Bitcoin has experienced a decline of more than 8% over the past week, from a high of $73,600 to a low of $67,500 overnight, before recovering to its current price.

Bitcoin Falls Below Its Strike Price

Bitcoin’s price has fallen below its strike price—a key metric that measures the average cost to buy all coins in circulation. The drop has dampened hopes of a quick recovery to $72,000, as a drop below the strike price typically indicates increased selling pressure.

BTC fell below its strike price on October 20, and in just three days, Bitcoin slid from $69,022 to $66,611. By October 28, Bitcoin’s strike price had continued to fall below its spot value. A day later, BTC surged to $72,708, fueling expectations that the coin could soon hit its all-time high.

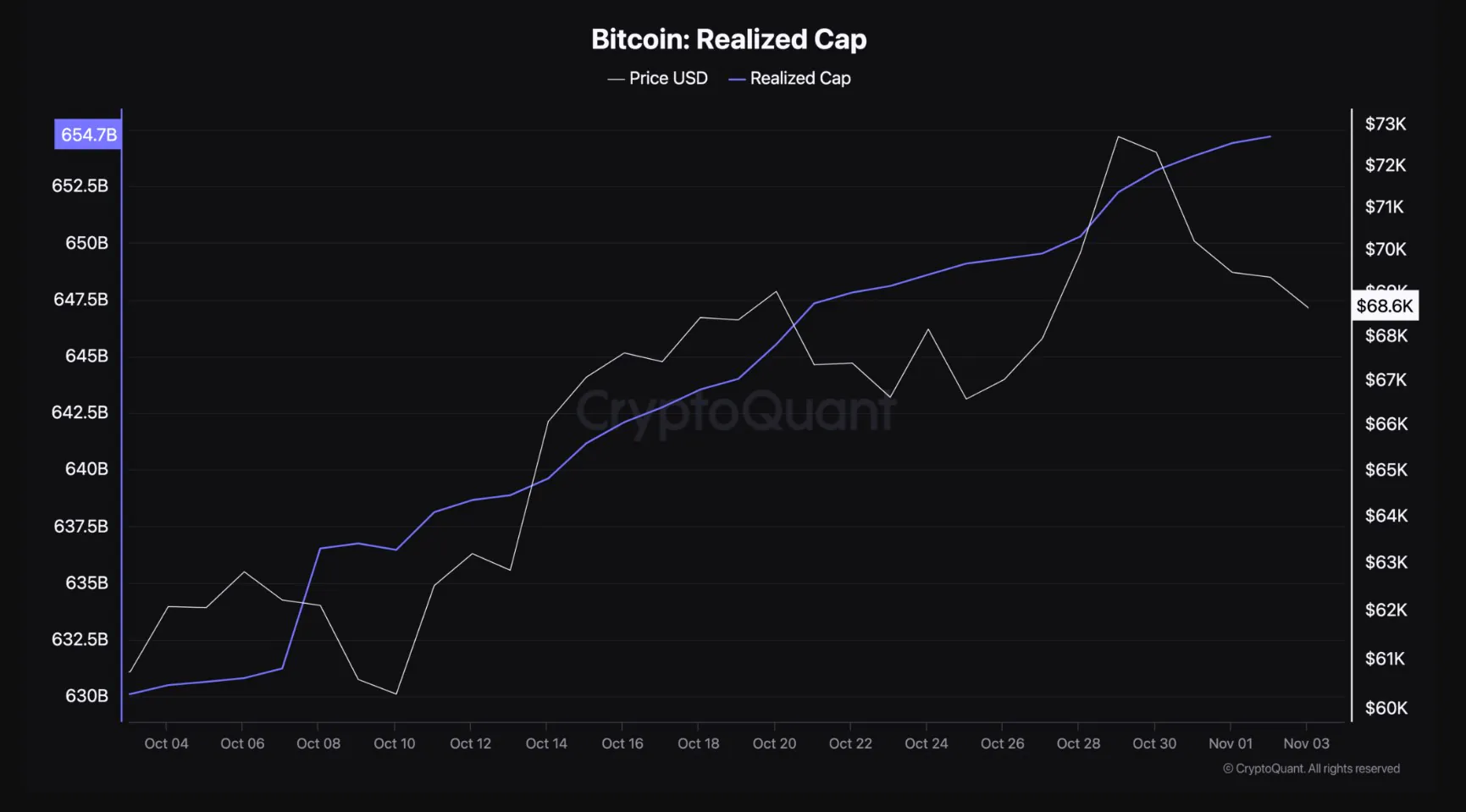

However, data from CryptoQuant shows that the actual price of Bitcoin is currently $69,352, which is higher than the current price. Typically, when the actual price is lower than the market price, it acts as a support level, indicating a potential price increase. But with the actual price higher than the current price, the chances of BTC reclaiming $72,000 in the short term appear limited.

