Bitcoin has successfully surpassed the $65,000 mark, fueled by growing investor confidence and prevailing market optimism. In addition to new buyers, long-term holders are re-entering the market, signaling a resurgence of the dominant cryptocurrency.

Purchase Bitcoin!

Data from Santiment indicates that Bitcoin traders are regaining confidence, as reflected in the trading volume metrics on social media, particularly in buying activities.

Specifically, there has been a notable surge in social media purchase volumes, indicating heightened interest and activity from buyers. On July 15, the buy sentiment score reached approximately 117, surpassing the social media sell volume, which stood at around 92 for the same period.

This disparity between buy and sell volumes suggests the current market sentiment is skewed towards buying, with more participants opting to purchase BTC rather than sell.

This trend highlights the growing fear of missing out (FOMO) across the market, as traders and investors rush to capitalize on Bitcoin’s upward momentum. Such movements typically contribute to sustaining and potentially accelerating price increases as demand significantly outpaces supply.

Related: Binance Launches Optimism-Powered Layer-2 Network

Bitcoin Welcomes Long-Term Holders Back

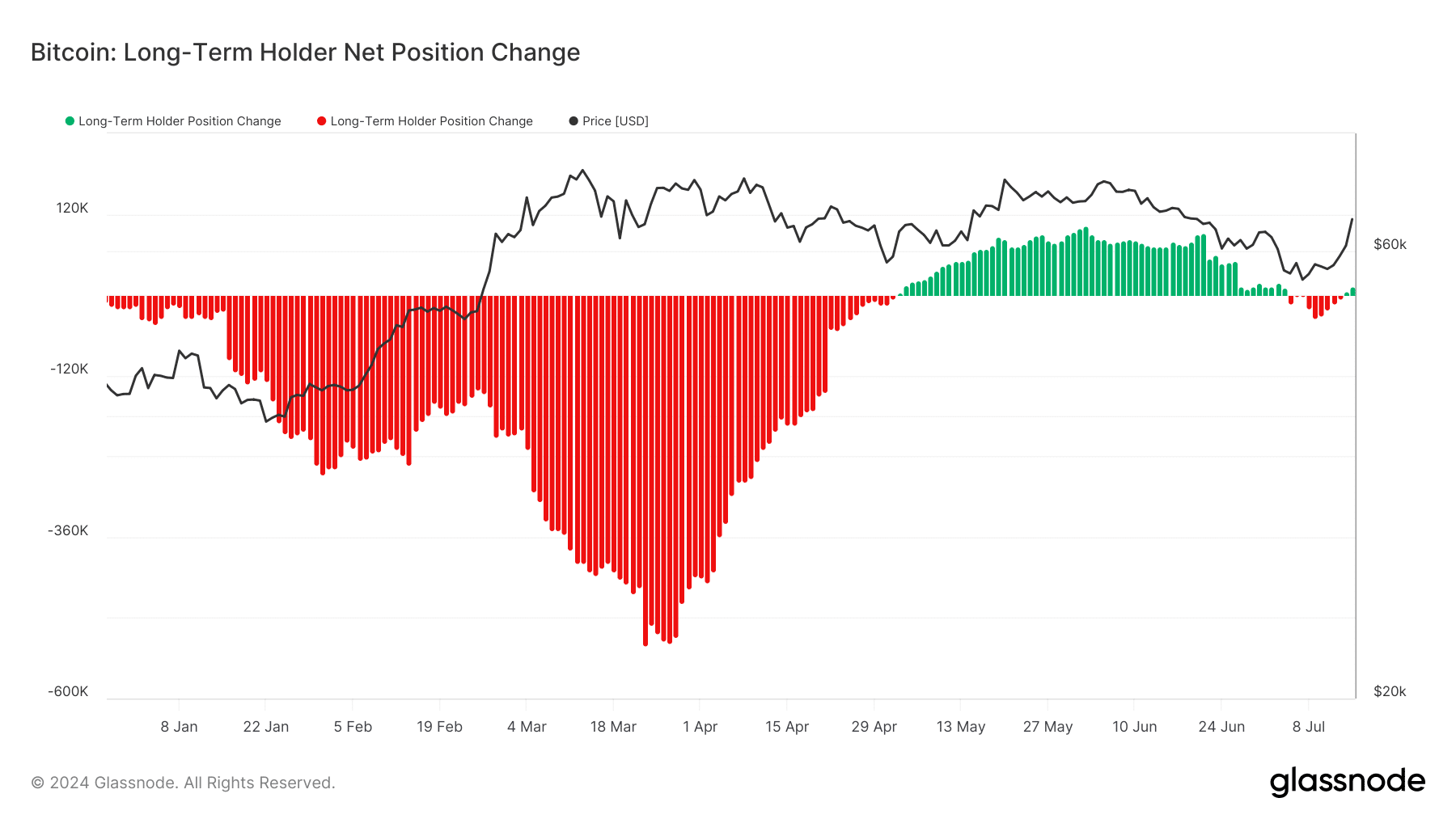

Recent data from Glassnode on the net position change of long-term Bitcoin holders provides compelling evidence of the current bullish trend for this cryptocurrency. Previously, this metric was negative, indicating that long-term holders were reducing their positions—essentially, they were selling more than they were buying.

This net selling trend persisted for much of the month, contributing to a pessimistic sentiment among seasoned investors. However, there has recently been a significant shift in this dynamic. The trend has reversed, and the metric now shows a positive value.

According to the latest analysis, the net position change is nearly 13,000. This positive shift indicates that long-term holders are accumulating Bitcoin once again. This trend signals renewed confidence in Bitcoin’s potential for future price appreciation. The accumulation phase by these experienced investors is often a strong bullish indicator.

BTC Breaks Through the $65,000 Mark

Additionally, this is the first time in nearly a month that Bitcoin has surpassed the short-term moving average (the yellow line), which previously acted as resistance within this price range. Despite a slight dip, the price remains above the short-term moving average, indicating that the yellow line may now serve as support. This shift from resistance to support could signal potential stability or further price appreciation if Bitcoin maintains its position above this crucial level.

OMN

OMN  BTC

BTC  ETH

ETH  USDT

USDT  XRP

XRP  BNB

BNB  SOL

SOL  USDC

USDC  TRX

TRX  DOGE

DOGE