Bitcoin has surged to $70,700, marking its highest price in nearly two weeks.

Analyzing the three-day chart, Bitcoin’s Relative Strength Index (RSI) and Money Flow Index (MFI) stand at 57.72 and 40.95, respectively. The combined readings of these momentum indicators suggest that while there is an increase in buying activity, notable selling activity is also present in the market.

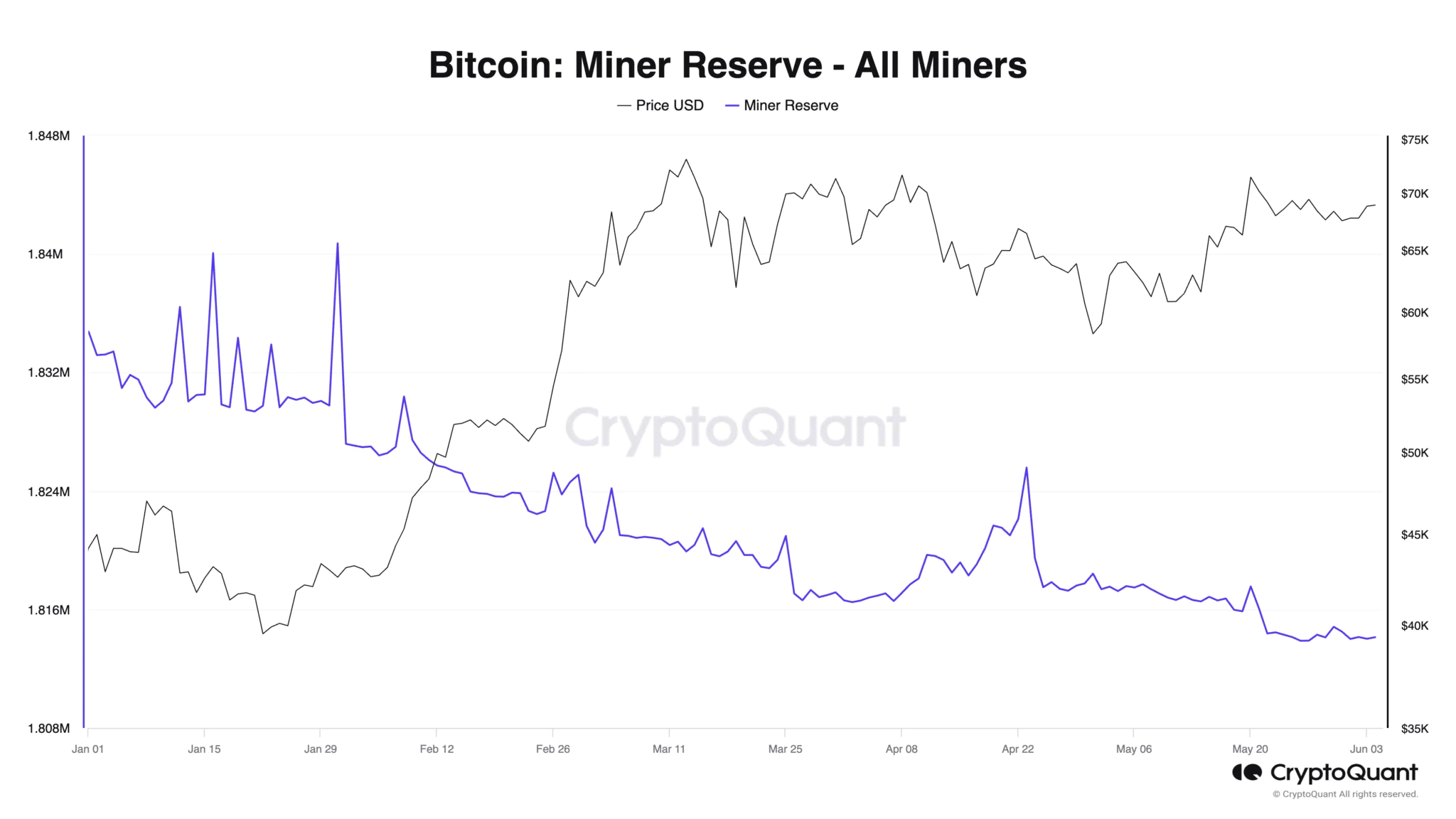

Data from CryptoQuant reveals that Bitcoin’s [BTC] mining reserves have dropped to their lowest level since the beginning of the year.

This metric measures the amount of Bitcoin held in miners’ wallets. It indicates the reserves that miners have yet to sell. As of the time of writing, 1.81 million BTC, worth $125 billion at current market prices, is held in miners’ wallets. A decrease in BTC mining reserves indicates that Bitcoin miners are distributing their coins to take profits or cover mining costs. Data from CryptoQuant shows that after a prolonged decline, BTC mining reserves began to trend upwards on April 8, as the market anticipates the fourth Bitcoin halving event scheduled for April 19.

