Data from CryptoQuant shows that on April 1, Bitcoin [BTC] recorded the second largest withdrawal from leading cryptocurrency exchange Coinbase.

According to information from the data provider, on that day, about 17,000 BTC, equivalent to about 1 billion USD, were withdrawn from the exchange. Previously, on March 28, a total of 16,800 BTC were withdrawn from Coinbase.

Large amount of Bitcoin leaves Coinbase

Coinbase withdrawals are often seen by large institutional investors moving large amounts of their Bitcoin holdings. The reason could be to diversify your investment portfolio or transfer money to other types of investment assets.

Sharing a similar view, CryptoQuant analyst Burak Kesmeci noted that the recent surge in Bitcoin outflows from Coinbase could be “related to institutional or Spot ETF buying.”

Source: CryptoQuant

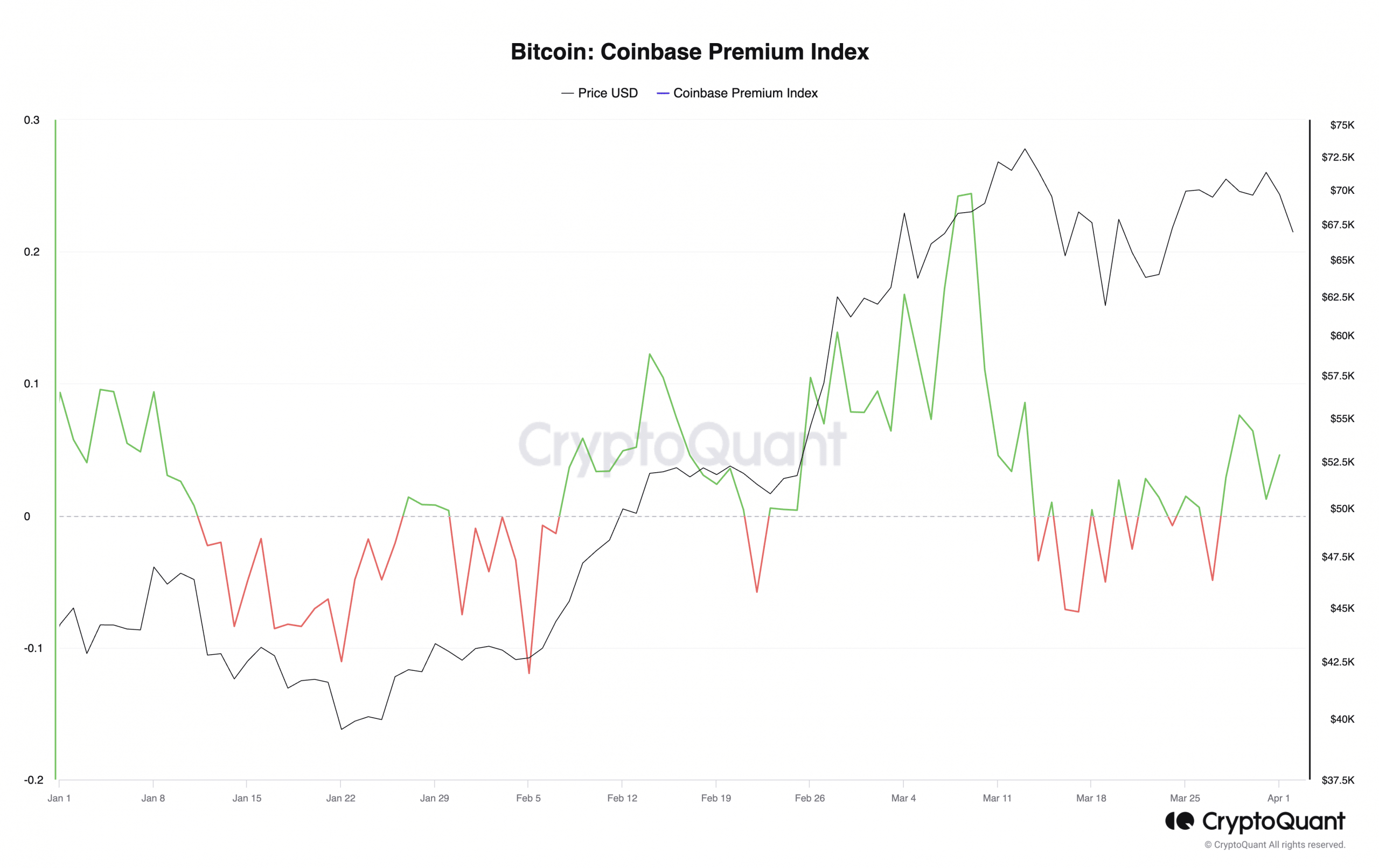

These premium Bitcoin withdrawals from Coinbase on April 1 also coincided with a reversal in Bitcoin’s Coinbase Premium Index (CPI).

