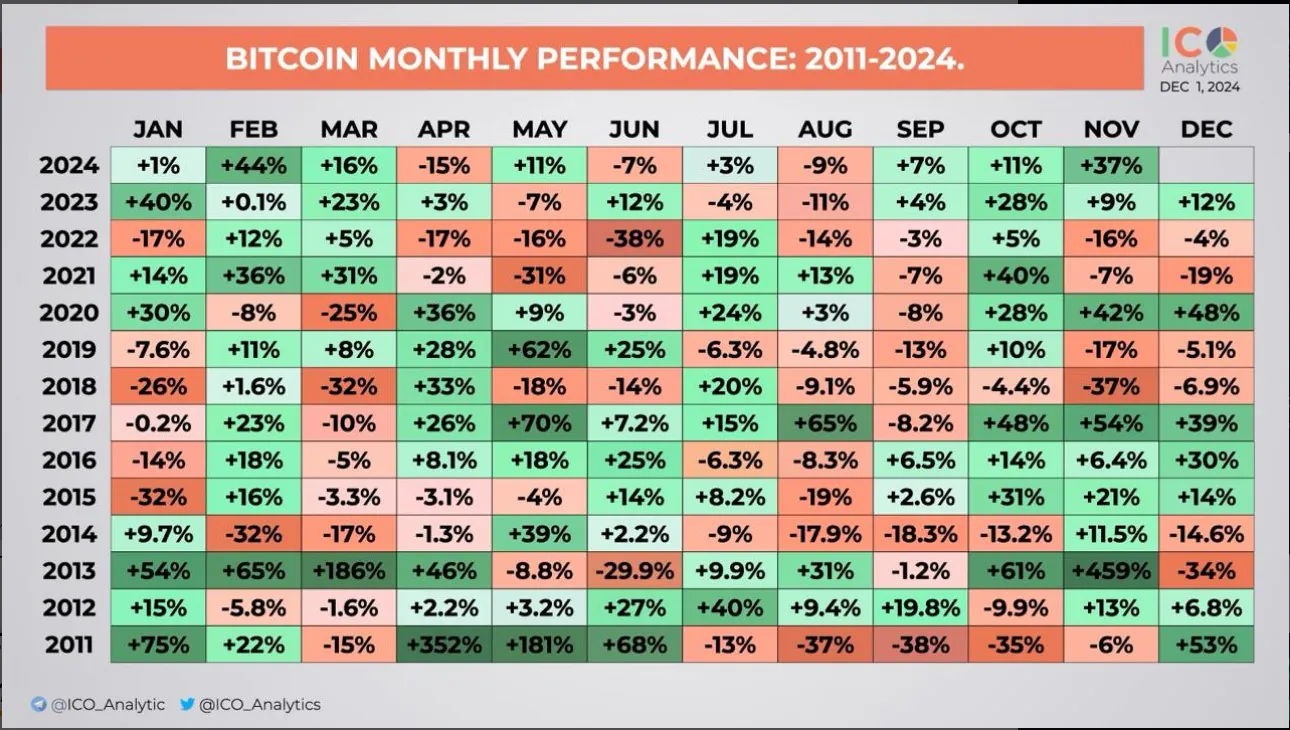

According to data from ICO Analytics, Bitcoin also recorded an impressive 37% increase in November alone. The data, which looks at Bitcoin’s monthly performance from 2011 to 2024, shows that only three years ago saw a stronger November gain: 2013 with a 459% surge, 2017 with 54%, and 2020 with 42%.

Bitcoin’s appeal has exploded once again as more than 55,000 BTC, worth $5.34 billion, were withdrawn from exchanges in just 72 hours. This move, along with the Fear and Greed Index hitting “extreme greed,” is reminiscent of the historic 2020-2021 bull run, when Bitcoin jumped from $15,000 to $57,000.

The sharp drop in exchange balances, now below 2.8 million BTC for the first time since 2018, reflects investors’ long-term investment strategies. The recent 55,000 BTC withdrawal coincides with a surge in on-chain activity, suggesting a strong accumulation wave is underway.

Read more: Can ETH Surge to $4,000 as 90% of Investors Turn Profitable?

In addition, the rising price trend further highlights the risk of a supply shortage. Historically, such large-scale BTC withdrawals typically precede bull cycles, when exchange supply decreases, selling pressure cools, and long-term holding sentiment becomes dominant.

Now that Bitcoin has surpassed the $99,000 mark in November, the market is focusing on the possibility of reaching the historic $100,000 mark, which could happen as early as this December.