On-chain Data Warning for Bitcoin

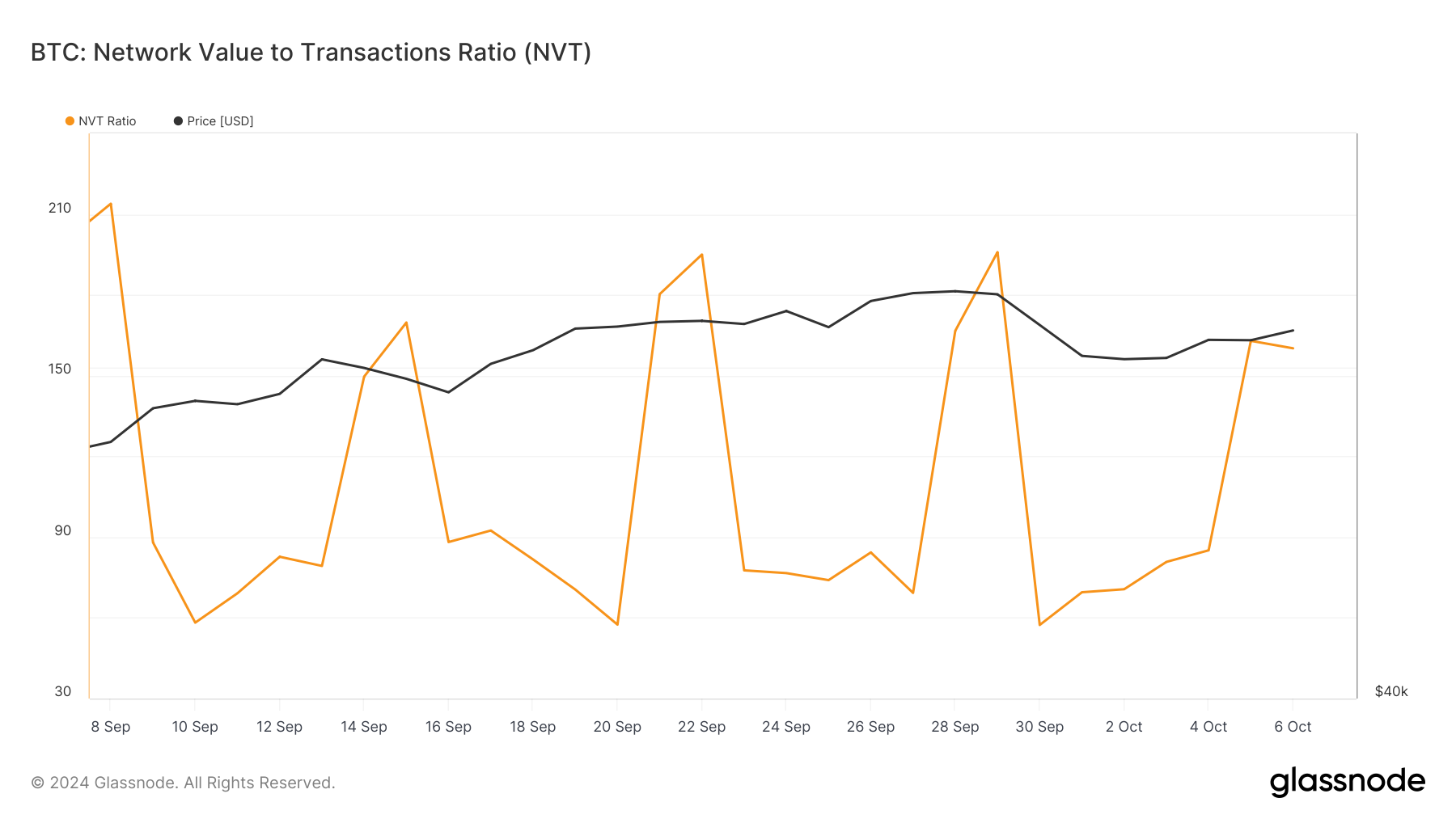

A key indicator that is supporting a correction in Bitcoin price is the Network Value to Transactions (NVT) ratio. This ratio shows whether the market capitalization is growing faster than the transaction volume of the cryptocurrency.

When the NVT ratio is falling, the transaction volume is increasing faster than the market capitalization, which is usually a sign of bullish potential. Conversely, when the NVT ratio is rising, this indicates that the Bitcoin network is under pressure because the market capitalization is much larger than the transaction volume.

According to data from Glassnode at the time of writing, the NVT ratio has been on the rise recently. This could indicate that Bitcoin is overvalued, and a short-term correction is likely.

