The cryptocurrency market is showing signs of recovery as global market capitalization reaches $2.71 trillion, marking a 1.13% increase, according to data from CoinMarketCap. However, beneath this resurgence, analysts warn of potential weaknesses as trading volume declines and price momentum slows, signaling exhaustion among traders.

In February, crypto trading volume peaked at $440 billion, driven by strong buying activity during market dips. However, as of March 12, this figure had plummeted by 63% to just $163 billion, according to CoinGecko. This sharp drop raises concerns about weakening growth momentum, prompting questions about the sustainability of the market’s recovery.

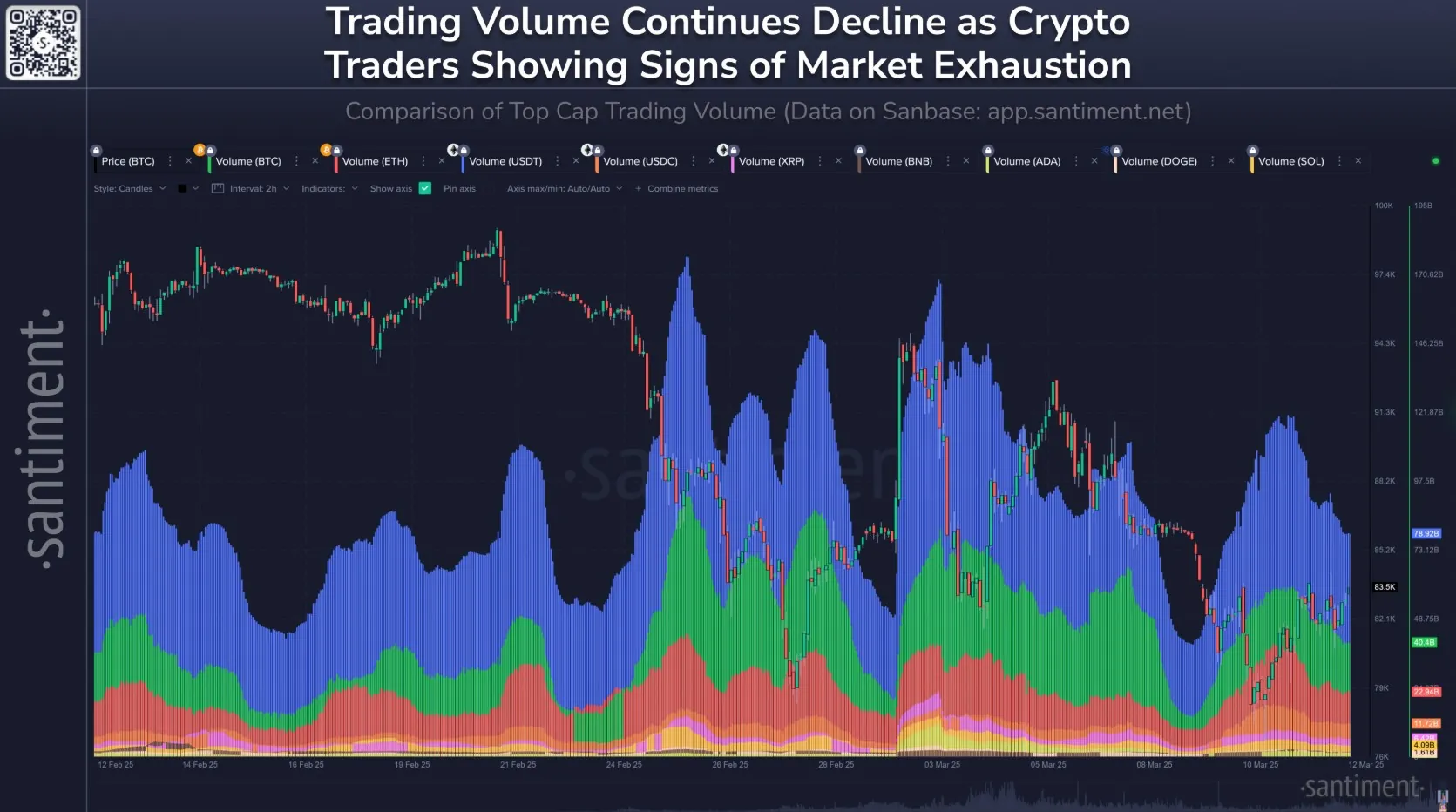

CoinMarketCap data reflects a similar trend, showing that trading volume peaked in early March 2025 before falling by 52%. Likewise, analytics firm Santiment highlights a notable shift in market sentiment, pointing out that trading volume has been steadily declining since its peak on February 27.

Santiment further noted:

“When the trading volume of major cryptocurrencies continues to drop, even as prices show mild signs of recovery (as seen on Wednesday), it often signals waning enthusiasm among traders.”

Initially fueled by optimism during the price downturn, the recent market cap decline is now accompanied by growing exhaustion, despair, and even signs of capitulation among traders.

As expected, with market volatility on the rise, traders are becoming more cautious, expressing skepticism about the sustainability of recent price gains. The drop in trading activity reflects increasing uncertainty, as fewer investors believe that current price levels offer attractive profit opportunities.

Moreover, the combination of weak trading volume and modest price recovery could indicate a loss of market momentum. Without significant buying pressure to support the uptrend, any short-term rebound risks losing steam, potentially triggering fresh volatility in the crypto market.

Read more:

Bitcoin Experiences Significant Volatility Over the Past 24 Hours

The “Volume Racing” Event of BingX: A Chance to Win 50,000 USDT!

“This raises the likelihood that any recovery may be short-lived, leaving prices vulnerable to another downturn.”

That said, while declining trading volume during a price recovery can be a warning sign, it is not necessarily a definitive bearish signal.

Trading volume reflects the level of participation from both retail and institutional investors. For a price rally to be sustainable, a rise in trading volume is a crucial factor. If buying activity strengthens significantly, it could lay the foundation for a more stable market trend.

“For a recovery to be considered healthy and sustainable, buyers typically want to see both price and trading volume increasing together.”