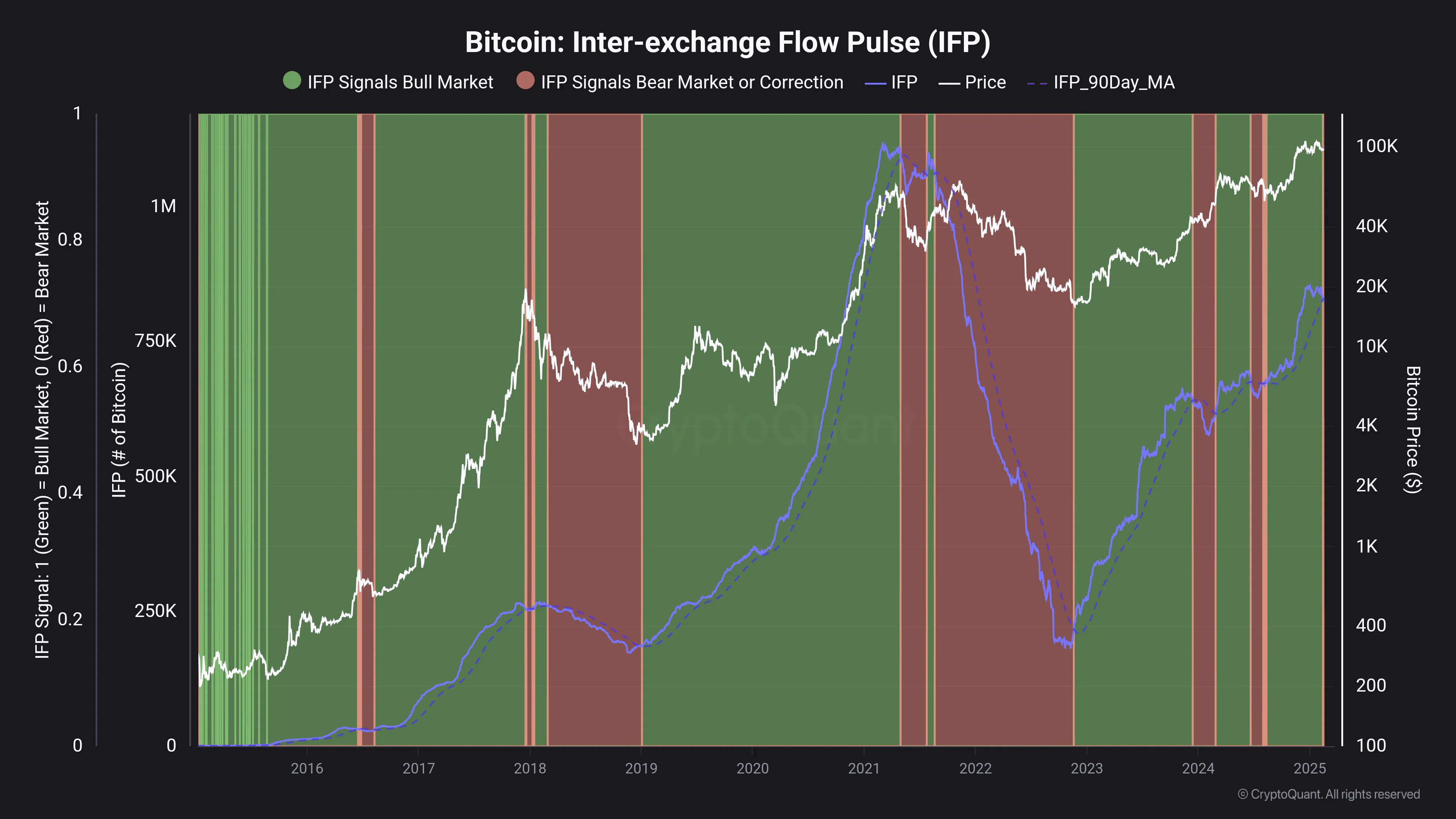

Bitcoin experienced a slight dip yesterday, settling at $96,000. Meanwhile, the Bitcoin Inter-Exchange Flow Pulse (IFP) indicator is flashing warning signs, suggesting that BTC’s price may be entering a downtrend.

On February 15, CryptoQuant issued a cautionary note, highlighting that Bitcoin is increasingly flowing out of derivatives exchanges. The movement of BTC between derivatives and spot exchanges has now become a key concern for those anticipating further price gains.

Using the IFP indicator, CryptoQuant analyst Maartunn observed a noticeable drop in Bitcoin’s transaction volume between these two types of trading platforms.

“When a large amount of Bitcoin moves into derivatives exchanges, this indicator signals a bullish phase. It suggests that traders are shifting funds to open leveraged long positions in the derivatives market,” Maartunn explained.

“However, when Bitcoin starts flowing out of derivatives exchanges into spot exchanges, it typically marks the beginning of a bearish phase. This often happens when long positions are being closed and whale investors are reducing their risk exposure.”

Accompanying charts indicate that the IFP trend has reversed downward—an event historically correlated with the onset of BTC price declines.

“The indicator has turned bearish today, signaling a decline in market risk appetite and potentially marking the beginning of a downtrend,” Maartunn concluded.

IFP previously peaked in March 2021, roughly a month before Bitcoin reached its all-time high of $58,000, which it maintained for around seven months.

In contrast, when BTC hit its current record high of $109,000 in January this year, the IFP had not yet reached the peak levels seen four years ago. Historical data suggests that each BTC price cycle top has coincided with a new IFP peak.

Despite this bearish signal, few believe the current Bitcoin bull run is nearing its end. Most analysts expect prices to recover, provided global liquidity remains strong. However, much depends on U.S. macroeconomic policy.

Recent inflation reports have reinforced the Federal Reserve’s stance on delaying interest rate cuts until 2025. This could push the U.S. Dollar Index (DXY) higher, potentially exerting downward pressure on Bitcoin’s price.

OMN

OMN  BTC

BTC  ETH

ETH  USDT

USDT  XRP

XRP  BNB

BNB  SOL

SOL  USDC

USDC  TRX

TRX  DOGE

DOGE