Bitcoin price could surge to $100,000, as significant amounts of stablecoins flow into exchanges, often seen as a signal of upcoming buying pressure.

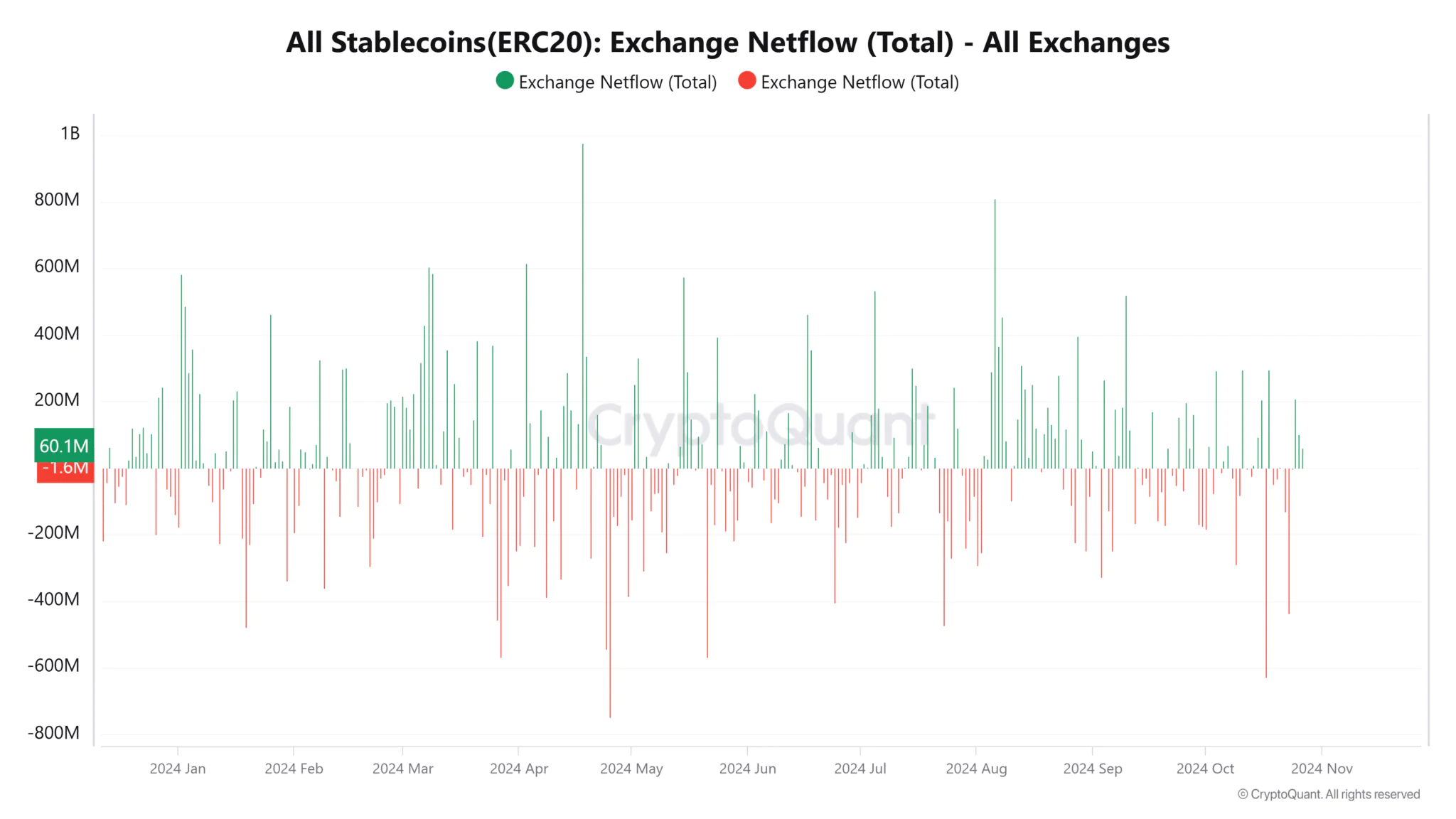

Stablecoin Inflows Reflect Strong Buying Demand

Analysis of the stablecoin net flow chart on CryptoQuant shows a steady inflow of stablecoins into exchanges, which has been particularly evident over the past few weeks.

This trend suggests that investors are gearing up to buy Bitcoin, as stablecoins are often the primary means of trading cryptocurrencies. Over $213 million has been inflowed so far, signaling a surge in market activity.

