Bitcoin has reclaimed the $62,000 level just days after the “Crypto Black Monday,” as traders highlighted a bullish pattern on the seven-day price chart, suggesting that Bitcoin may have bottomed out.

“Bitcoin is showing a large green weekly candle with a significant wick,” crypto trader Matthew Hyland noted in an analysis video on August 8 as Bitcoin surpassed $61,000.

“Currently, this trend is shaping up to be a strong upward move on the weekly timeframe,” he added, suggesting that “Bitcoin may have reached the bottom for this entire structure.”

On August 8, Bitcoin briefly hit $62,510 before retreating to $61,068 at the time of publication. According to CoinMarketCap data, the asset had gained 12.46% since August 7.

This swift recovery occurred just days after Bitcoin fell below the critical support level of $49,751 on August 5, which was dubbed “Crypto Black Monday.” It marked the first time the price dropped below $50,000 since February.

Some traders believe that this swift reversal might indicate the recent price drop was a bear trap—where experienced traders intentionally sell Bitcoin in a controlled manner to temporarily lower the asset’s price and lure in short sellers.

“What a wild week. Probably the most epic bear trap I’ve ever seen,” remarked crypto trader Byzantine General in a post on X.

What an insane weekly.

Probably the most epic bear trap I’ve ever seen.$BTC pic.twitter.com/W8SLyRm4pB

— Byzantine General (@ByzGeneral) August 8, 2024

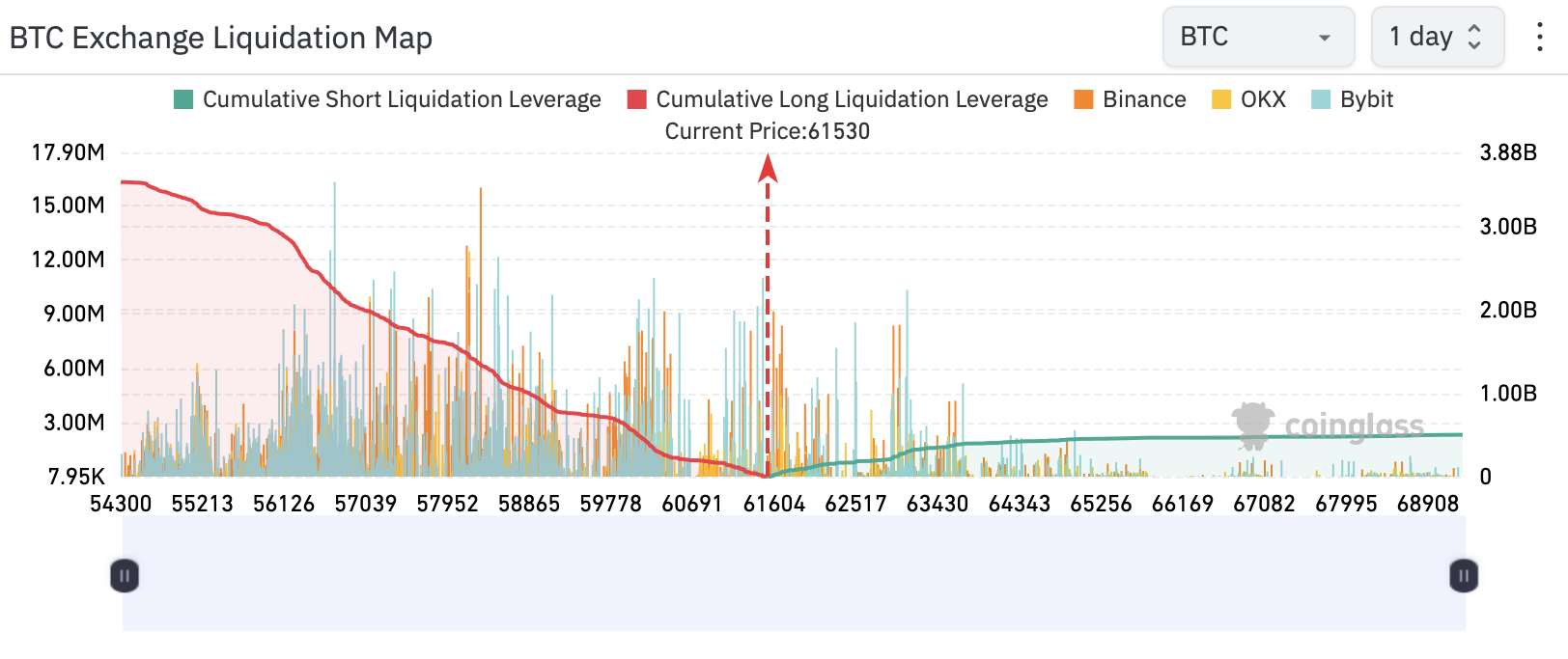

The sentiment among futures traders has shifted significantly towards bullish positions. According to CoinGlass data, 52.48% of positions are now long, compared to 47.52% short.

This development came just one day after Morgan Stanley, the largest wealth management firm in the U.S., allowed its 15,000 financial advisors to start offering Bitcoin exchange-traded funds (ETFs) to clients.

However, not all crypto analysts are convinced that Bitcoin has reached its bottom. Some predict there may be further declines before the cryptocurrency hits new record highs.

On August 7, Markus Thielen, Head of Research at 10x, stated that “for the next bull run to have an ideal setup, we are targeting Bitcoin to drop to the low $40,000 range.”

On August 5, Timothy Peterson, founder of Cane Island Alternative Advisors, predicted that “there’s a good chance we see both $40,000 and $80,000 within the next 60 days.”

OMN

OMN  BTC

BTC  ETH

ETH  USDT

USDT  XRP

XRP  BNB

BNB  SOL

SOL  USDC

USDC  TRX

TRX  DOGE

DOGE

Bitcoin passed of 73000$