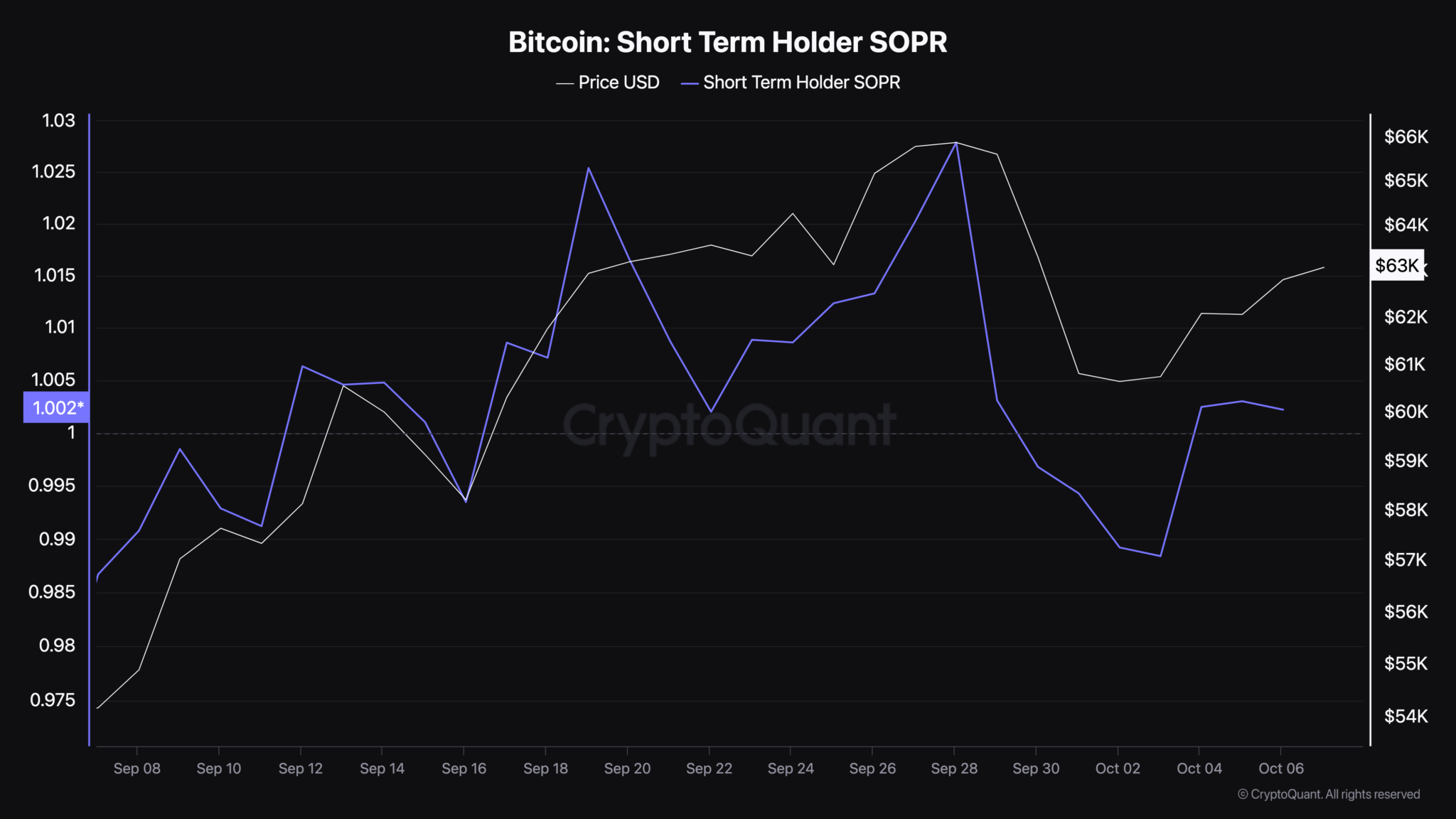

Another factor that supports this outlook is the Short-Term Holders’ Output Profit Ratio (STH-SOPR). This indicator tracks the activity of short-term investors and shows whether they are selling at a profit or a loss.

When the STH-SOPR ratio is below 1, it indicates that investors are selling at a loss. Conversely, when the ratio is above 1, investors are selling at a profit. However, at the moment, the ratio is exactly 1, which indicates that the trading volume between selling at a loss and selling at a profit is balanced.

In terms of the impact on Bitcoin price, this implies that the price may continue to fluctuate without a clear trend. However, the possibility of Bitcoin rising to $70,000 seems unlikely in the current situation.

BTC Price Forecast: Bitcoin Could Drop Below $60,000

On the daily chart, Bitcoin is currently at $62,400, up slightly from 24 hours ago. However, the Money Flow Index (MFI) is signaling a decline in capital inflows into the cryptocurrency market.

MFI is a technical indicator that combines price and trading volume to gauge the level of buying and selling pressure in the market. When the MFI is rising, liquidity increases and prices tend to rise.

Since the MFI is currently falling, this implies that investors are taking profits from previous rallies, which could slow down Bitcoin’s upward momentum. If this trend continues, BTC could drop to $59,978.

However, if investors stop selling and start accumulating aggressively, Bitcoin could potentially rise to $66,527 and even hit $70,000.

OMN

OMN  BTC

BTC  ETH

ETH  USDT

USDT  XRP

XRP  BNB

BNB  SOL

SOL  USDC

USDC  TRX

TRX  DOGE

DOGE