Bitcoin has been on a strong uptrend since late October 2023, which is evident from the price chart. However, it is still unclear what will happen next.

Signals from whales

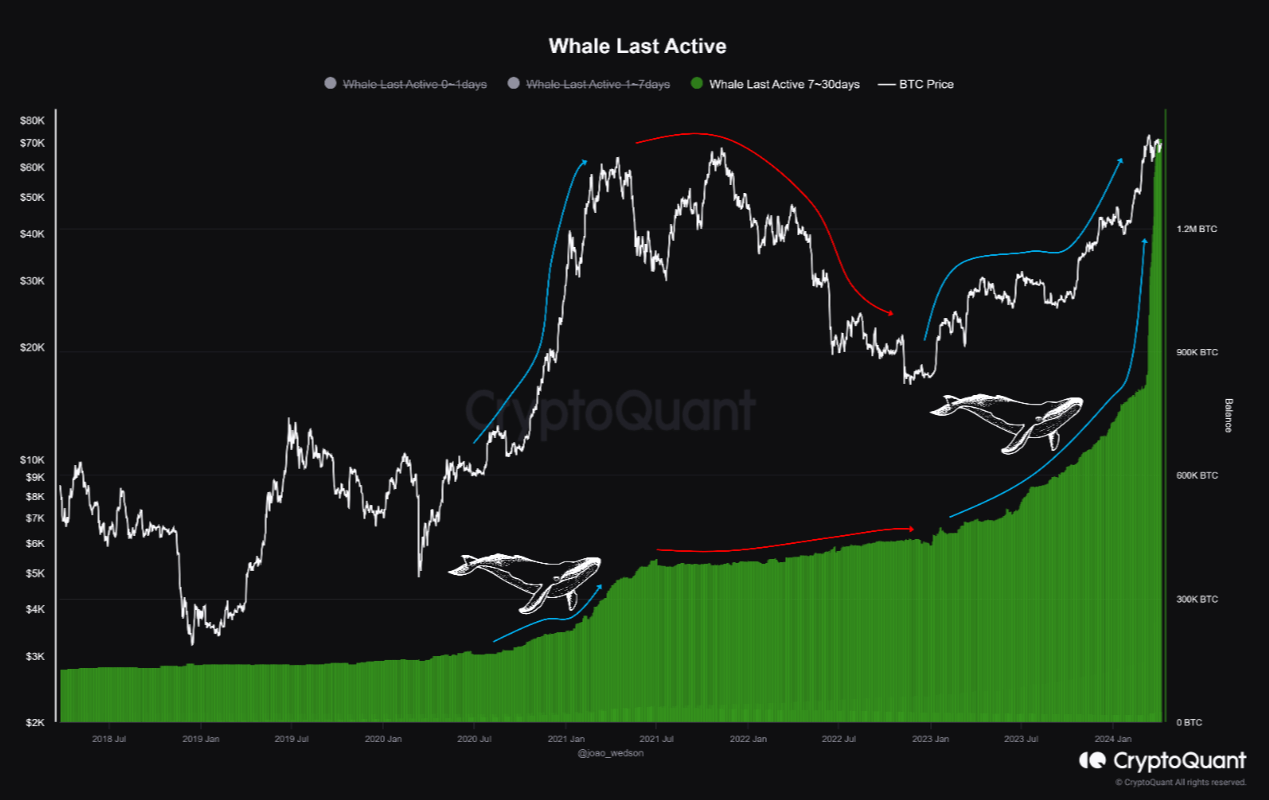

CryptoQuant user joaowedson pointed out that the Whale’s most recent 7-30 day indicator is increasing from March 2023. During the previous bullish period, whale activity increased in mid-2020, while Bitcoin price also increased sharply.

Source: CryptoQuant Insights

A similar situation has been occurring over the past 6-8 months, with the indicator starting to move significantly higher.

In addition to watching the price chart, the whale indicator is also another sign that the current uptrend could be a long-term rally starting from the $30K price level.

