Bitcoin has rebounded to $98K following a disappointing January CPI report. The Consumer Price Index (CPI) for January came in higher than expected on both a monthly and yearly basis.

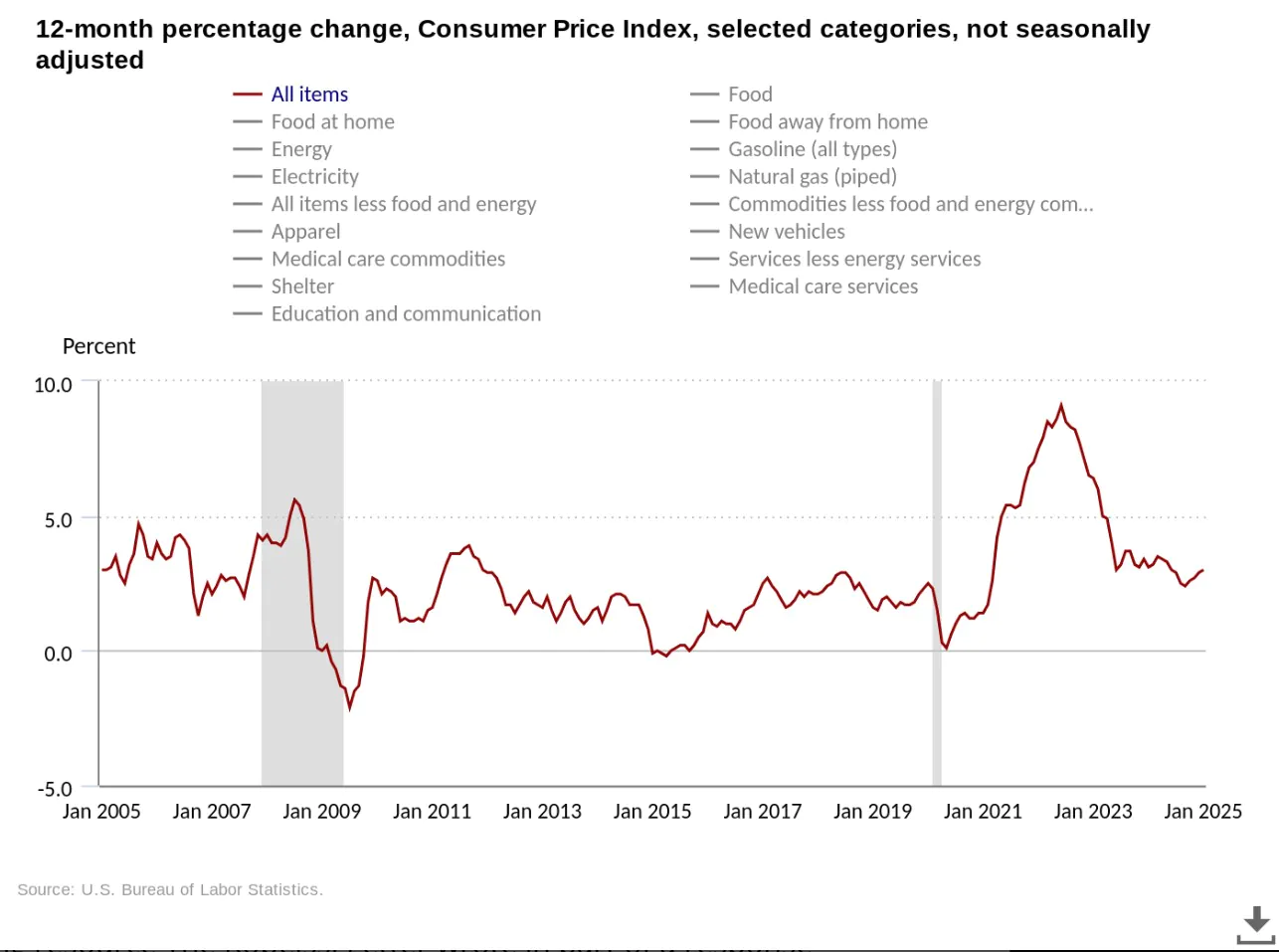

Data from the U.S. Bureau of Labor Statistics confirmed that CPI rose 0.5% last month, significantly exceeding the forecast of 0.2%. On a yearly basis, inflation stood at 3%, slightly above the projected 2.9%.

Traders have also lowered their expectations for a rate cut in the first half of 2025, now eyeing October as the next potential window for monetary easing.

Kobeissi remarked, “The market is unlikely to see another bullish scenario until DECEMBER 2026. In fact, recent data shifts suggest interest rates may remain elevated in the coming years.”

Bitcoin investors have secured nearly $800 million in profits, marking a substantial shift in profit-taking activity.

An analysis of Bitcoin inflows and outflows indicates that 82% of Bitcoin addresses are currently in profit, with an average entry price of $51,086.23. This high proportion of profitable holders reflects strong optimism among Bitcoin investors. However, 7.85% of addresses remain in the red, meaning some holders could face losses if prices decline further.

When a large number of addresses are in profit, selling pressure may increase, potentially impacting the overall price trend.

Bitcoin’s net inflows over the past 24 hours have risen by +2.31K BTC, indicating that more Bitcoin is being moved to exchanges, likely for selling.

Over the past 30 days, inflows have surged by +136.53K BTC, signaling substantial liquidity in the market. This trend could suggest that traders are positioning themselves for potential volatility. However, it may also indicate a bullish outlook if Bitcoin manages to break through key resistance levels.