Bitcoin Continues to be Acquired by Tether

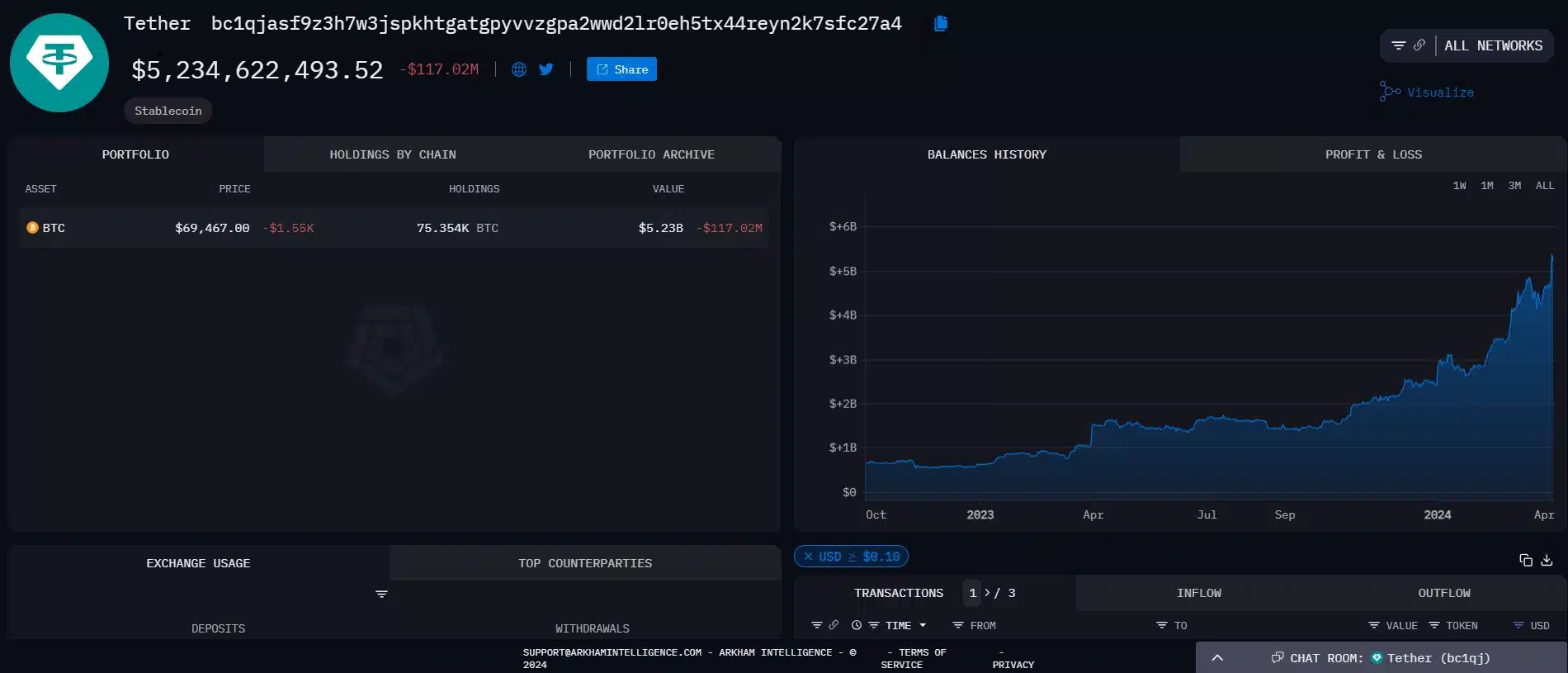

Entering the first quarter of 2024, the stablecoin giant Tether has caused a stir by purchasing a massive amount of Bitcoin – $627 million, thereby pushing the total value of Bitcoin in its reserves to a record-breaking $5.2 billion, equivalent to 75,354 BTC. For the first time, the amount of Bitcoin owned by Tether has surpassed the $5 billion mark, marking a significant milestone.

While Tether still keeps its Bitcoin addresses private, last year, The Block unveiled and verified an address belonging to this major player. According to their findings, this address has been accumulating Bitcoin reserves quarterly since September 2022. With the recent purchase, Tether’s position has skyrocketed to the 7th place in the list of the largest Bitcoin whales, a steep climb from its previous 11th position.

Tether’s Chief Technology Officer, Paolo Ardoino, confirmed the new purchase to The Block, stating that the company has spent a substantial amount to acquire 8,889 BTC in the first quarter. He said:

The purchases took place throughout the quarter, and were settled at the end of the quarter.

For the first time, in May 2023, Tether publicly disclosed the amount of Bitcoin they hold through a quarterly financial report. At that time, the company asserted that it would use 15% of its quarterly profit to buy Bitcoin and shift its stablecoin reserves into cryptocurrencies.

Tether Increases Market Influence

This significant-scale Bitcoin purchase by Tether has sounded alarm bells for cryptocurrency investors. As the largest stablecoin in the market, Tether’s decision to bolster its Bitcoin reserves could directly impact the value and liquidity of the USDT token, which currently holds 60% of the global stablecoin market share.

In addition to direct investments in Bitcoin, Tether is also involved in mining and energy production for Bitcoin. This behemoth has also begun to venture into the field of artificial intelligence (AI), with ambitions to “lead in the development of diverse open-source AI models to set new standards for the industry, promote innovation, and utility for AI technology.”

Related: Tether Expands Investment Portfolio into AI Category

OMN

OMN  BTC

BTC  ETH

ETH  USDT

USDT  XRP

XRP  BNB

BNB  SOL

SOL  USDC

USDC  TRX

TRX  DOGE

DOGE

En quoi celle acquisition massive de Bitcoin par Ether est-profitable pour nous ?

AZ to the moon