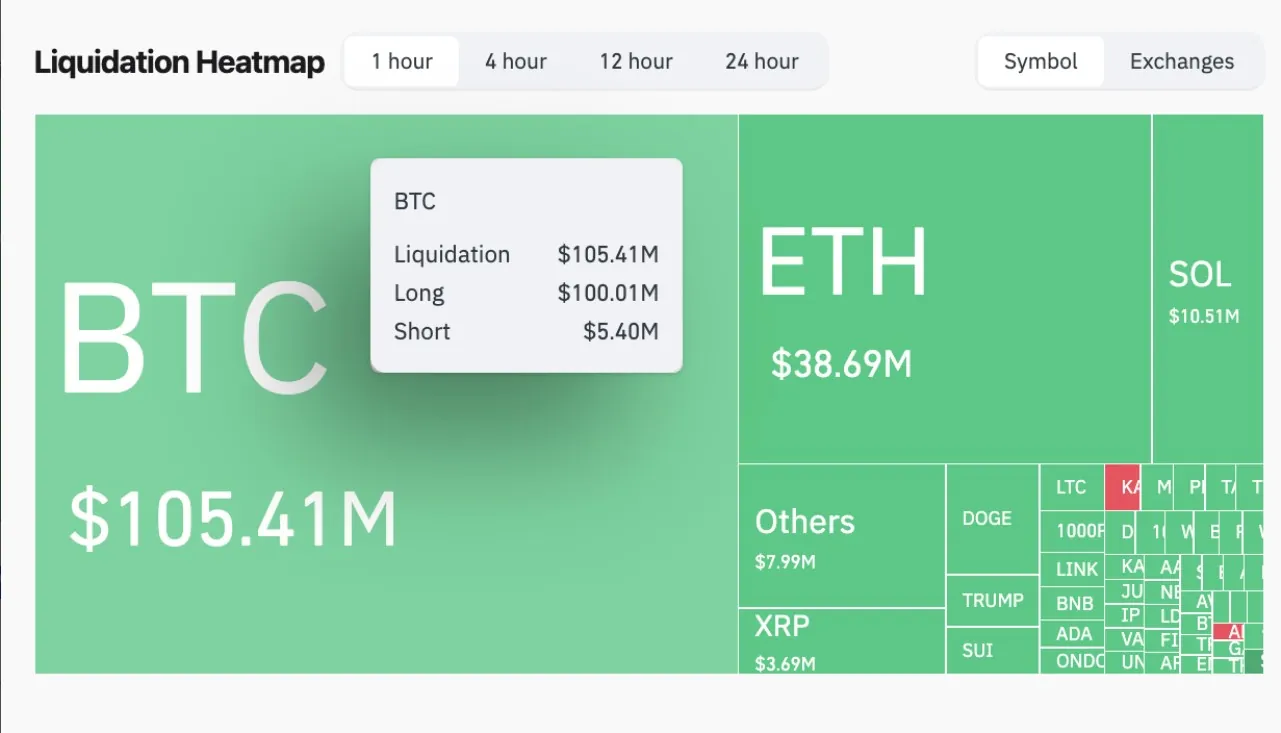

On February 27, Bitcoin (BTC) tumbled to $79,752, according to TradingView data, marking a sharp 2.65% decline within the past hour. This sudden drop resulted in the liquidation of $100.01 million in long positions, as reported by CoinGlass.

The last time Bitcoin traded at this level was on November 11, just days after Trump’s election victory, when optimism surrounding his pro-crypto policies fueled hopes for a major rally in 2025.

Traders Brace for a Potential Drop to $70,000

Over the past few days, many crypto traders identified $82,000 as a potential support level for Bitcoin. However, with the latest downturn, growing concerns suggest a further slide toward $70,000.

Crypto trader dmac expressed skepticism in a February 27 post on X, stating, “Dip buyers are getting smoked. I still see $70K as the target.” Bitcoin has not traded at this price since November 5, when election polling results appeared favorable for Trump.

Echoing a similar sentiment, pseudonymous trader Mandrik quipped, “If you liked $80K Bitcoin, then you’re gonna love $70K Bitcoin.”

However, not all traders share the same level of concern. Prominent crypto analyst Rager reassured their 201,500 X followers that a drop to the mid-to-low $70,000 range would not be out of the ordinary.

“Historically, Bitcoin corrections of 30% to 40% are quite normal—even during bull markets,” Rager noted.

Meanwhile, market sentiment remains divided. Data from the crypto predictions platform Polymarket suggests that traders are evenly split on whether Bitcoin will rebound or continue its descent toward $70,000.

“There’s nearly a 50/50 chance that Bitcoin extends its decline and falls below $70K,” Polymarket stated in a February 27 post on X.

Macroeconomic Uncertainty and Tariff Concerns Weigh on Crypto Markets

Analysts widely attribute Bitcoin’s recent volatility to macroeconomic uncertainty, particularly concerns over Trump’s proposed tariffs and their potential impact on global markets.

Since Trump’s inauguration on January 20—when Bitcoin soared to an all-time high of $109,000—the cryptocurrency has declined by nearly 26%.

Despite the turbulence, institutional investors remain optimistic about Bitcoin’s long-term prospects. On February 27, Geoffrey Kendrick, Head of Digital Assets Research at Standard Chartered, reaffirmed his bullish outlook, predicting Bitcoin could reach $200,000 this year before surging to $500,000 by the end of Trump’s second term.

OMN

OMN  BTC

BTC  ETH

ETH  USDT

USDT  XRP

XRP  BNB

BNB  SOL

SOL  USDC

USDC  TRX

TRX  DOGE

DOGE