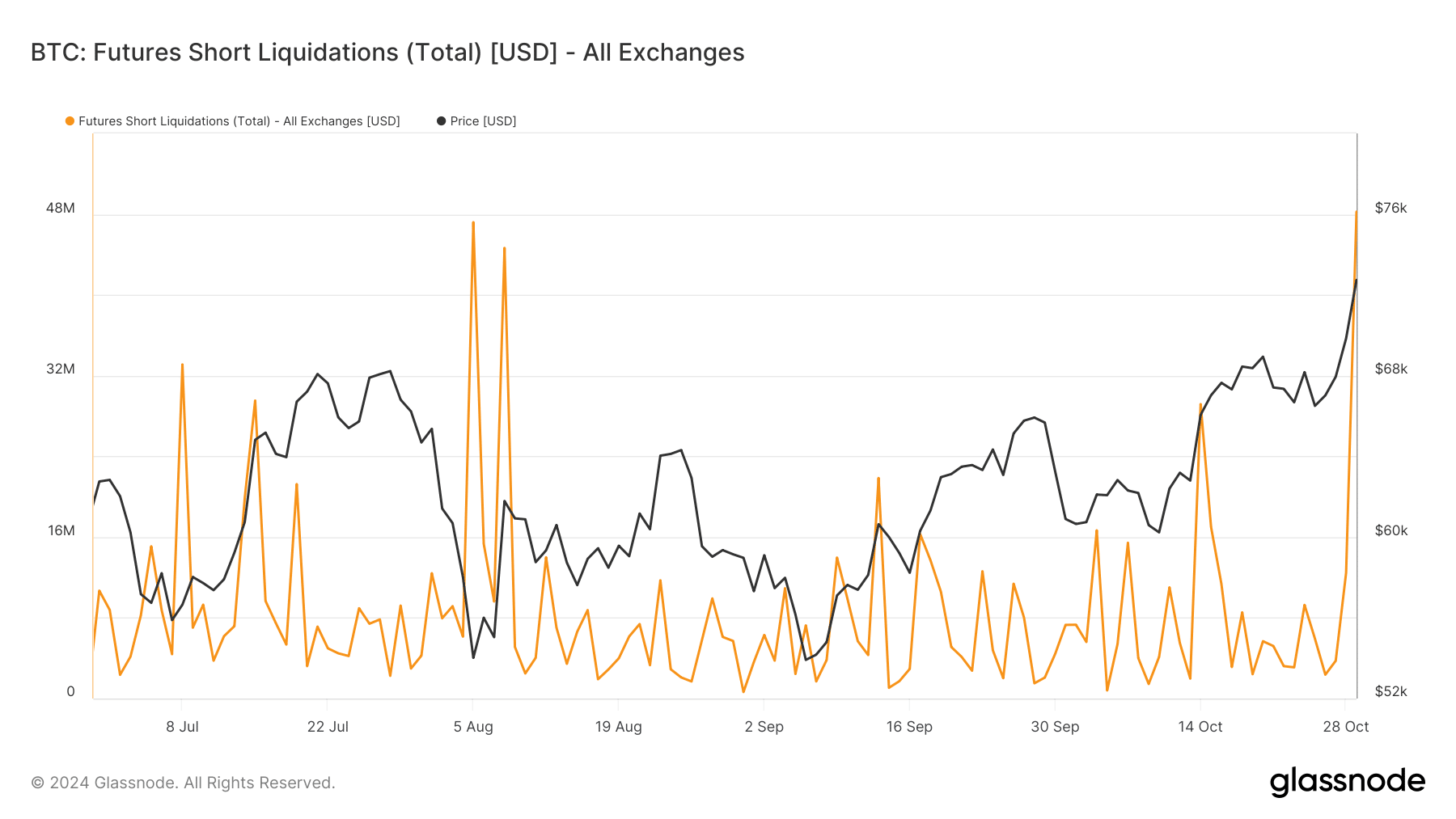

As Bitcoin price surpassed $72,000, the number of short liquidations surged, causing heavy losses for many traders. According to data from Glassnode, the total number of short liquidations hit a record high, with over $48 million wiped out in a single day as BTC broke through a key resistance level. The ripple effect of these liquidations often fuels further price gains.

Along with the strong wave of liquidations, the Fear and Greed Index also recorded a steady increase, reflecting a shift from a cautious market sentiment to a more optimistic outlook. In early October, the index was in the “fear” zone, reflecting investor hesitation.