Following the halving event, this metric swiftly climbed to a peak of 1.82 million BTC on April 23, before resuming a downward trend. Since then, the amount of BTC held by miners has decreased by 1%.

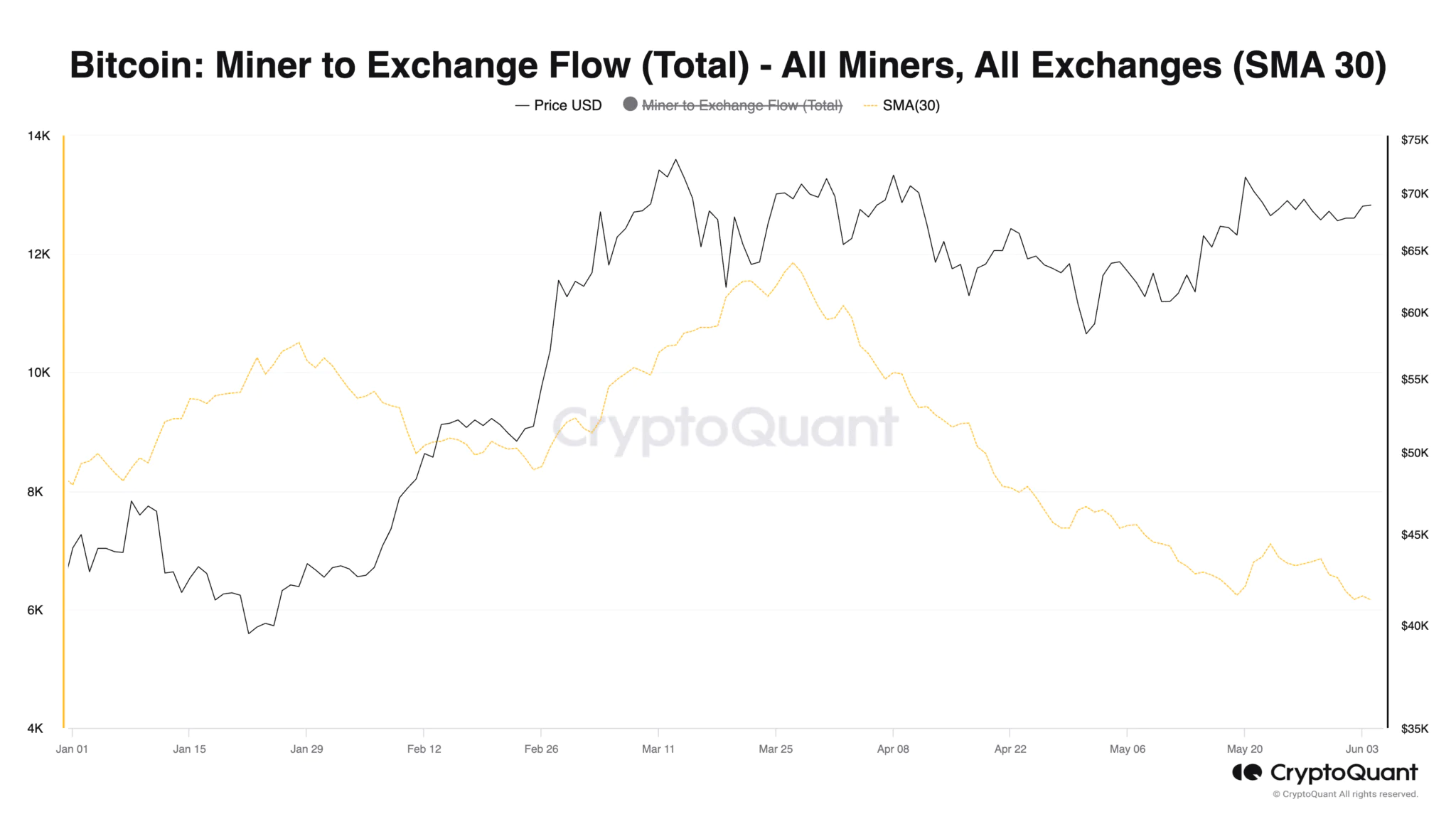

Interestingly, mining activity on exchanges has declined over the past three months.

Related: The First Bitcoin ETF Spot Officially Launched in Australia

According to CryptoQuant, the flow of BTC from miners’ wallets to exchanges (assessed using a 30-day moving average) has dropped by 48% since reaching a year-to-date high of 11,853 BTC on March 27. However, this doesn’t necessarily mean miners aren’t selling their coins. They might be selling BTC through over-the-counter (OTC) markets rather than directly on exchanges.

They may also be engaging in peer-to-peer transactions, selling directly to buyers without using exchanges.

Very nice

I love it

Ok mình rất thích

I love bit coin