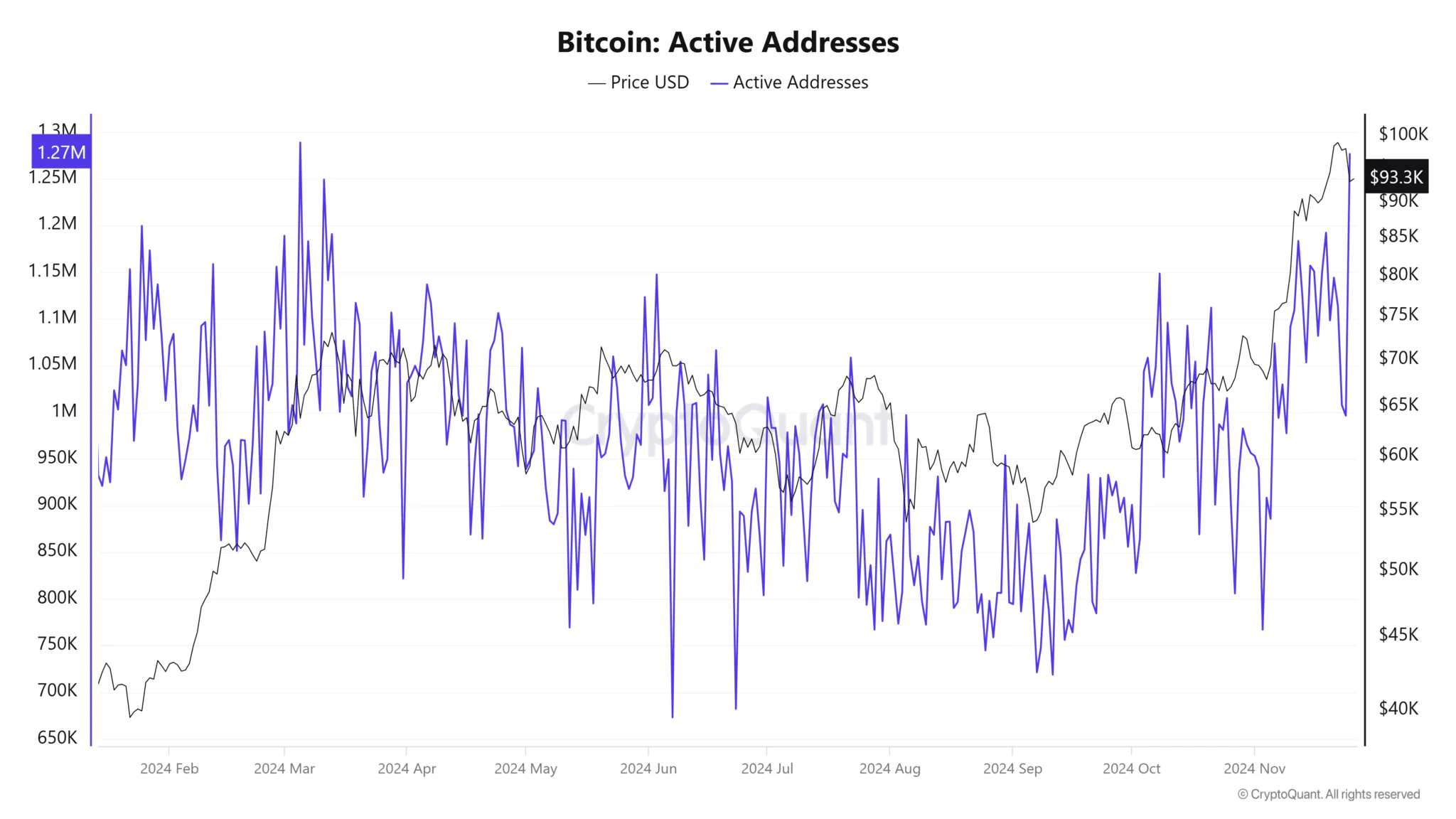

Active Addresses Surge Along with Network Activity

Bitcoin’s active address count, a measure of usage and network engagement, has been steadily rising in line with Bitcoin’s price and stablecoin inflows.

The latest data shows that the number of active addresses has reached around 1.27 million, the highest level since March. This reflects growing participation in the Bitcoin ecosystem, further strengthening the momentum for the current rally.

The increase in Bitcoin active addresses reflects growing interest from investors, and is consistent with historical bullish patterns during periods of network activity.

Bitcoin Net Flows: A Multi-Dimensional Story

Data on Bitcoin exchange net flows provides a multi-dimensional view. While inflows highlight increased trading activity, outflows also increased, indicating that investors are accumulating, while reducing selling pressure.

This balance contributes to Bitcoin’s gradual move towards $100,000. Currently, net flows remain negative, with over 5,000 BTC withdrawn from exchanges, reinforcing the accumulation trend.

Stablecoin metrics and other key indicators underscore that stablecoins will play a vital role in Bitcoin’s journey towards the $100,000 mark.