Bitcoin [BTC] experienced a captivating week in terms of price volatility, with a dynamic breakout surpassing the domestic high of $67,000 on May 20th.

On May 23rd and 24th, Bitcoin retested the $66.3k-$66.6k range as support before rebounding higher, trading at $68.7k at the time of writing.

Further gains seem likely as demand for the leading cryptocurrency continues to rise. Jack Mallers, CEO of the blockchain-based payment app Strike, stated in a conversation with Antony Pompliano that “Bitcoin is the best thing you can own.” Social metrics and on-chain activity show signs of weakening.

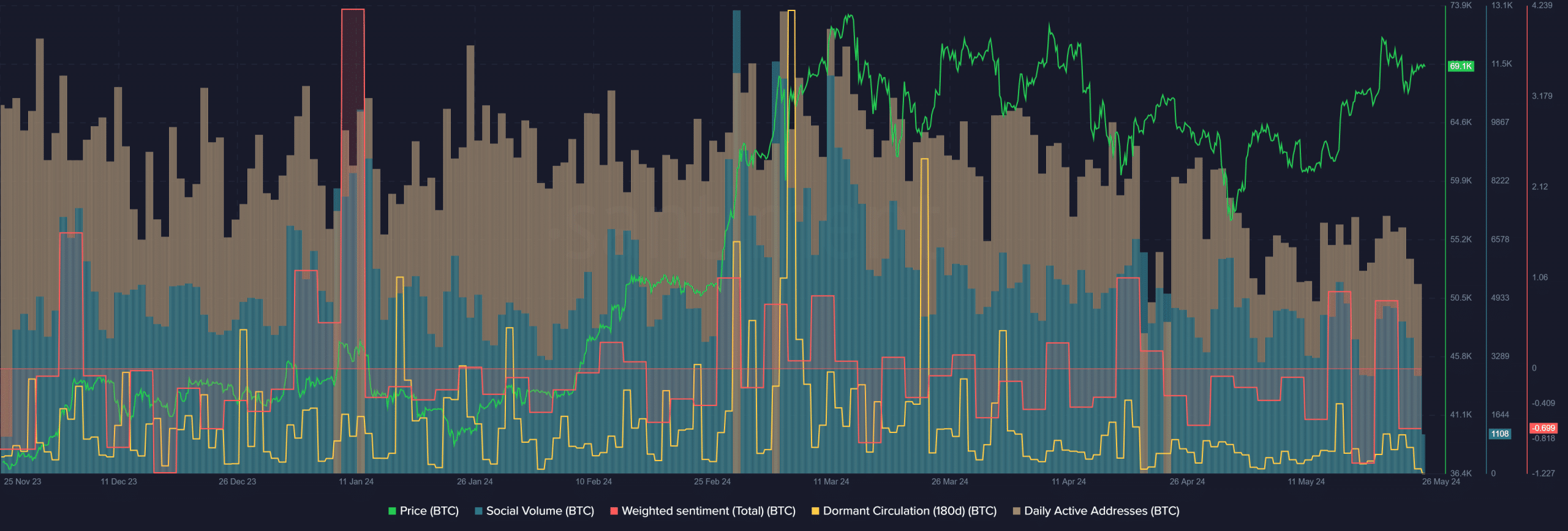

Social volume for Bitcoin has gradually declined since March 11th. Sentiment has been predominantly negative throughout May, with only two positive spikes since mid-month. Together, these indicators suggest reduced engagement on social media.

Source: Santiment

Daily activity has also trended lower since mid-March. Conversely, dormant circulation saw significant spikes on April 18th and May 15th, although these did not match the levels seen in March or late February.

This reveals that there has recently been no significant movement of dormant Bitcoin on-chain, indicating that a major selling wave has yet to occur. This is a positive sign, emphasizing that selling pressure has diminished.

Is demand for Bitcoin higher than ever?