On that day, Bitcoin’s CPI, after falling into negative territory, changed direction and trended upward. This index measures the difference between Bitcoin prices on Coinbase and Binance. When the CPI value increases, it represents significant buying activity from US investors on Coinbase.

Conversely, when the index falls and enters negative territory, it signifies that there is less trading activity on the US-based exchange. At the time of writing, BTC’s CPI is 0.045.

Source: CryptoQuant

Between March 31 and April 1, this number increased by more than 250%. This increase confirms a resurgence in trading activity from US-based coin holding investors. BTC’s Coinbase Premium Gap also increased by more than 200% within that 24 hours.

Related: Bitcoin’s Drop to $65,000 Triggers Strong Liquidation Wave

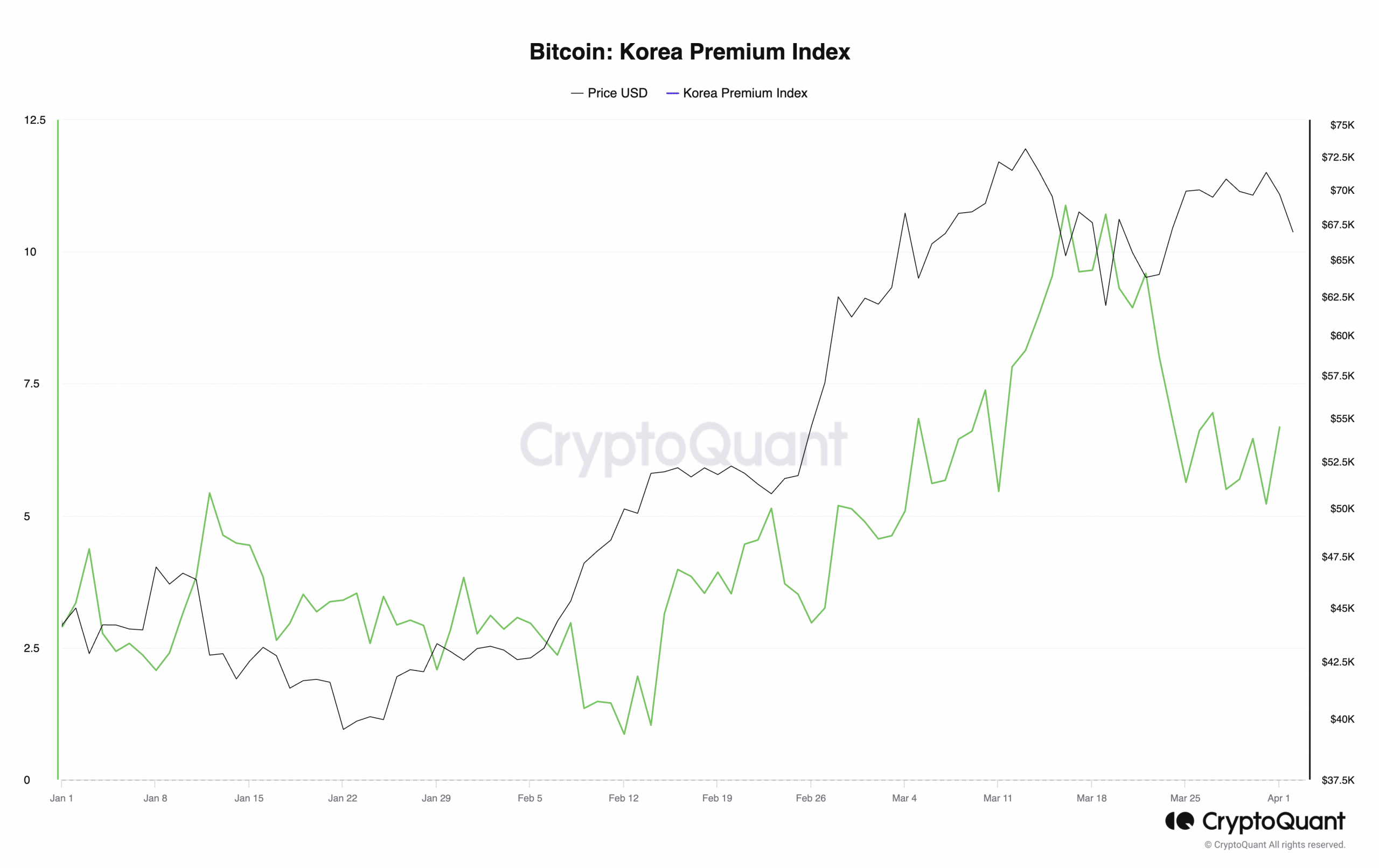

Although the Asian market also followed a similar trend during this period, an assessment of BTC’s Korea Premium Index (KPI) shows that the demand for Bitcoin in this market remains positive in 2024, despite many retreats.

At the time of writing, BTC’s KPI is 6.68. This metric measures the price gap of BTC between exchanges in South Korea and other global exchanges. When the index is positive, it indicates that the demand for Bitcoin in the Korean market is increasing compared to other markets.