Despite a recent surge pushing Bitcoin briefly to $62,000, the largest cryptocurrency by market capitalization continues to struggle under bearish pressure. After reaching a high of over $73,000 in March, Bitcoin has dropped nearly 20%, trading below $61,000 with recent fluctuations hitting a low of $60,606 at the time of writing.

This decline occurs amidst broader market challenges and reflects a significant retreat from previous gains, indicating underlying weaknesses in market fundamentals.

Evaluating Bitcoin’s Recent Price Increase

Crypto analyst Willy Woo recently provided insights into BTC’s volatility, suggesting that while recent price corrections have reduced some of the market’s excessive leverage, a full recovery is still distant.

According to Woo, the market continues to face excessive speculation that needs to be addressed for price stabilization. Woo noted that the recent rise to $62,000 was more of a technical rebound rather than a fundamental recovery, indicating deeper issues still affecting the Bitcoin market. He described the latest price increase as a technical correction driven by automated trading algorithms, rather than a genuine surge in buyer demand.

He pointed to specific patterns, such as the TD9 reversal and hidden bullish divergence, indicating a short-term recovery but not necessarily long-term health. Woo stated, “So far, this technical reversal is underway.”

Nice to see some of the speculation getting purged the last few days.

Still a bit heavy, still too much speculation.

Bears still in control, but #Bitcoin got so oversold in the liquidations that it’s really hard to go lower without an uptick. pic.twitter.com/EJeqmaLe0Z

— Willy Woo (@woonomic) June 26, 2024

However, he emphasized that this recovery does not reflect underlying fundamental strength. The market is merely adjusting from previous overselling without any significant changes in the actual supply and demand dynamics of Bitcoin.

For a true bullish reversal in fundamentals, there needs to be an increase in the number of spot buyers purchasing coins directly from exchanges, a trend that is not yet evident.

Woo also noted, “We are still waiting for the hash rate to rise again, which is a clear sign that miners have stopped selling to fund hardware upgrades.”

He concluded, “So, be prepared for boring price action for several more weeks. This is not the time for moonshots. It’s time for speculators to either liquidate themselves or become disheartened and close their positions. Only then can we move forward. The best path here is to stack up and let the weak hands get out.”

Related: Layer-2 Bitcoin Solutions are Revolutionizing On-Chain Operations

In-Depth Market Insights

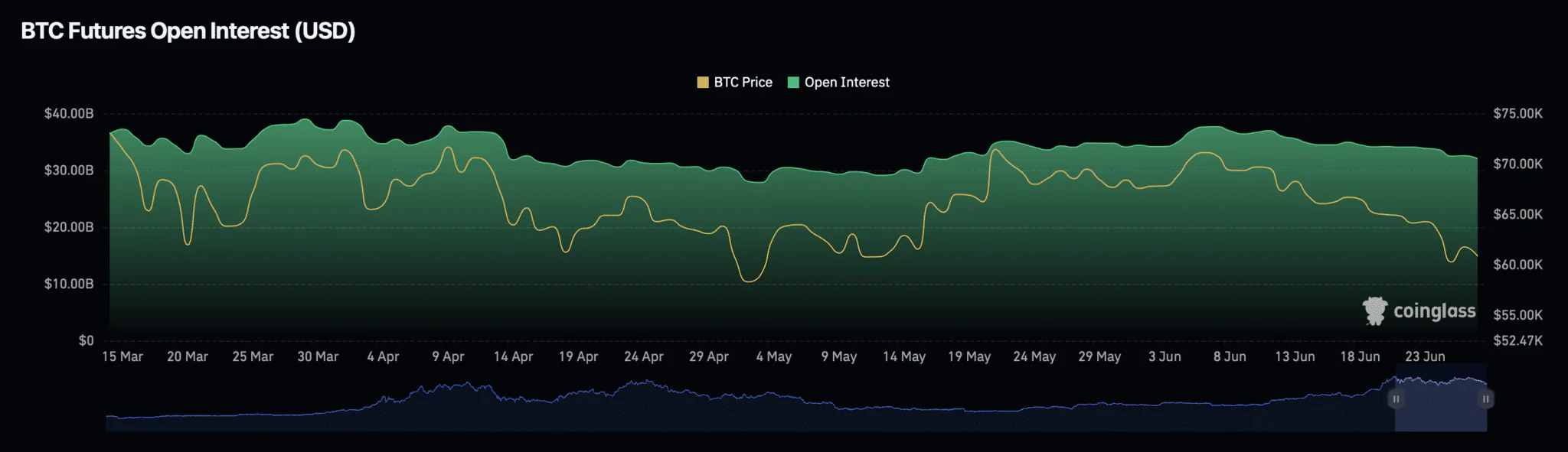

Market data on Bitcoin’s open interest and trading volume further exacerbate its bearish outlook.

