Bitcoin recorded a sharp drop to $92,700 yesterday before recovering to its current price. The strong volatility has caused leveraged traders to suffer heavy losses, with the total value of liquidations in the market, especially long orders, reaching $337.6 million in the past 24 hours alone. Data from major exchanges shows significant selling pressure.

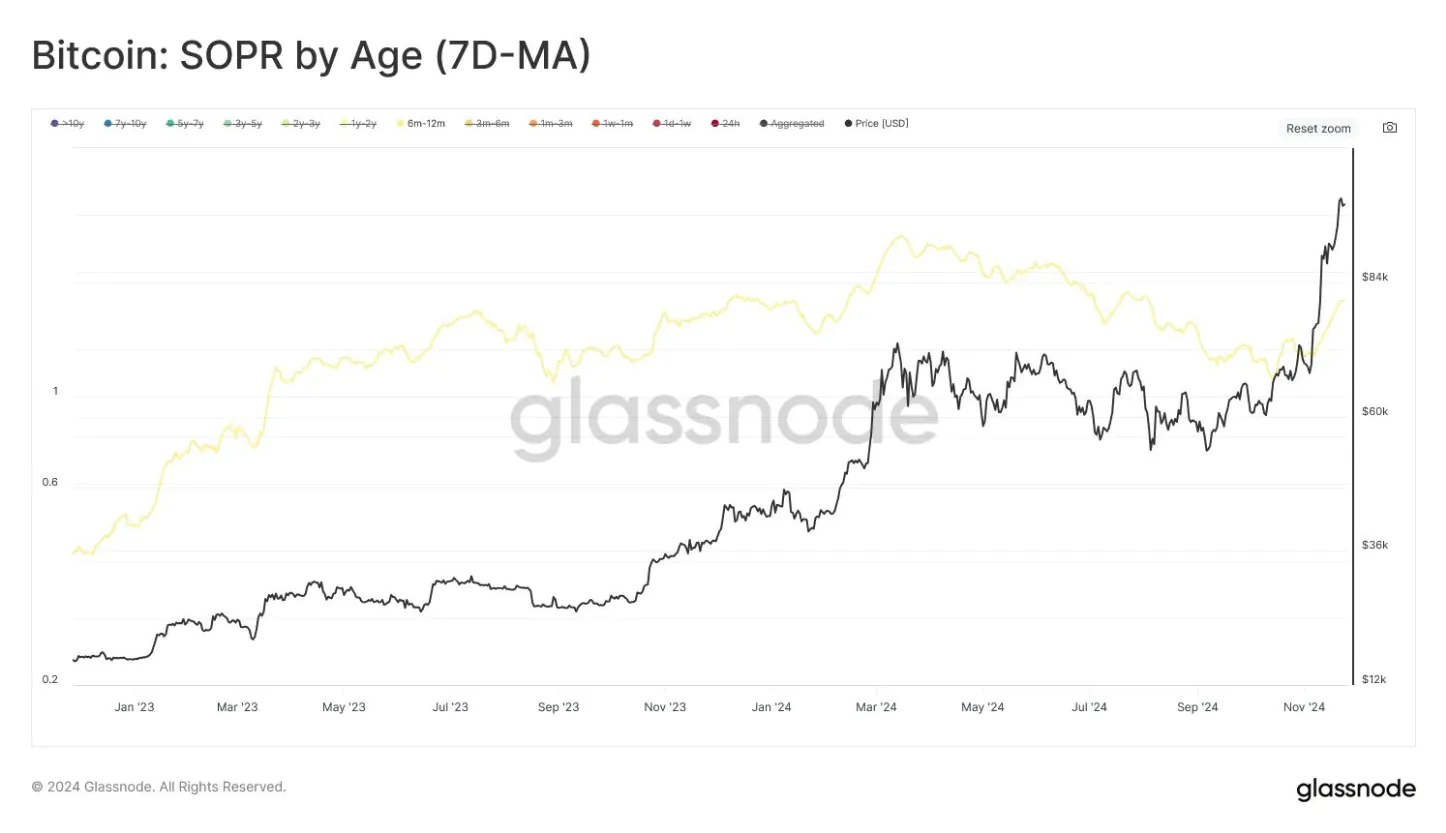

According to Glassnode, another factor contributing to this sell-off is long-term Bitcoin investors. Specifically, the group of investors with a holding period of 6 to 12 months has become the main selling force, with their average base price being 71% lower than the current market price (around $57.9k).

“When Bitcoin surged from $74,000 to $99,000, many investors took advantage of this opportunity to increase profits.”

Read more: Whale Dumps PEPE, Shifts Focus to EIGEN

Financial markets always operate on a balance between buyers and sellers. Today’s price action reflects a shift in sentiment from short-term Spot and Long positions to short selling. As liquidation pressure increased and Bitcoin fell near $90,000, a surge in short positions emerged, pushing the BTC funding rate from 0.019 to a peak of 0.04. Liquidation map data indicates that if Bitcoin falls below $94,000, a further sell-off could be triggered, pushing the price back to $90,000, where some traders may consider re-entering the market.