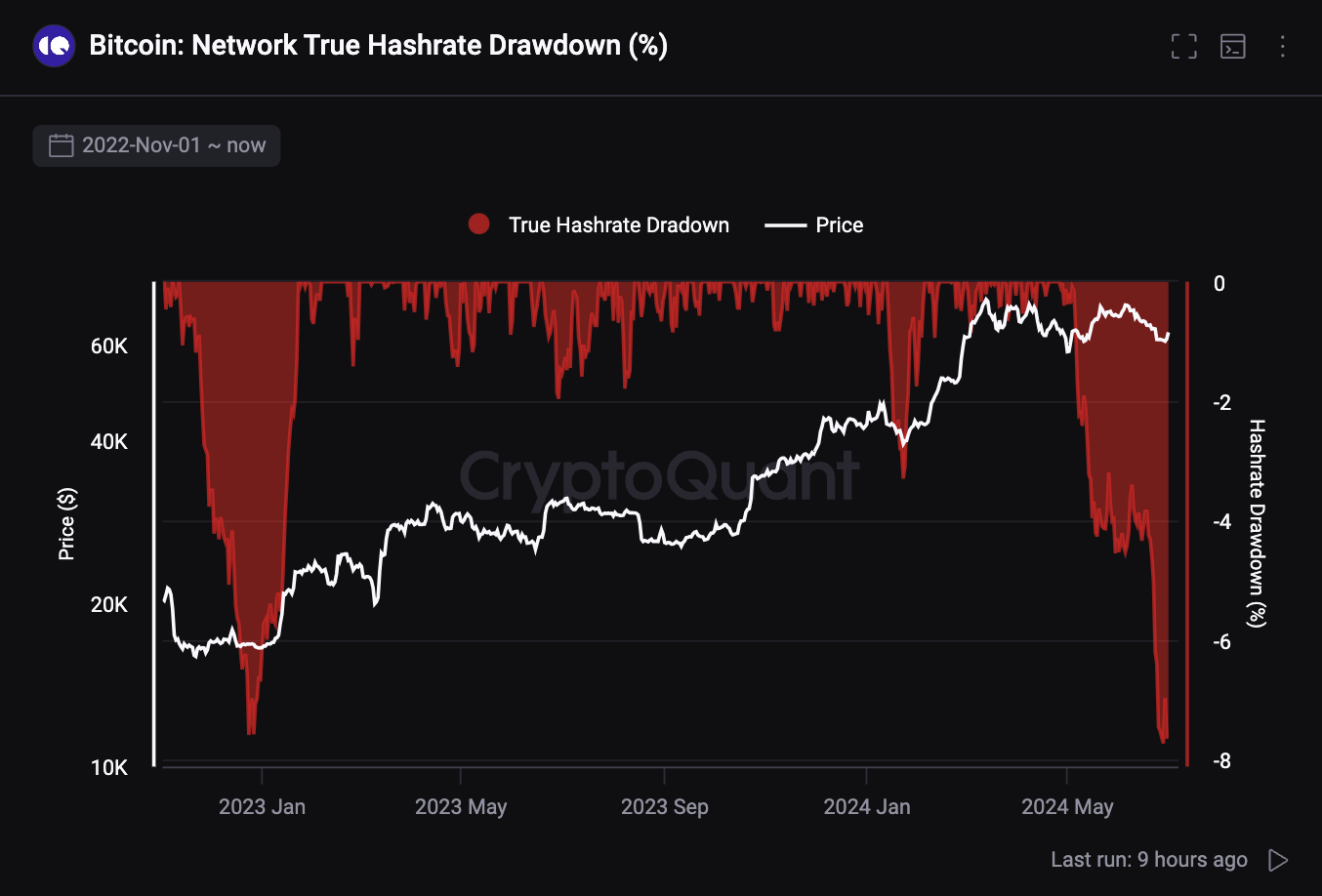

According to data from CryptoQuant, the True Bitcoin Hashrate Drawdown is currently at -7.6%, which may indicate a price bottom for Bitcoin. This potential market bottom is further supported by other metrics such as Bitcoin Exchange Reserve, the Miners Position Index (MPI), and the Bitcoin Miner Reserve, all pointing to low selling pressure.

Miner Capitulation and the Current Cycle

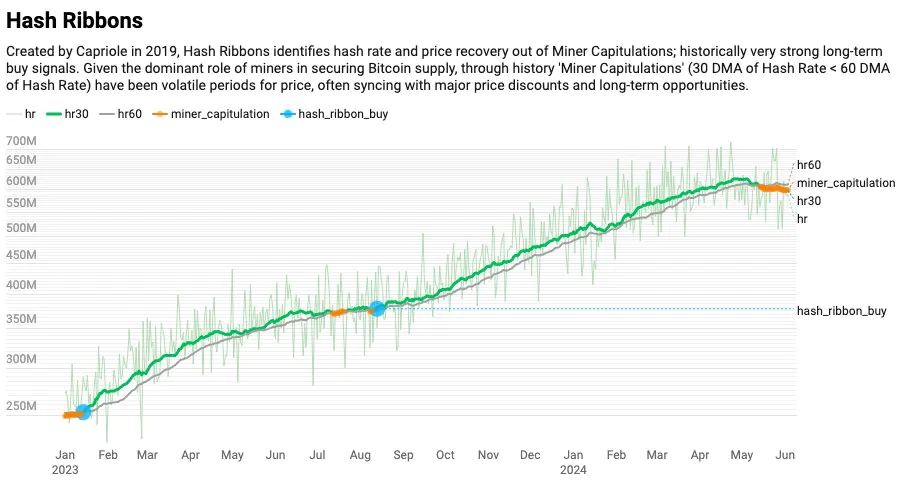

In recent weeks, various indicators have suggested that miners are starting to capitulate, signaling potential buying opportunities for Bitcoin. At the beginning of June, Charles Edwards, founder of crypto hedge fund Capriole, highlighted that the Bitcoin Hash Ribbons indicator developed by his firm was signaling a buy. This indicator reflects a relative slowdown in network computational power by comparing the 60-day moving average of the Bitcoin hashrate against a 30-day average. When the 30-day average falls below the 60-day average, it indicates a decrease in hash power.

Market analyst Will Woo concurred with Edwards, noting that the market will not reach new highs until weaker miners are compelled to shut down their operations—a phenomenon typically occurring in the weeks after a halving event but seems to be extending in the current cycle.

The Bitcoin hashrate drawdown, which tracks declines in the network’s computational power, has fallen to levels last seen in December 2022, shortly after the collapse of FTX during the previous bear market.

Recently, Bitcoin miner withdrawals have decreased by up to 90% since the halving, suggesting reduced selling pressure from miners and a likely continued rise in Bitcoin’s price.

Post-Halving Realities and the Bitcoin Mining Industry

Ahead of the April 2024 halving event, financial services firm Cantor Fitzgerald released a report outlining the challenges miners would face due to the reduced block subsidy.

Related: AI Captivates Cryptocurrency Investors

The report highlighted 11 mining companies, including Marathon Digital, Hut8, and Argo Blockchain, as potentially at risk of becoming unprofitable because of high mining costs and decreased rewards.

According to the report, if Bitcoin’s market price drops to $40,000, some of the largest mining companies in the world may be forced to capitulate, underscoring the difficulties the mining industry could face post-halving.

OMN

OMN  BTC

BTC  ETH

ETH  USDT

USDT  XRP

XRP  BNB

BNB  SOL

SOL  USDC

USDC  TRX

TRX  DOGE

DOGE