An analysis of Coinglass data reveals a significant 2.16% drop in open interest and a 25% decrease in open interest volume over the past day, indicating reduced trading activity and potentially lower speculative interest. This decline suggests traders are less willing to take positions in Bitcoin, anticipating further price drops.

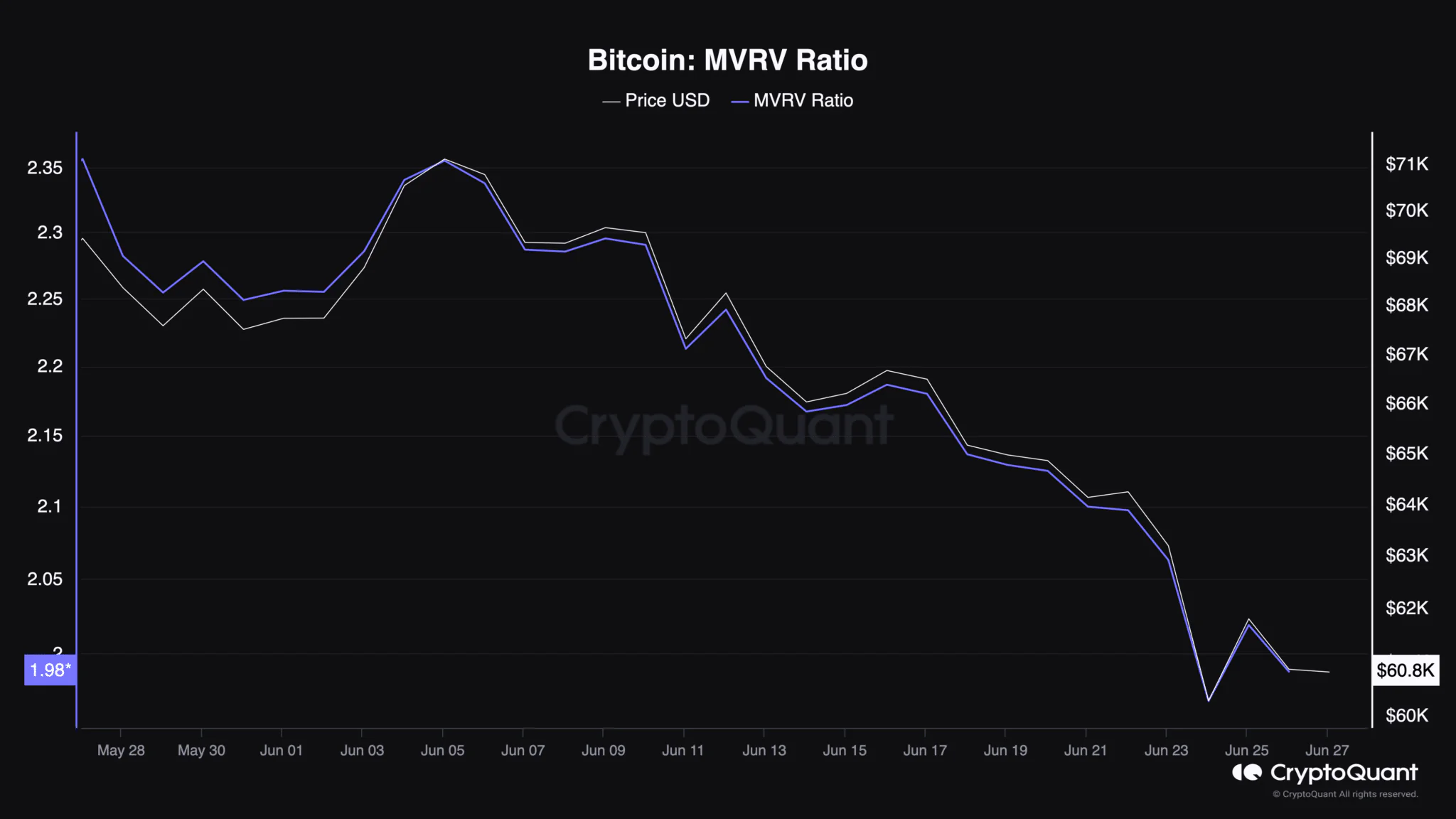

Moreover, the MVRV ratio, which compares Bitcoin’s market value to its realized value, stands at 1.98 at the time of writing. This ratio helps determine whether Bitcoin is undervalued or overvalued relative to its historical price norms. An MVRV ratio below 2 typically indicates Bitcoin is undervalued, suggesting prices could rise if market sentiment shifts. However, given the current market conditions and economic uncertainty, this potential growth should be approached with caution.

Despite the downward trend, some optimistic forecasts remain, such as predictions indicating a rise to $250,000 based on the Bitcoin rainbow chart.

OMN

OMN  BTC

BTC  ETH

ETH  USDT

USDT  XRP

XRP  BNB

BNB  SOL

SOL  USDC

USDC  DOGE

DOGE  TRX

TRX