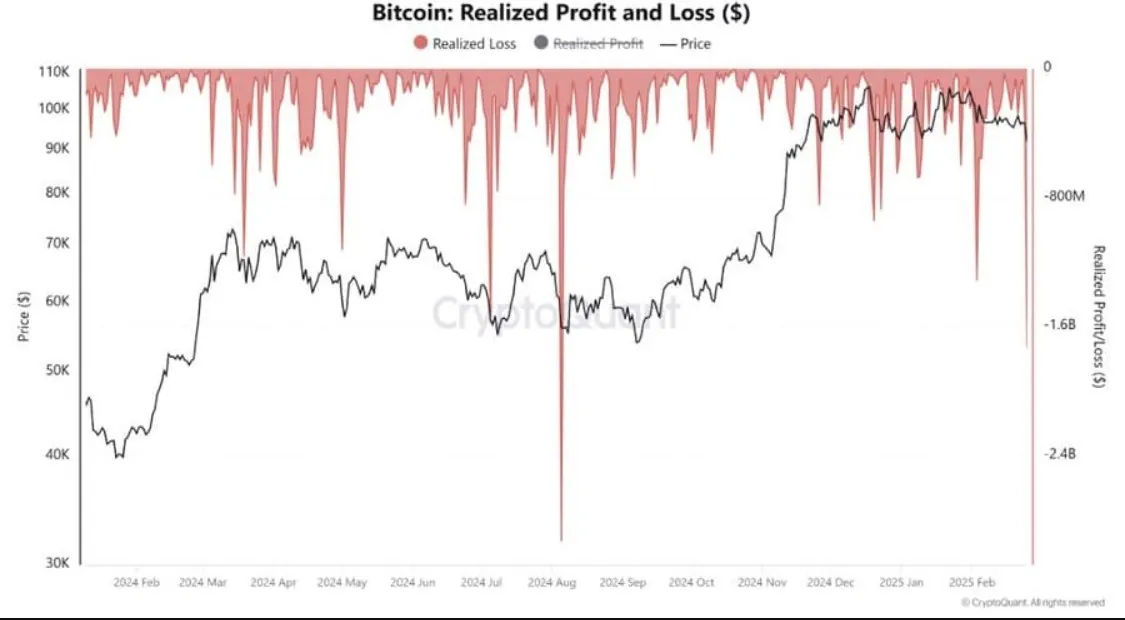

Over the past week, Bitcoin has experienced a notable decline, recording a significant loss of 10.77%—the largest drop in the past month. The downward trend has continued over the last 24 hours, with an additional 2.38% decline, marking the first major market capitulation since August 2024.

However, historical data suggests a strong potential for a price rebound, indicating that a new high could emerge once buying activity resumes. Short-term holders play a crucial role in shaping market trends based on their reactions.

In market conditions like these, analyzing the Short-Term Holder Spent Output Profit Ratio (STH-SOPR)—which tracks whether this group is selling at a profit or a loss—along with the Bollinger Bands, a technical indicator used to identify overbought and oversold zones, provides valuable insights into potential price action.

Historically, when STH-SOPR falls below the lower Bollinger Band—marked by the red circle on the left—Bitcoin has tended to rally sharply, quickly recovering previous losses. These rebounds typically range between 8% and 42%, and BTC is currently in this phase. If history repeats itself, Bitcoin could witness a significant upward recovery.

Additionally, Bitcoin recently recorded its largest market sell-off of 2025, the first of its kind since August 2024, primarily driven by new investors. This resulted in the sale of 79,000 BTC on the spot market and $1.7 billion in liquidated derivatives contracts, pushing Bitcoin’s price below $90,000 for the first time in three months.

A closer look at the charts reveals that following the major capitulation in August (marked by the red cloud on the left), Bitcoin’s price (black line) began a steady ascent. With a similar event occurring in the past 24 hours, BTC now has a significant opportunity for a price surge.

However, the bullish momentum depends on whether traders step in to buy. Market sentiment is gradually turning optimistic. Over the past four hours, a large short squeeze of $11.59 million has taken place, compared to only $663,900 in long liquidations.

When short liquidations significantly outpace long liquidations, it indicates that the market is moving against sellers. In this case, with short liquidations outnumbering long liquidations by 17.4 times, strong buying pressure is evident.

Another key market indicator, the funding rate, further confirms that long positions are dominating. A positive funding rate of 0.0039% supports this trend.

If buying activity continues to strengthen, Bitcoin could see a significant price rally in the coming weeks.