Bitcoin experienced a sudden pullback to $86,000, wiping out nearly all of its gains from the previous day. This price fluctuation followed reports about a new U.S. initiative on cryptocurrency reserves, which includes Bitcoin and other major digital assets.

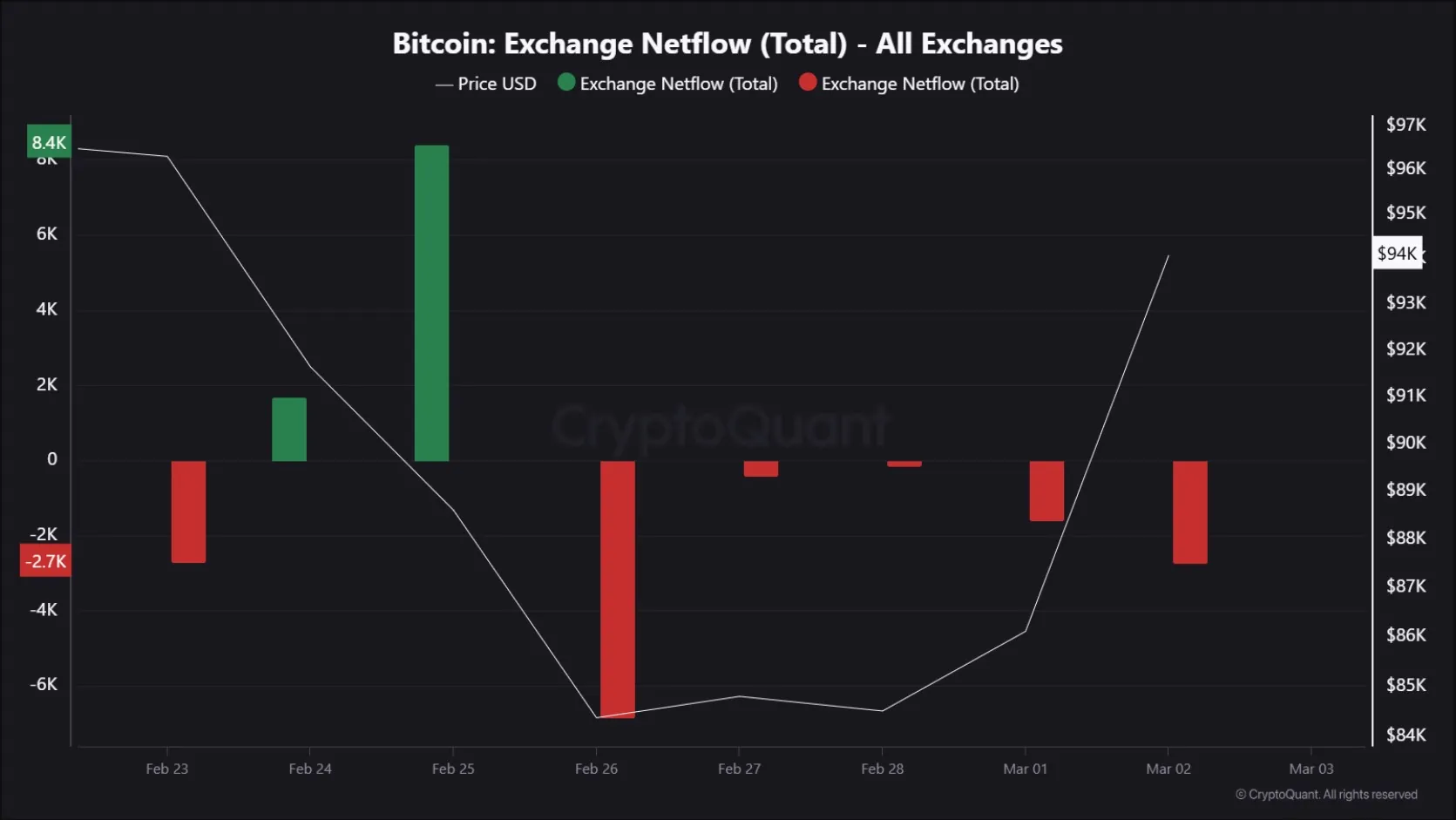

After surging past $94,000, Bitcoin swiftly retraced, marking extreme volatility within the past 48 hours. Data from CryptoQuant highlighted significant activity among cryptocurrency exchanges, revealing key insights into market movements.

The inflow and outflow of Bitcoin across exchanges have played a crucial role in shaping market sentiment and price trends. On February 25, approximately 8,400 BTC were deposited into exchanges, increasing selling pressure and triggering a subsequent price drop. However, the following day saw a reversal, with a substantial outflow of Bitcoin signaling a shift toward long-term holding strategies. This shift helped stabilize Bitcoin’s price and contributed to its recovery in early March.

Exchange flow data underscores how quickly investor sentiment can change in response to external factors. Analysts note that an increase in inflows often correlates with heightened selling pressure, leading to short-term price declines. Conversely, outflows typically indicate a preference for long-term storage, reducing immediate selling pressure and potentially setting the stage for upward momentum.

Historical data supports this relationship: periods of increased Bitcoin outflows have frequently coincided with price surges due to a tightening supply.

“As of March 2, Bitcoin’s price has started to rebound. Historically, when exchange outflows rise, prices tend to follow an upward trajectory,” analysts explain. “This is because as investors withdraw Bitcoin from exchanges, the circulating supply shrinks, easing selling pressure and paving the way for potential price appreciation.”

Beyond exchange movements, data from Glassnode revealed a surge in new Bitcoin addresses in February, reaching a monthly peak of 371,442 on February 26. While this figure dipped slightly to around 300,000 in early March, the overall rise in new addresses suggests growing retail investor interest in BTC.

The increase in address activity, combined with observed exchange flows, provides a more comprehensive picture of the evolving market dynamics.

OMN

OMN  BTC

BTC  ETH

ETH  USDT

USDT  XRP

XRP  BNB

BNB  SOL

SOL  USDC

USDC  TRX

TRX  DOGE

DOGE