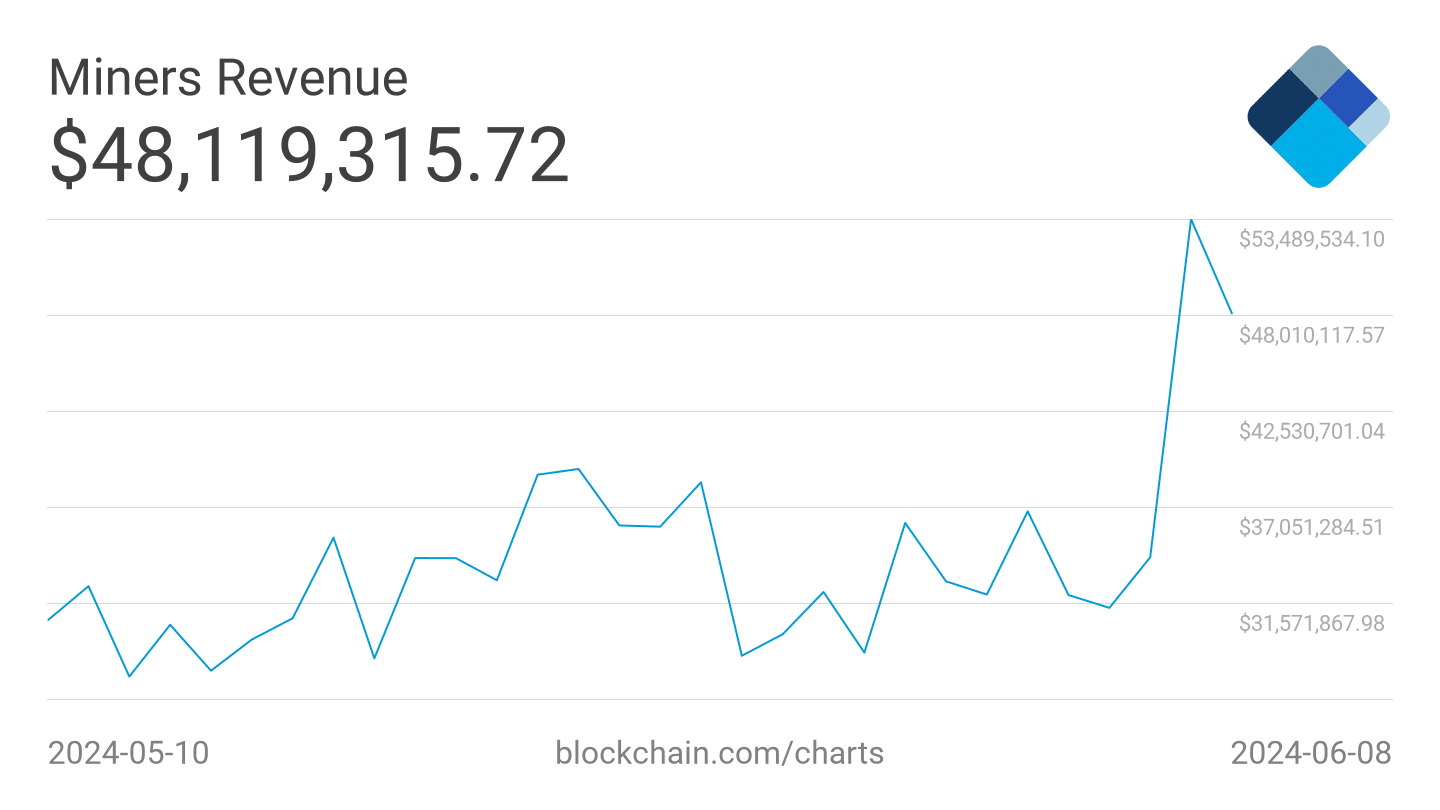

Decline in Mining Revenue

Another factor that could impact BTC’s status is the activity of mining companies. Over the past few days, revenue earned by miners has dropped from $53.48 million to $48 million. If this trend continues, miners may need to sell their holdings to maintain profitability, potentially adding more selling pressure on BTC and driving prices further down.

Related: Why Did the Cryptocurrency Market Plunge Over the Weekend?

ETF Interest Could Mitigate Selling Pressure

What might alleviate the selling pressure on BTC is the interest in Bitcoin ETFs. Since May 31st, ETF inflows have been exceptionally strong. If interest in BTC continues to grow at this pace and more institutional investors keep purchasing BTC, we might see increased price volatility and potential upward movements in the future.

OMN

OMN  BTC

BTC  ETH

ETH  USDT

USDT  XRP

XRP  BNB

BNB  SOL

SOL  USDC

USDC  TRX

TRX  DOGE

DOGE

暴跌吧