As Bitcoin price continued to break through resistance levels, the index moved into “greed” mode, reaching its highest level since mid-year. The Fear and Greed Index has long been viewed as a gauge of market corrections, as extreme greed often precedes short-term corrections.

Currently, optimism is rising due to strong market fundamentals and growing interest from financial institutions, which could help sustain Bitcoin’s bullish trend. At the same time, Bitcoin ETF inflows have also hit a new record. On October 29, the price of BTC peaked at over $73,000, with Bitcoin ETFs recording inflows of $870 million in a single day – the highest since early June.

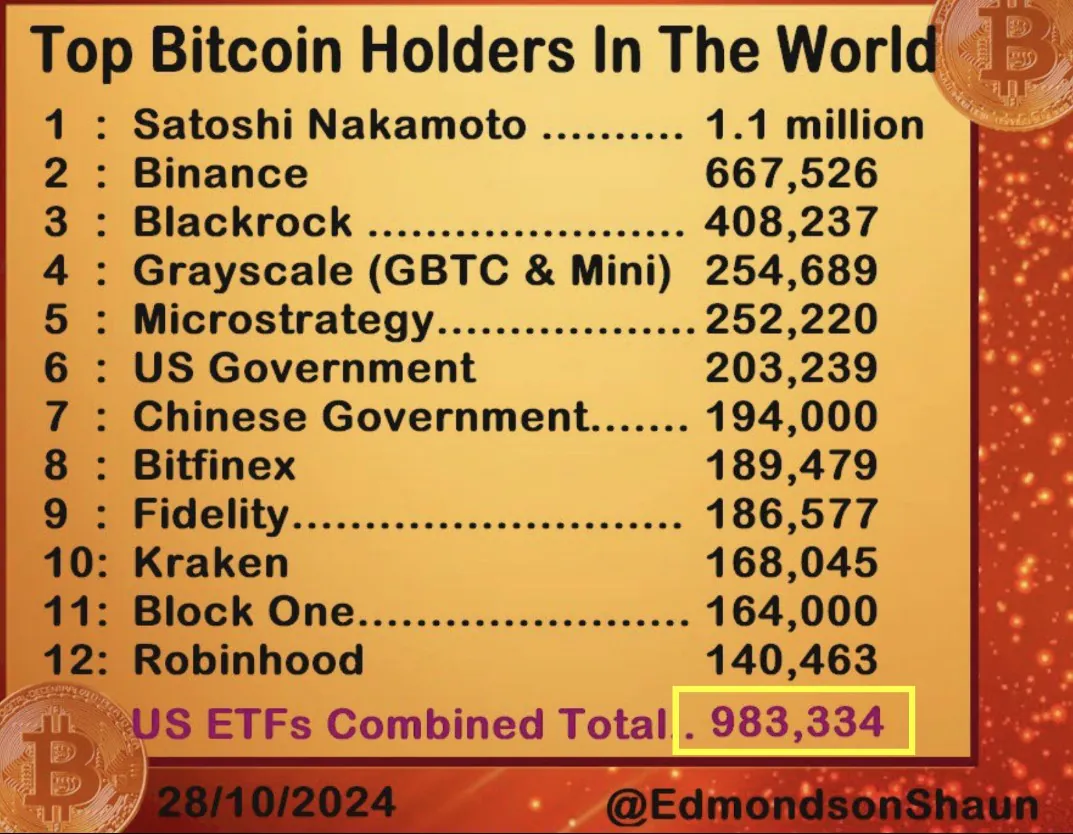

Bitcoin ETFs on the verge of surpassing Satoshi Nakamoto

In a post on the X platform, Eric Balchunas highlighted that a major milestone is approaching as the total amount of Bitcoin held by US spot ETFs could surpass 1 million BTC next Wednesday. That would likely surpass the amount of Bitcoin held by Satoshi Nakamoto, the creator of Bitcoin, in mid-December.

Read more: Wikipedia Suddenly Calls Donald Trump a Fascism

ETFs have been buying around 17,000 BTC per week, bringing them closer to holding more Bitcoin than Satoshi’s iconic wallet—a historic achievement for the asset. Eric Balchunas also noted that under certain conditions, such as a spike in prices or a re-election of Donald Trump, FOMO could bring that milestone even closer.

OMN

OMN  BTC

BTC  ETH

ETH  USDT

USDT  XRP

XRP  BNB

BNB  SOL

SOL  USDC

USDC  TRX

TRX  DOGE

DOGE