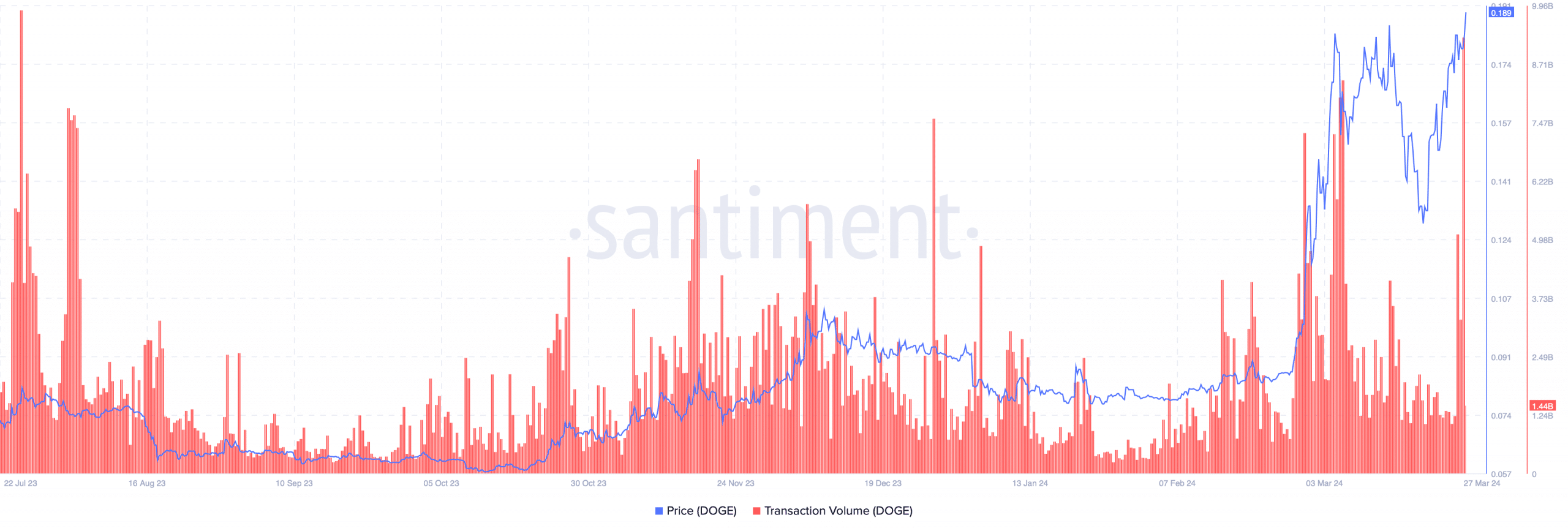

The price of Dogecoin (DOGE) has experienced a significant increase in recent weeks, even though the overall market has experienced a lot of volatility. One of the possible causes of this phenomenon is the sharp increase in online transaction volume.

Surge in volume

Data from Santiment shows that Dogecoin’s trading volume has increased significantly, from 1.22 billion to 9.20 billion within 48 hours. At the same time, the overall speed of movement around DOGE has also increased. This suggests that the number of DOGE transactions has also increased in recent days, possibly adding further impetus to DOGE’s recent rally.

Additionally, the number of DOGE holders is also increasing. This suggests that the recent price increase may have come from new market entrants, rather than from the accumulation of previous DOGE holders.

Interest in DOGE is shown by the many new addresses appearing, indicating its popularity in the cryptocurrency community is increasing. However, there are other factors that could hinder DOGE’s future growth.