Check miner behavior

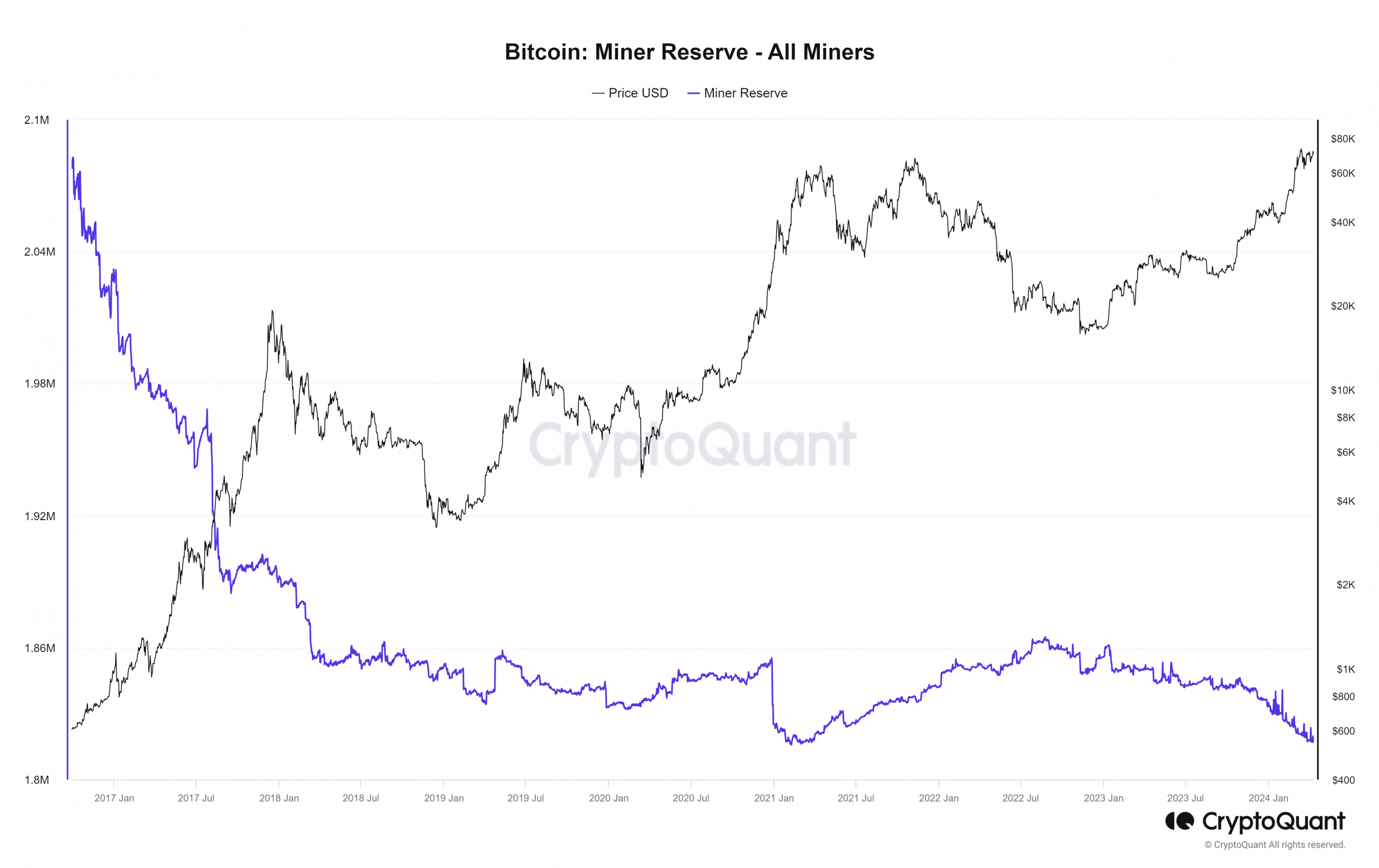

The reduction of the miner’s reward from 6.25 BTC to 3.125 BTC after the halving event is becoming a topic of interest to many people. This could cause many miners to shut down if Bitcoin prices do not rise higher to compensate.

Another solution could be to reduce the network hash rate and subsequent mining difficulty, but this is very difficult to do.

The miner stock chart from CryptoQuant shows a gradual decrease since November 2023. This gradual decrease has been coupled with price increases in the last two cycles.

Source: CryptoQuant

Therefore, there are various signs proving that Bitcoin could begin a long-term bull run ahead of the halving event. Bitcoin also reached an all-time high price before the halving, which is new compared to previous cycles.

The importance of miners’ Bitcoin transactions also decreased over successive cycles. This may continue as whales and institutional investors become important players. In this case, the halving event could become a “news sale event”.

Related: Bitcoin Slides to $69,000 Alongside Negative Signals

With whale activity and miner reserve data, along with price charts, supporting the idea of a current bull run, the question of “when will the cycle end” has become important than.

Previous cycle peaks occurred between 526 and 547 days after the halving event. Can the duration of this cycle be significantly shortened after the last 6-8 months? Only time will tell.

真是太牛了

Time will really tell. Optimism is the life’s propeller.