Bitcoin dipped to a 24-hour low of $66,000 before making a modest recovery to around $67,000.

Bitcoin ETFs [BTC] have seen inflows for 19 consecutive days after experiencing a prolonged period of outflows. Led by the BlackRock Bitcoin ETF, nearly $3 billion has flowed into these funds over the past few weeks.

For example, on June 10, BlackRock reported an inflow of $6.34 million, while Bitwise’s IBIT saw $7.59 million. However, the landscape shifted as Grayscale’s GBTC experienced significant outflows, totaling $39.53 million.

Due to GBTC’s outflows, the total outflows exceeded the inflows. For those unfamiliar, Bitcoin ETFs differ from BTC, the cryptocurrency. Outflows are now dominating the scene. With Bitcoin ETFs, owning Bitcoin is not required. Instead, investors gain exposure to the cryptocurrency as its price impacts the ETF’s Net Asset Value (NAV).

In the first quarter (Q1) of 2024, assets led by the BlackRock Bitcoin ETF recorded billions in inflows over a few days. This influx drove the cryptocurrency’s price to a new all-time high in March.

Subsequently, the inflows ceased, causing Bitcoin to briefly fall below $60,000. However, the recent resurgence over the past few weeks has ensured that BTC’s correction has slowed. Additionally, during this period, the BlackRock Bitcoin ETF reached $20 billion in Assets Under Management (AUM). AUM reflects the fund’s inflows, outflows, and asset price performance.

Related: Ethereum Investors Purchase $574 Million Worth of ETH

Will BTC fall below $67,000?

As a result, the total supply of profit has decreased. According to Santiment, Bitcoin’s total supply of profit has dropped to 18.54 million from a peak of 19.64 million.

If Bitcoin’s price continues to fall, the supply of profit will also decline. However, a lower supply of profit could present a buying opportunity for market participants to acquire Bitcoin at a discounted price.

If this buy signal materializes, Bitcoin might rebound to $70,000 in the short term. Conversely, if the selling pressure persists, BTC’s price could drop to $65,000. Beyond the BlackRock Bitcoin ETF and the aforementioned metrics, another crucial indicator to consider is the Hodler Net Position Change.

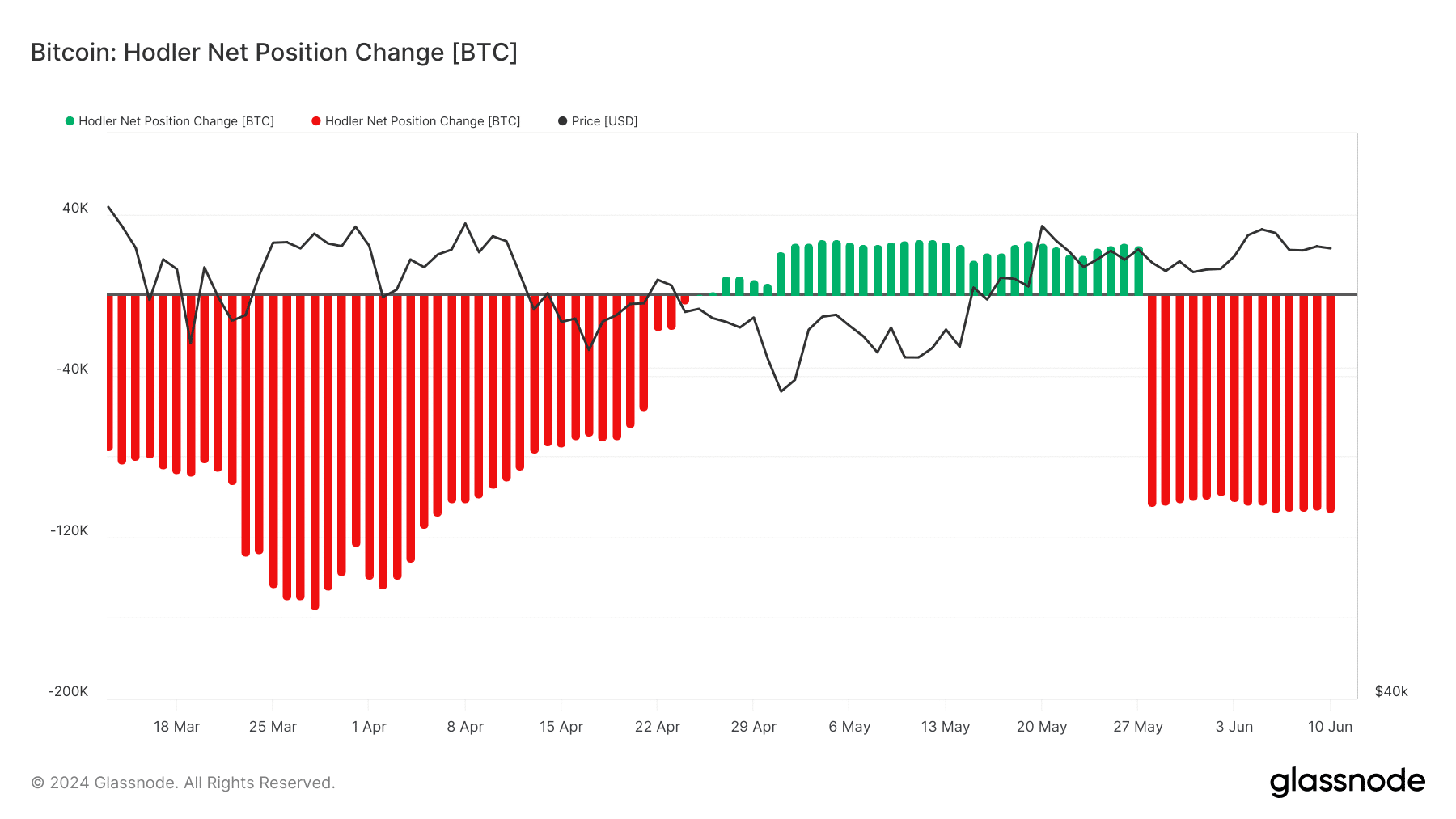

This metric shows whether long-term holders are accumulating or selling. A positive value indicates accumulation, while a negative value suggests an increase in Bitcoin being cashed out.

According to Glassnode, Bitcoin’s Hodler Net Position Change is -107,211 BTC, implying that HODLers have been taking profits. Thus, Bitcoin’s price may decline further rather than rebound. However, the bearish trend could be reversed if significant accumulation begins.

OMN

OMN  BTC

BTC  ETH

ETH  USDT

USDT  XRP

XRP  BNB

BNB  SOL

SOL  USDC

USDC  TRX

TRX  DOGE

DOGE