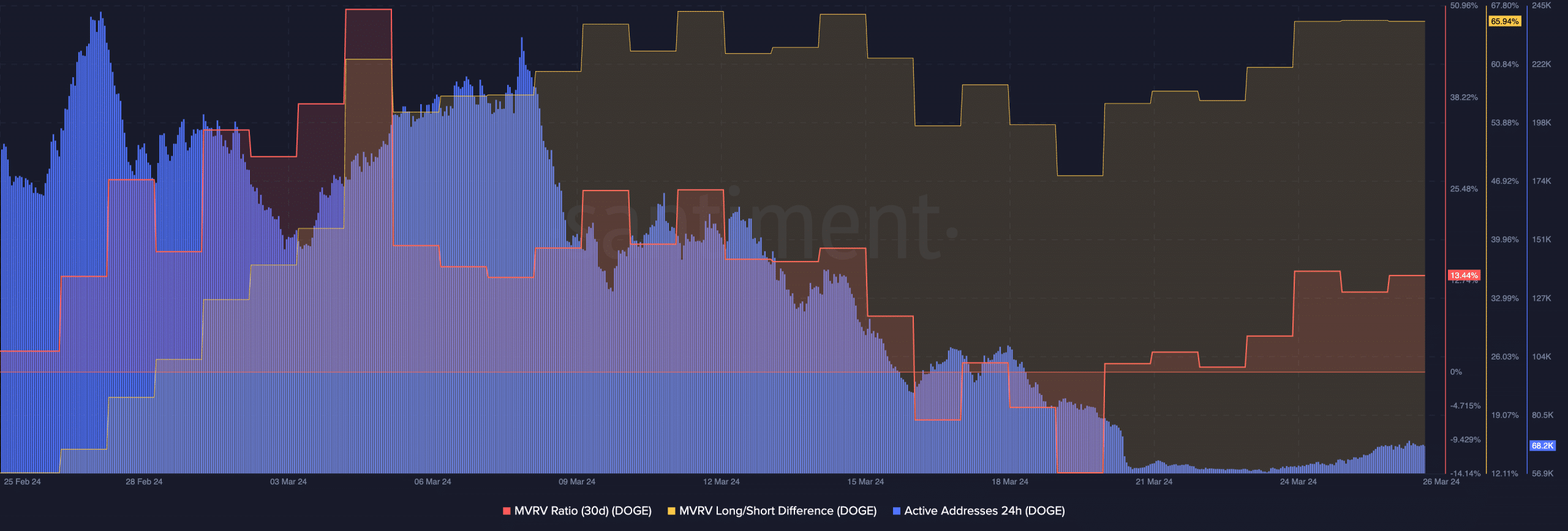

Analysis of data from Santiment shows that the number of daily active addresses on the Dogecoin network has decreased significantly over the past few days.

Source: Santiment

Some challenges ahead

The decline in activity on the network shows waning interest in Dogecoin’s overall ecosystem. If this interest continues to decline, there could be serious consequences for DOGE in the long term.

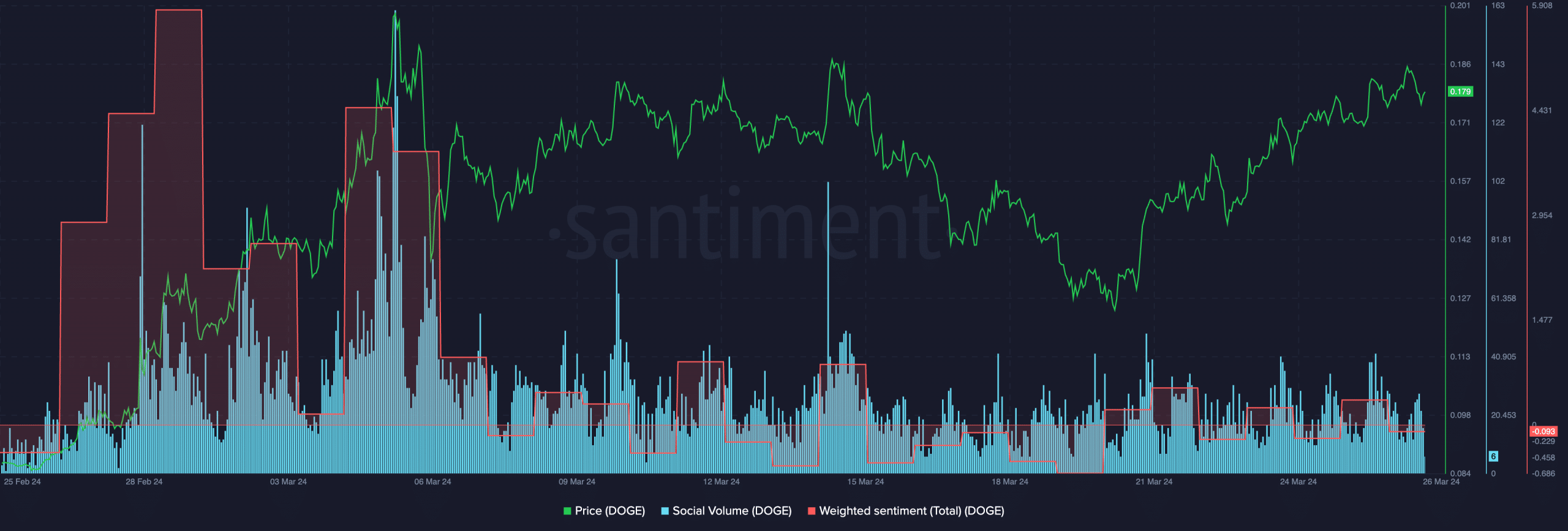

Another challenge that could affect DOGE is the volume of social activity surrounding the cryptocurrency. Since DOGE is a type of memecoin, its price is largely driven by activity on social networks.

Related: Elon Musk Continues to Promote Dogecoin

Latest data shows that the volume of social activity around DOGE has decreased significantly over the past few days. In addition, social sentiment around this cryptocurrency also decreased.

Source: Santiment

This means that the number of positive comments about DOGE has decreased, while the number of negative comments has increased. These factors may affect DOGE’s ability to recover.

Furthermore, the memecoin sector has seen significant growth over the past few months, both in high and low market capitalization areas. Memecoins such as PEPE and WIF have gained immense popularity and gained significant ground in the sector. The Solana memecoin craze has also attracted a large number of users. This could reduce DOGE’s liquidity and returns in the future.

BTC

BTC  ETH

ETH  USDT

USDT  XRP

XRP  SOL

SOL  BNB

BNB  DOGE

DOGE  USDC

USDC  ADA

ADA  TRX

TRX

Thanks