Bitcoin has recovered to $97,000, after falling to $89,000 just a day earlier. A key metric noted involves the amount of Bitcoin held by miners.

Bitcoin Miners Set New Record

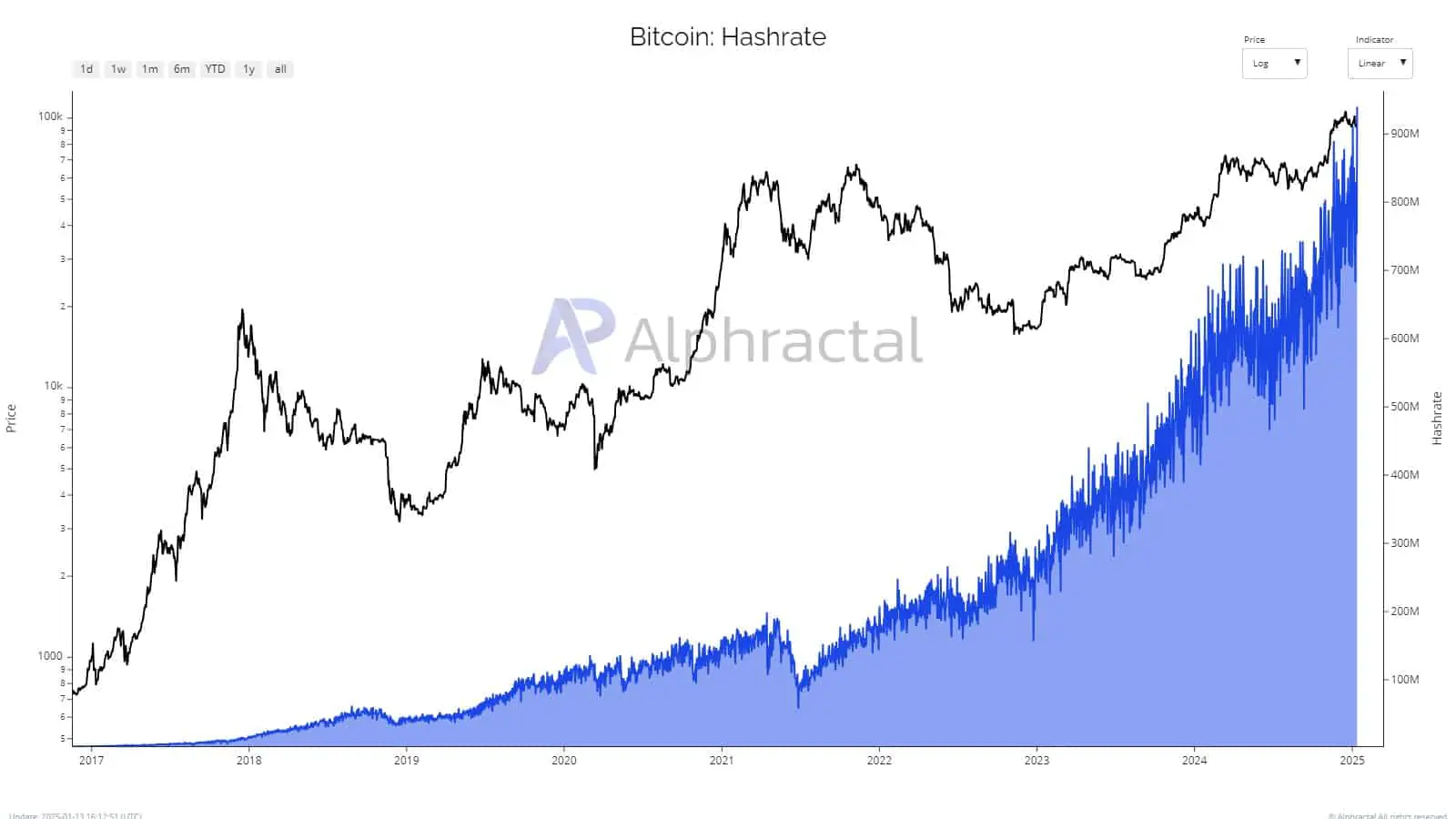

Bitcoin miners set a new record for the highest dollar value ever moved in late 2024, with a large amount of Bitcoin flowing out of their reserves, adding to the selling pressure on the market. The record high hash rate pushed mining costs skyrocketing, forcing miners to liquidate Bitcoin to cover costs. However, data from January 2025 shows that this selling trend has slowed significantly.

Bitcoin’s hash rate reached an all-time high in late 2024, reflecting the network’s superior security and fierce competition among miners. This rapid increase was coupled with the increasing difficulty of mining new Bitcoins, causing operating costs to skyrocket.

While the high hash rate reflects strong confidence in the Bitcoin protocol, it also places a significant financial burden on miners. In particular, they face the challenge of maintaining expensive and energy-intensive hardware.

This imbalance forced many miners to liquidate their assets in the last quarter of 2024, further exacerbating Bitcoin’s bearish trend. However, with the hash rate remaining stable in early 2025, miners have an opportunity to seek short-term profits.

