MicroStrategy, a well-known Bitcoin development company listed on Nasdaq, has announced plans to issue $700 million in convertible senior notes, set to mature in 2028.

According to data from CoinMarketCap, 42% of investors maintain a bullish outlook on BTC, while 58% hold a bearish view, reflecting the market’s instability. MicroStrategy’s Bitcoin Investment Strategy According to the press release, the bond issuance will be offered privately to qualified institutional investors under Rule 144A of the Securities Act of 1933.

Convertible senior notes are a form of debt that can be converted into equity (the company’s stock) under certain conditions. Additionally, being “senior notes,” they take priority over other debts in the event of liquidation. This private offering, targeted exclusively at qualified institutional investors, allows the company to bypass stricter public offering regulations while ensuring capital raising through this debt instrument, providing investors with the option to convert into company stock.

Community Reaction However, renowned Bitcoin critic Peter Schiff seemed unfazed by these developments. In a post on X, he expressed his opinion: “Not this again. What will happen when MSTR becomes the last remaining buyer? There is a limit to how much debt MSTR can issue to keep the pyramid from collapsing.”

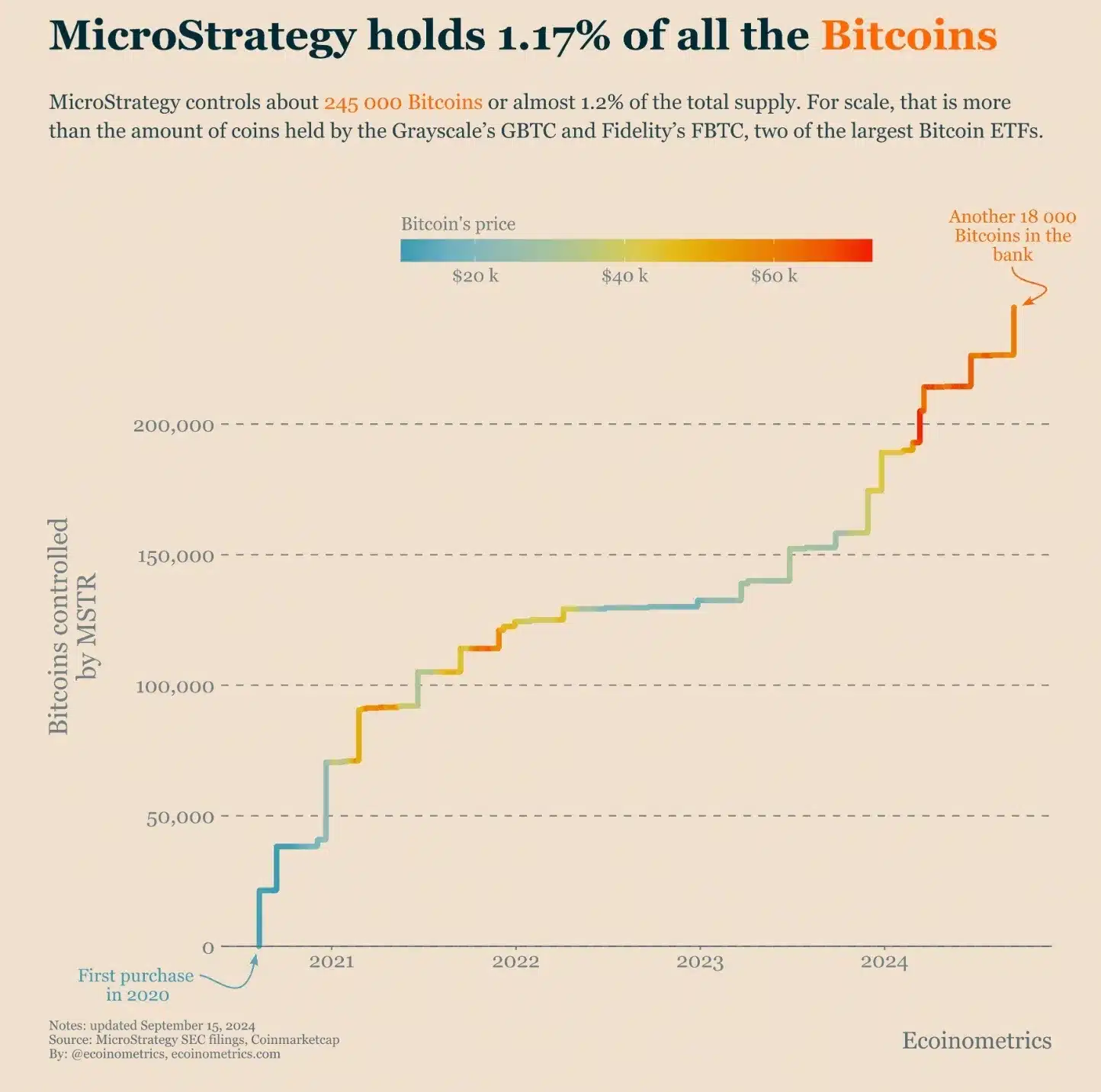

Meanwhile, Ecoinometrics reported that MicroStrategy now holds 1.17% of the total Bitcoin supply. The company continues to steadily increase its Bitcoin reserves, surpassing most Bitcoin ETFs in terms of holdings.

Other Companies Following MicroStrategy’s Strategy Following MicroStrategy’s bold Bitcoin investment strategy, other companies have begun adopting similar approaches.

Metaplanet, a publicly listed consulting and investment company based in Japan, has continued its “buy the dip” strategy despite Bitcoin’s recent difficulties. Recently, Metaplanet purchased an additional 38.46 BTC for $2.1 million, bringing its total Bitcoin holdings to nearly 400 BTC, worth approximately $23 million. According to MarketWatch, since Metaplanet adopted its Bitcoin investment strategy in April, the company’s stock price has surged by 480%.

In contrast, MicroStrategy’s stock dropped by 4.91% on September 17, although it has risen 294.98% over the past year, according to Google Finance. MicroStrategy’s continued accumulation of Bitcoin reinforces the company’s long-term commitment to cryptocurrency and solidifies its position as one of the major players in the digital asset space.

OMN

OMN  BTC

BTC  ETH

ETH  USDT

USDT  XRP

XRP  BNB

BNB  SOL

SOL  USDC

USDC  TRX

TRX  DOGE

DOGE