Bitcoin has undergone a sharp correction over the past 24 hours, falling from a high of $69,500 to a low of $66,800, before recovering to its current price.

Signals Bitcoin Bearish

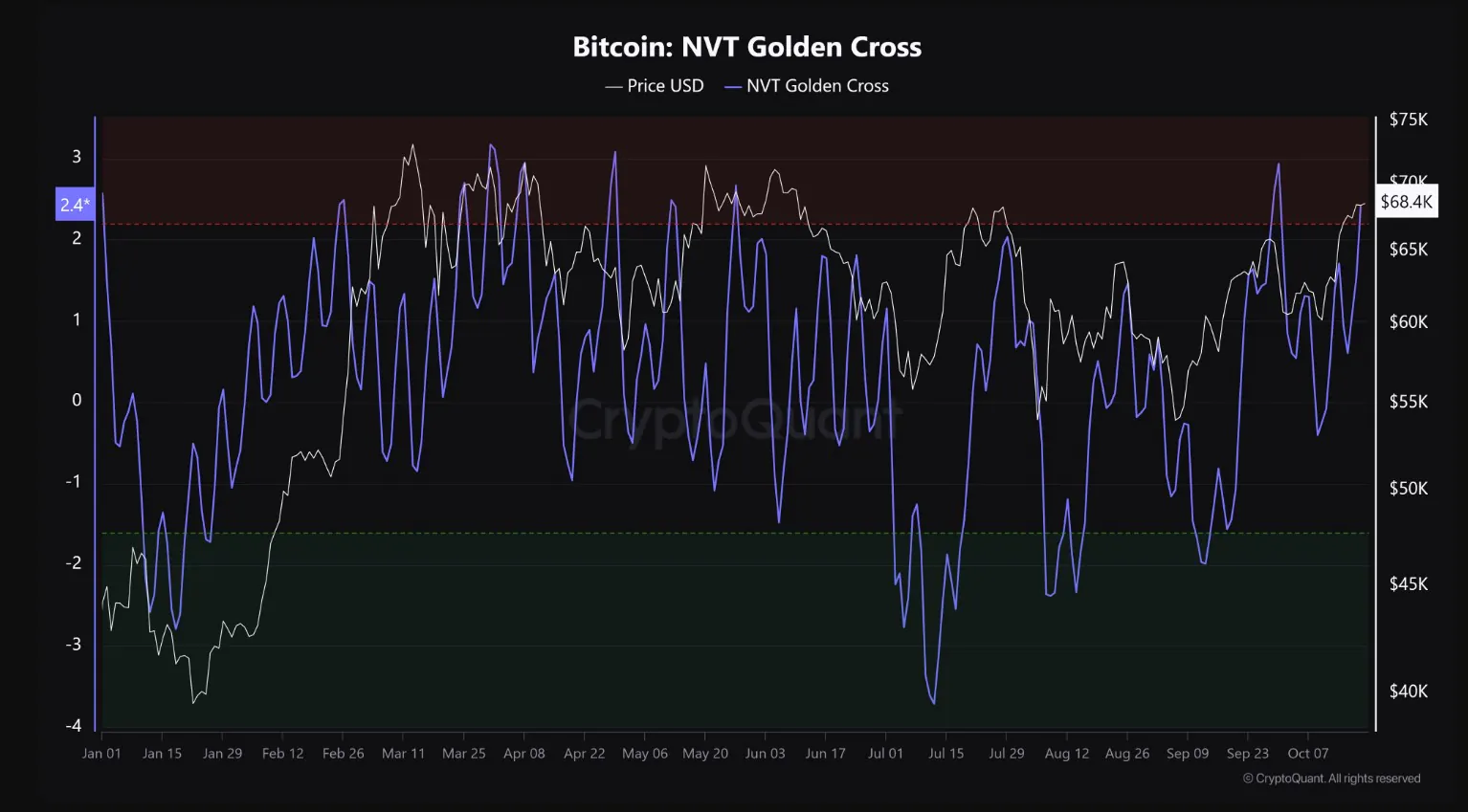

CryptoQuant analyst Burak Kesmeci said that Bitcoin is entering a correction after the golden cross signal on the NVT indicator appeared.

Bitcoin’s NVT Golden Cross has entered the overheated zone in the short term. The market is likely to correct before continuing the uptrend. The NVT Golden Cross reaching the overheated level suggests that Bitcoin’s price is currently above the level that network activity can support.

This implies that the price has been pushed higher than the actual value transferred on the blockchain, leading to overbought conditions. When the rally is not supported by real demand from the network, such conditions often signal a correction, when the market needs to bring the price back into balance with the fundamentals of the system.

