The cryptocurrency market experienced a sharp correction yesterday, especially on exchanges in South Korea, after the country’s government declared an emergency martial law. The South Korean president stated that the martial law was implemented to “protect a free Korea from threats from North Korea and eliminate anti-state elements.”

Although the prices of some cryptocurrencies fell sharply during that time, the market quickly recovered. Bitcoin is currently hovering around $96,000, after bottoming out at $93,500 yesterday and quickly rebounding to its current price.

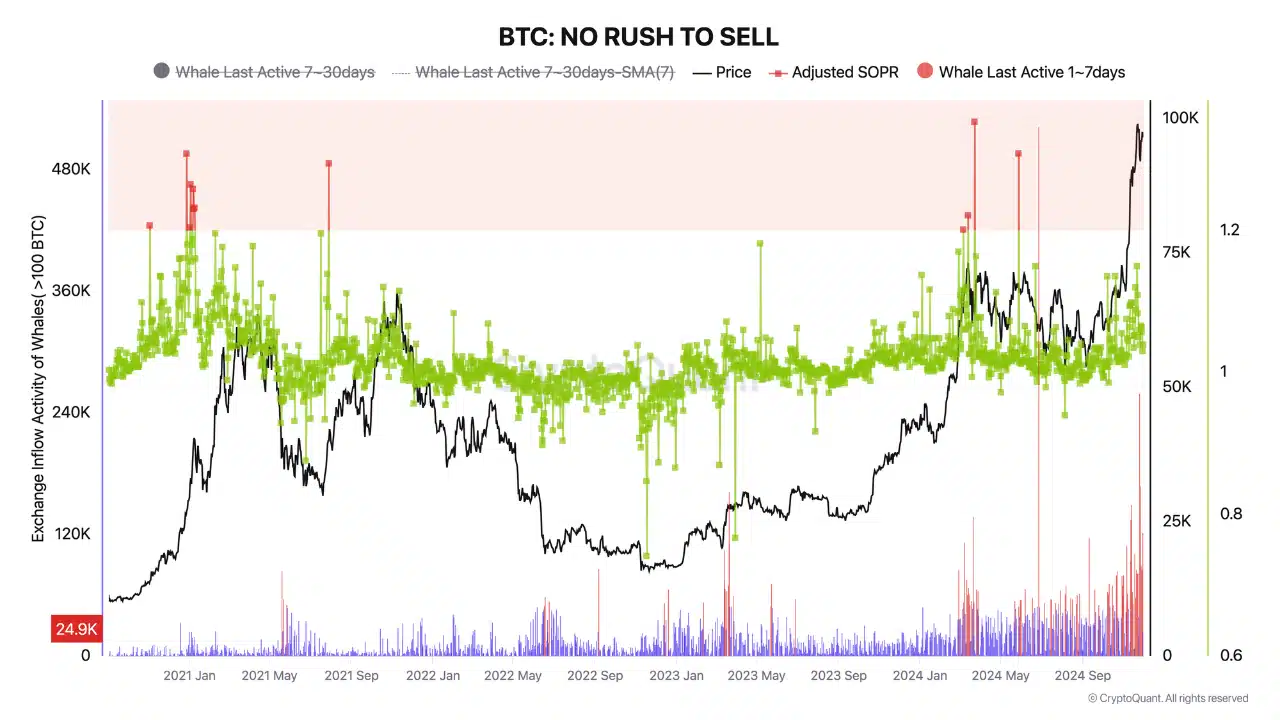

An analyst from CryptoQuant pointed out a notable trend related to whale activity in the market, especially after the US Presidential election. Since November 5, the amount of Bitcoin transferred to exchanges from wallets belonging to whales has increased significantly.

However, the SOPR index, a measure of profit-taking activity in the market, has yet to record any major sell-offs.

While the large inflows into Bitcoin may create short-term selling pressure, the lack of aggressive selling by whales reflects caution, reflecting a “wait and see” strategy.

Bitcoin’s price trajectory can be further analyzed through the MVRV ratio and the number of active addresses. The MVRV ratio, a comparison of the market capitalization and the realized capitalization, helps assess Bitcoin’s valuation. A ratio above 1 suggests that most investors are making profits, while a value of 3.7 signals that Bitcoin may be overvalued. Currently, the MVRV ratio is at 2.57, implying that profits are still at a reasonable level.

In addition, the number of Bitcoin active addresses has been growing steadily since August. Although the number dropped below 750,000 on December 1, it has now recovered above 900,000.

Read more: South Korea Channels $19 Billion into Crypto and Stock Markets

The resurgence of active addresses suggests that investor participation has recovered, opening up the potential for Bitcoin prices to rise further in the coming period.