A recent report from Outlier Ventures claims that the four-year Bitcoin halving cycle is “dead,” arguing that halving events no longer significantly impact Bitcoin’s price as the cryptocurrency market matures. The report suggests that the influence of halving has diminished since 2016, with recent price fluctuations driven more by Bitcoin ETFs and macroeconomic factors, such as the post-COVID capital injection in 2020, rather than halving events.

The report asserts that the impact of Bitcoin halving on price has been overstated. Outlier Ventures, a Web3 accelerator, released its latest Token Trendlines report on Tuesday, declaring that “the four-year cycle is dead,” based on an analysis of Bitcoin price movements following the 2024 halving event.

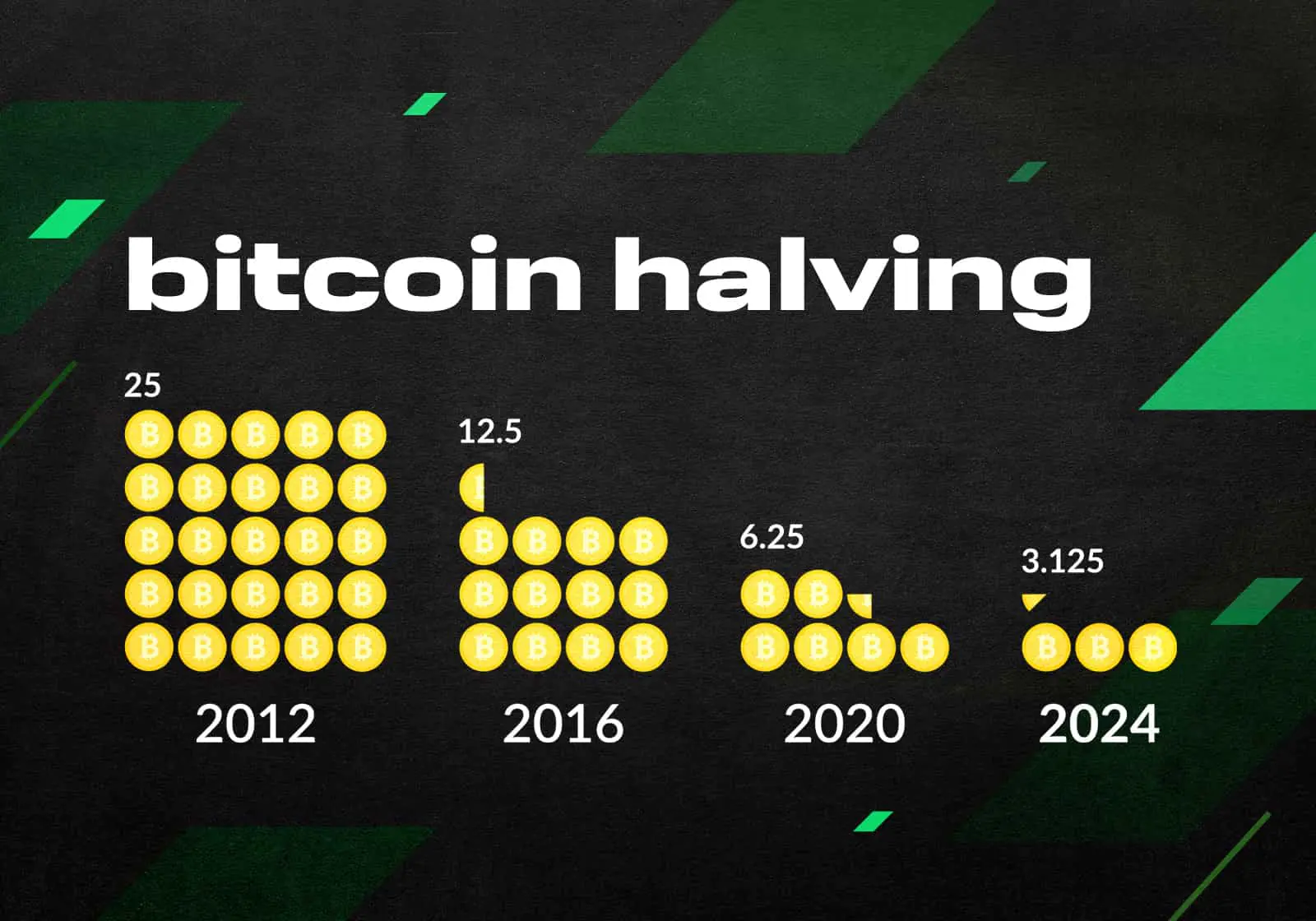

Authored by Jasper De Maere, the company’s Head of Research, the report argues that the effect of Bitcoin halving events has significantly decreased over time. He writes: “We believe 2016 was the last time halving had a major, fundamental impact on BTC price action. Since then, the size of BTC block rewards for miners has become negligible as the cryptocurrency market matures and continues to diversify.”

The analysis argues that the traditional four-year cycle is no longer a relevant factor in predicting price trends as the cryptocurrency market evolves.

Strategically, De Maere challenges the assumption that Bitcoin halving continues to play a critical role in price movements. He explains, “The strong performance of the BTC and crypto markets following the 2020 halving was coincidental, as the 2020 halving coincided with an unprecedented global capital injection post-COVID, with the U.S. alone increasing its money supply (M2) by 25.3% that year.”

Moreover, the report dismisses the notion that the four-year cycle will still hold in 2024, stating: “The approval of a Bitcoin ETF is a demand-driven catalyst, whereas halving is a supply-driven one, meaning they are not mutually exclusive.”

De Maere concludes, “While halving may have some psychological effect, reminding holders of their forgotten BTC wallets, it’s clear that its fundamental impact has become irrelevant. It’s time for founders and investors attempting to time the market to focus on more important macroeconomic factors instead of relying on the four-year cycle.”