Miners Continue to Cut Storage

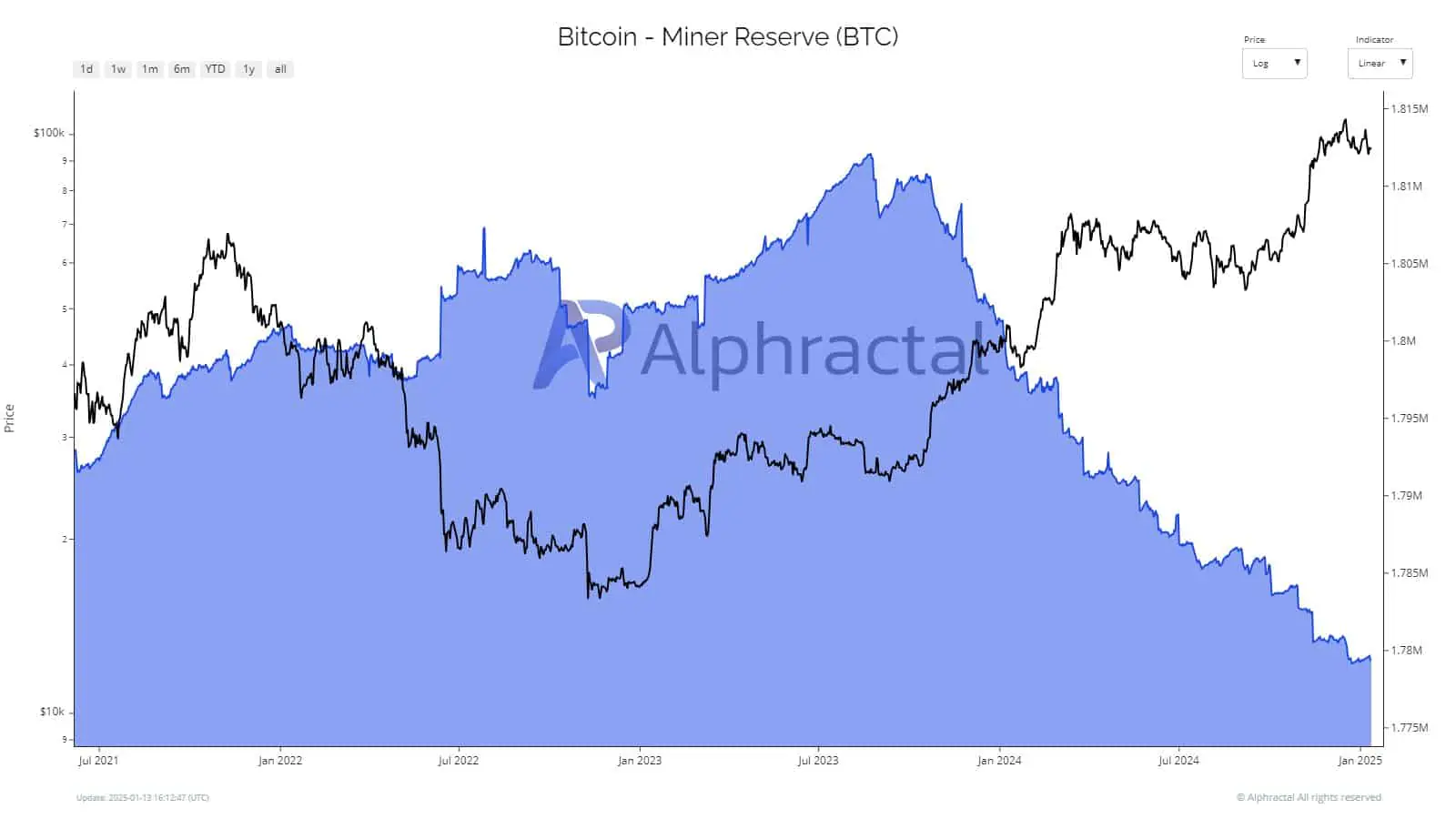

Since mid-2023, Bitcoin miners have been continuously cutting their storage due to rising operating costs. Record-breaking hash rates, coupled with rising energy prices, have put great pressure on mining profitability. This strategic shift highlights miners’ need for liquidity amid increasing market volatility, with the majority of large reserve reductions occurring at Bitcoin’s peak.

Read more: JPMorgan’s Bold Prediction for Solana and XRP ETFs

As miner Bitcoin reserves near multi-year lows in 2025, concerns have grown about their ability to stabilize the market as prices correct. However, data from January 2025 shows that miner selling pressure has decreased significantly. The selling pressure chart reflects a sharp decline in outflows compared to late 2024, signaling a potential shift in market dynamics.

This suggests that miners are adopting a more conservative strategy, possibly holding onto Bitcoin in anticipation of future price increases. Additionally, adjusting mining operations or leveraging external funding may have reduced the need for large liquidations, thereby reducing the negative impact of miners on the Bitcoin market.

OMN

OMN  BTC

BTC  ETH

ETH  USDT

USDT  XRP

XRP  BNB

BNB  SOL

SOL  USDC

USDC  TRX

TRX  DOGE

DOGE