Bitcoin made a strong breakout, reaching nearly $94,000 yesterday, marking a new milestone with an all-time high price, before slightly correcting to the current price. This event further affirmed Bitcoin’s position in the global financial market and attracted the attention of both individual and institutional investors.

Factors driving the price increase

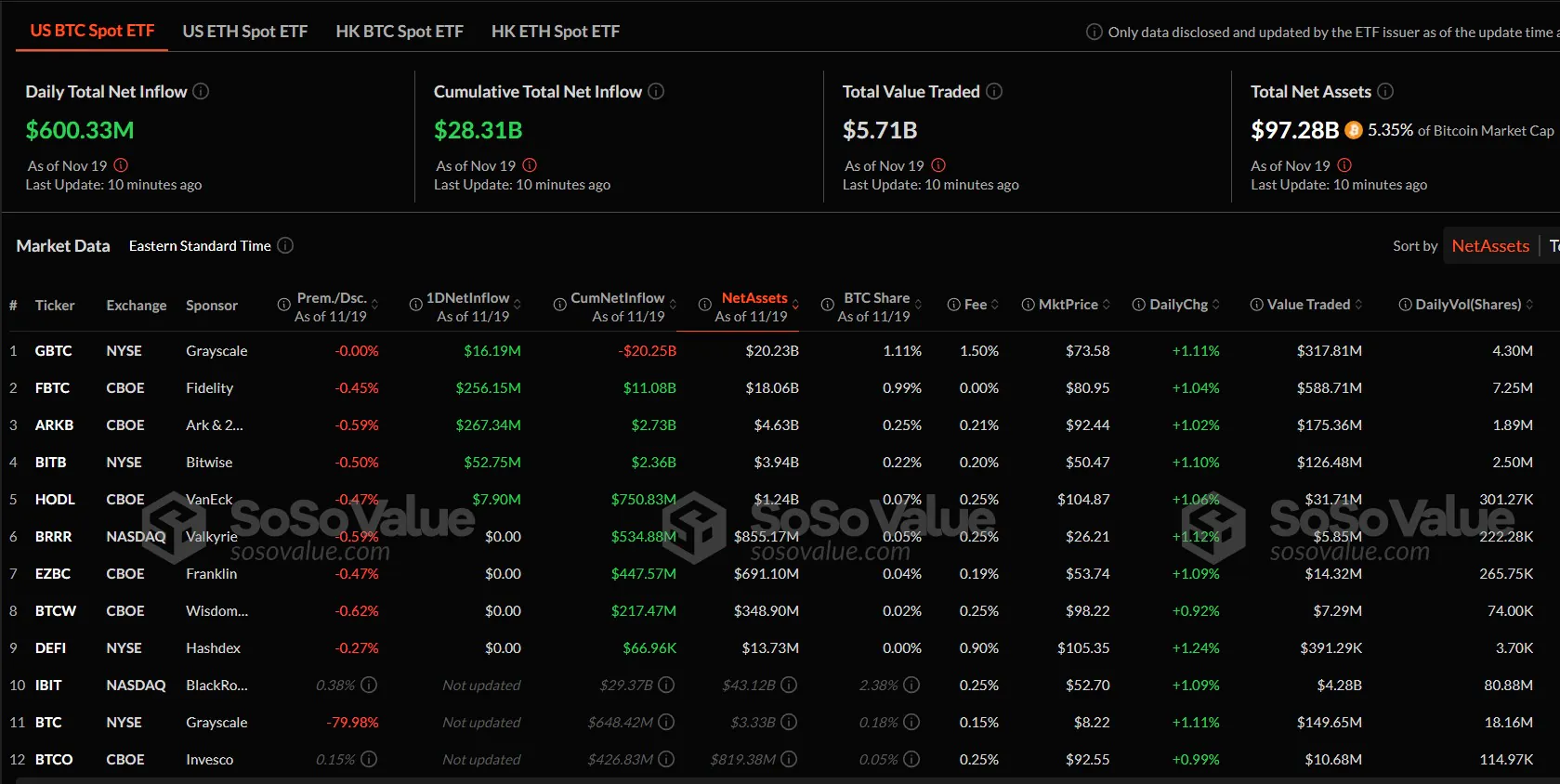

A key factor driving this growth is the launch of options trading for Bitcoin Spot ETFs, starting from November 19. This is seen as a major step, paving the way for large financial institutions to participate more deeply in the Bitcoin market. In the United States, there are currently 11 spot Bitcoin ETFs, but only BlackRock’s iShares Bitcoin Trust (IBIT) is listed on Nasdaq, making it the only ETF eligible for options trading.

The appeal of Bitcoin ETFs lies not only in their high liquidity but also in their recent strong growth. According to statistics, these funds attracted up to $1.67 billion in investment inflows in just five days, from November 11 to 15, marking six consecutive weeks of positive growth. Of these, iShares Bitcoin Trust took the lead, accumulating $29.3 billion, far surpassing other competitors. In contrast, Grayscale’s Bitcoin Trust ETF saw $20.3 billion in outflows since the launch of Bitcoin ETFs in January this year.

Read more: Resignation Pressure Mounts on SEC Chairman Gary Gensler

The key price of $94,000

Data from CoinGlass also shows that the majority of selling activity was concentrated at recent highs, extending to $94,000. An in-depth analysis shows that large liquidation clusters at $93,000 and above coincide with all-time highs.

Bitcoin is not just a digital asset, but also a symbol of change and revolution in the way we look at money and investing. With recent developments, Bitcoin is gradually consolidating its position as an important financial tool, not only for individual investors but also for major financial institutions around the world. The future of Bitcoin remains an intriguing mystery, and what happens next will be the focus of global markets.

OMN

OMN  BTC

BTC  ETH

ETH  USDT

USDT  XRP

XRP  BNB

BNB  SOL

SOL  USDC

USDC  TRX

TRX  DOGE

DOGE