Whale Inflow

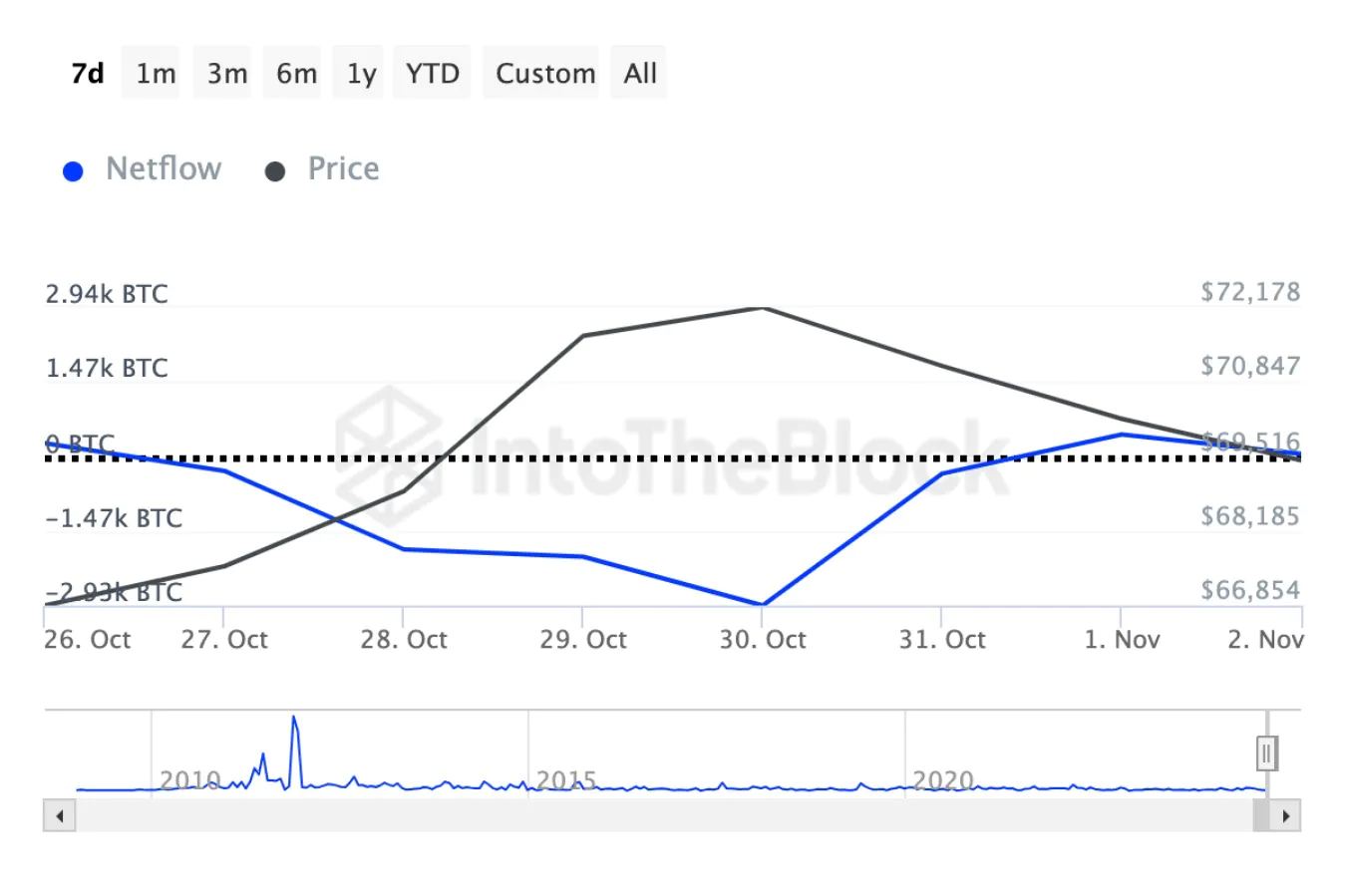

Another indicator that Bitcoin may have trouble recovering is the inflow from large holders. This metric analyzes the activity of addresses that own between 0.1% and 1% of the total circulating supply.

When the inflow from large investors is positive, it indicates that crypto whales are accumulating, leading to a possible price increase. However, data from IntoTheBlock shows that the inflow has decreased, meaning that whales have sold more than they bought over the past seven days.

If this trend continues, there is a high chance that Bitcoin will see another decline.

Read more: TON Blockchain Successfully Fixes Two Critical Vulnerabilities

Technically, Bitcoin is currently at risk of breaking out of an ascending channel on the daily chart. This pattern, which consists of two rising trendlines forming resistance at the top and support at the bottom, shows that Bitcoin is trading near the support level at $67,940.

If Bitcoin’s actual price falls below its current value, it could signal a trend reversal. In this case, BTC could rise to $72,770, opening the door to a new all-time high.

OMN

OMN  BTC

BTC  ETH

ETH  USDT

USDT  XRP

XRP  BNB

BNB  SOL

SOL  USDC

USDC  TRX

TRX  DOGE

DOGE