Source: AxelAdlerJr on X

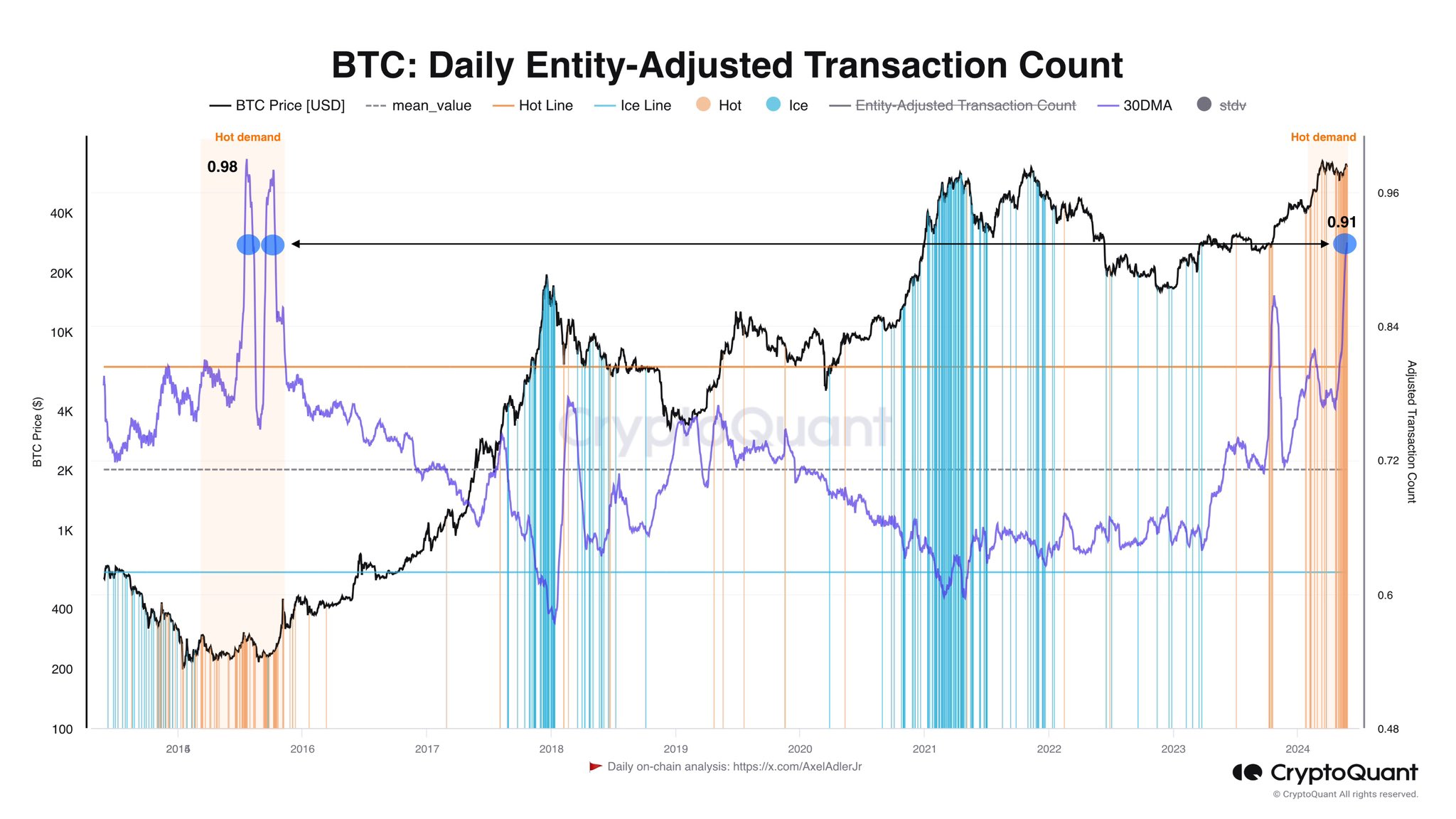

In a post on X (formerly Twitter), cryptocurrency analyst Axel Adler highlighted that demand is extremely robust. This conclusion is based on the number of transactions adjusted by unit. According to the chart data, demand is nearly matching the surge seen in 2016.

Related: Bitcoin Whales Accumulate Aggressively Amid Market Euphoria

Adler also noted that Bitcoin’s price back then was $300, compared to $69,100 now. Therefore, the capital involved is significantly greater than it was eight years ago.

This demand from both retail and institutional investors, combined with reduced selling pressure indicated by dormant circulation metrics, suggests that Bitcoin is likely to surpass the $71,400 region once again.