The current rally is unsustainable

The current fundamentals do not support a sustainable rally and are likely to correct to meet market demand. According to CryptoQuant, the NVT ratio has increased over the past week, indicating that Bitcoin is overvalued relative to its real utility and network activity. This results in the current price not being sustained.

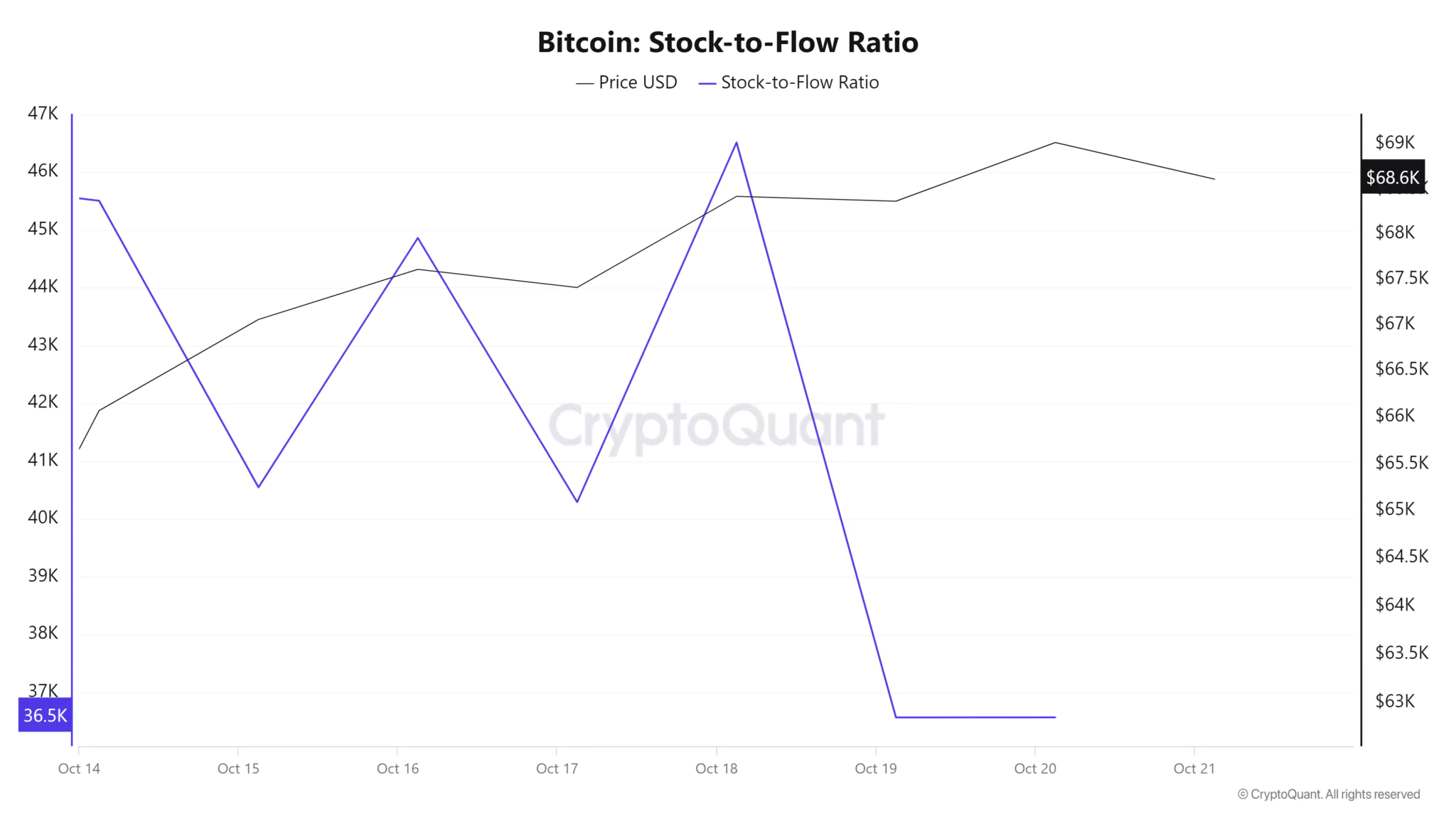

In addition, Bitcoin’s Stock-to-Flow ratio has decreased, indicating an increase in supply. Increasing availability of BTC often causes the market to turn bearish, especially when demand does not increase accordingly.

In addition, the divergence between Bitcoin’s price and DAA has remained negative over the past week, indicating that the current rally is not sustainable. When DAA is negative, it suggests that the current rally is largely driven by speculation or short-term demand. Therefore, although BTC has hit $69,500, the rally is largely driven by speculation rather than real demand. A correction is needed for Bitcoin to gain momentum and continue to rise to higher levels in the future.