Bitcoin is slowly recovering as selling pressure from active investors gradually subsides. With no significant macro hurdles in sight, BTC is expected to continue its steady growth momentum this week.

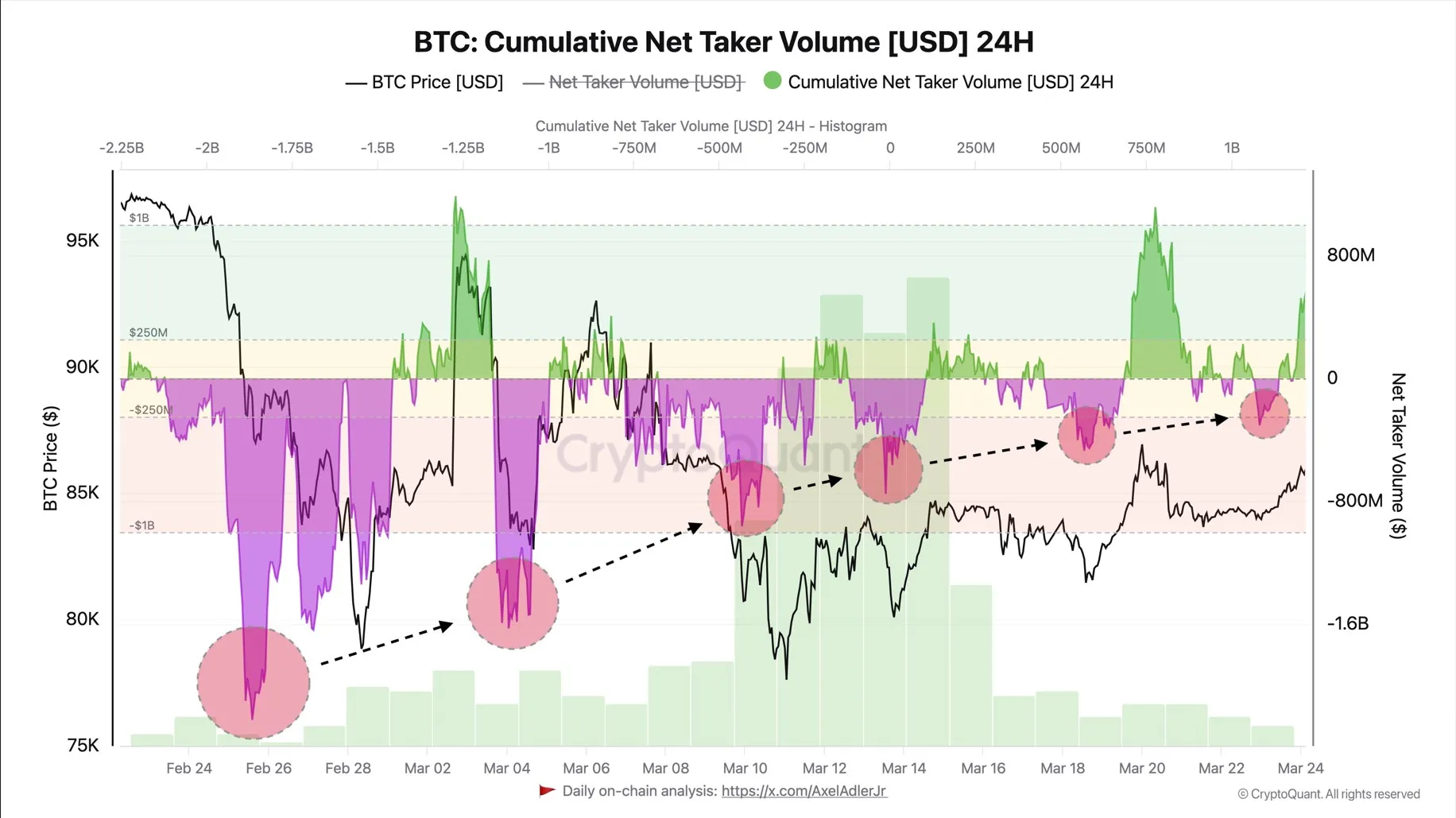

Over the past month, Bitcoin’s cumulative 24-hour trading volume has recorded many notable fluctuations. This indicator is a clear measure of market excitement. For most of February, the market was in the red as net trading volume fell to a low of -1 billion USD, indicating that selling pressure was dominant.

However, in recent days, there has been a clear reversal as the indicator has returned to positive territory, signaling that buying pressure is gradually taking over the market after a long period of selling pressure. History shows that whenever this indicator changes from negative to positive, BTC price usually responds with a slight increase.

The latest recovery is no exception to this trend, with BTC price bouncing from below $80,000 to above $87,000, in line with the overall market recovery.

