Rapid fluctuations in the market have caused significant losses. Bitcoin’s price plummeted from $69,450 to $65,970 in less than 30 minutes, resulting in a loss of 5%.

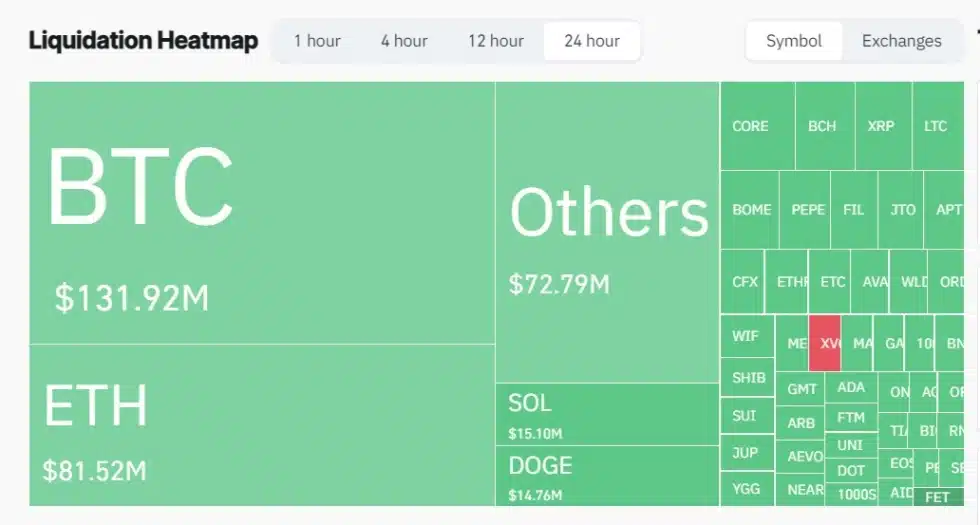

This sudden drop triggered the liquidation of over $165 million for leveraged traders, especially affecting Bitcoin and Ethereum holders, with total liquidations exceeding $90 million la. At the same time, Dogecoin and Solana traders also faced millions of dollars in losses, demonstrating the widespread impact of Bitcoin’s price fluctuations on the market.

Along with the Bitcoin blitz, cryptocurrency exchange-traded funds (ETFs) have seen significant financial fluctuations, with net inflows reaching $86 million. While BlackRock’s ETF recorded the highest net capital inflows, Grayscale’s GBTC faced significant capital outflows, demonstrating investor sentiment at this time.

Additionally, stablecoin Tether experienced a brief period of divergence from the dollar exchange rate, adding to the instability in this turbulent market. The temporary cause of this instability for Tether remains unclear, with speculation surrounding errors in data tracking or sudden shifts in the market.

ETFs and Tether react to market fluctuations

The impact of this event on traders and markets is remarkable. It highlights the potential dangers of using leverage in a volatile cryptocurrency market. The rapid liquidation of more than $165 million in positions has served as a warning to traders about the use of their investment assets, especially in a market known for its sudden and strong fluctuations.

Related: Tether Acquires $627 Million Worth of Bitcoin in Q1 2024

Additionally, the reaction of ETFs and the temporary outage of Tether have highlighted the relationship between different aspects of the crypto ecosystem, where volatility in one segment can comprehensive impact.

Conclude

Bitcoin’s sudden 5% price drop and the liquidation of $165 million worth of leveraged positions have highlighted the volatility of the cryptocurrency market and the hidden dangers behind the use of leverage. The impact of this event has also spread to ETFs and stablecoins, illustrating the far-reaching consequences that significant price movements can have on the financial landscape.

As the market recovers, both traders and investors need to remember the importance of a prudent trading strategy and careful market analysis in an unpredictable cryptocurrency environment.

OMN

OMN  BTC

BTC  ETH

ETH  USDT

USDT  XRP

XRP  BNB

BNB  SOL

SOL  USDC

USDC  TRX

TRX  DOGE

DOGE

I need

This is the effect of the expected Bitcoin halving.

I wish I can start investing on a Bitcoin now

I will like to know more about Bitcoin