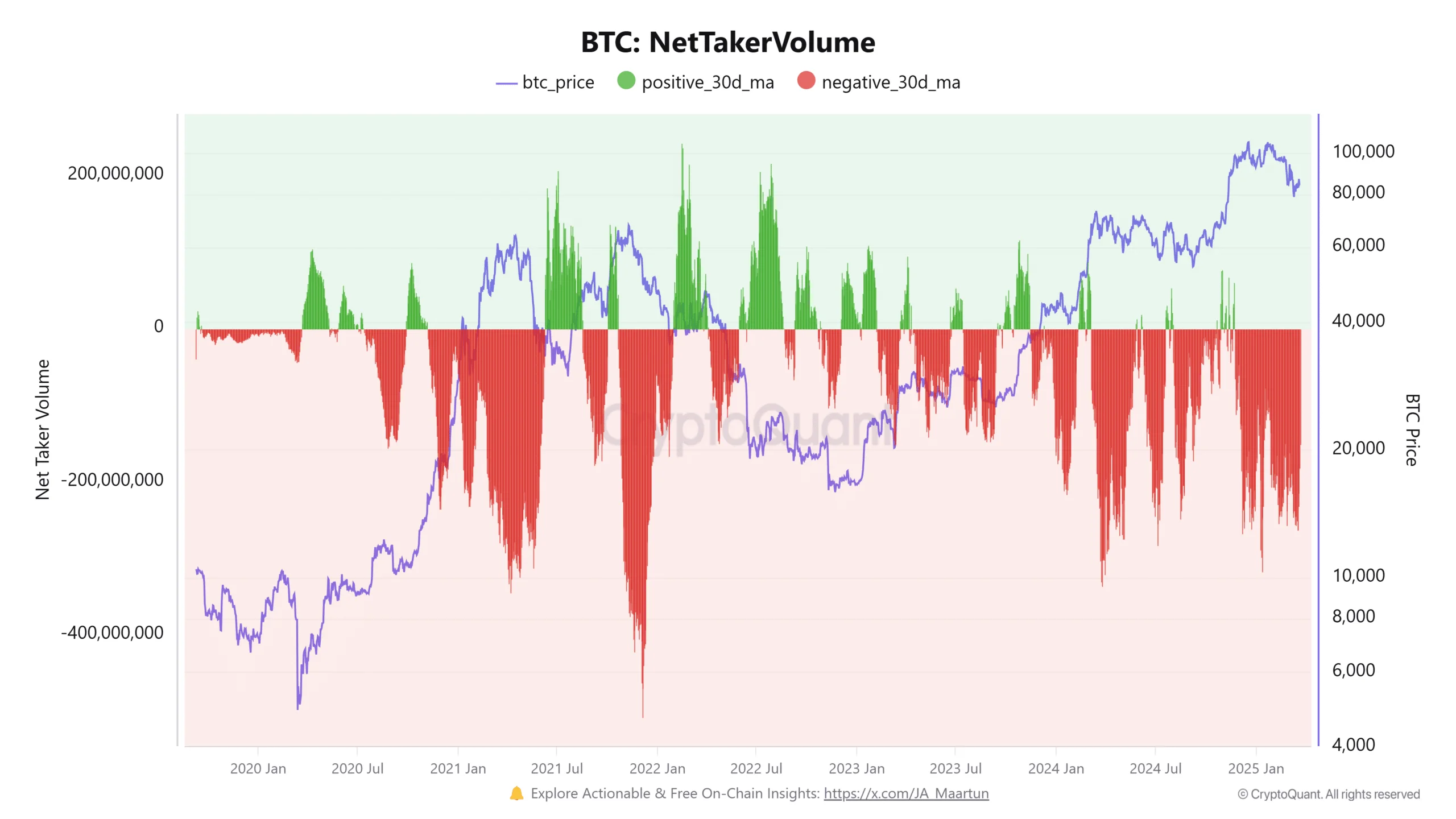

However, the positive signals in the 24-hour time frame are not enough to completely erase the caution from a long-term perspective. The Net Taker Volume indicator based on the 30-day moving average continues to show a dominance of net sellers, as shown by consecutive red bars on the chart — evidence that selling pressure is still present.

Although there have been a few short-term bursts with positive net trading volume in recent months, BTC’s growth momentum has not been truly stable. This suggests that the market needs more time to consolidate before entering a more sustainable uptrend.

This suggests that, although Bitcoin is showing positive recovery signals, the market still needs more time and momentum to establish a sustainable uptrend.

The recent recovery reflects a temporary cooling of selling pressure, but the lingering effects of previous sharp sell-offs are still weighing on market sentiment. A steady and sustained move into positive territory on the long-term chart would be crucial in cementing BTC’s bullish trend. If this scenario plays out, Bitcoin’s upside potential would improve significantly.

On the price front, Bitcoin has broken above its 50-day moving average (MA) at $85,017 and is currently trading around $87,134. The 12-hour chart shows continued improvement in market momentum, with the Relative Strength Index (RSI) rising to 58.35 — approaching bullish territory but not yet reaching overbought levels. This is a signal that the market is regaining balance, but needs more momentum to move into a stronger growth phase.