Bitcoin experienced a dip to $94,900 before making a mild recovery. Over time, its volatility has been influenced by multiple factors, including market sentiment and institutional investment strategies. However, one often-overlooked element is the role of over-the-counter (OTC) transactions in shaping price movements.

How OTC Markets Affect Bitcoin Liquidity

OTC trading platforms allow large-scale Bitcoin transactions to occur privately, minimizing their immediate impact on market prices. These platforms are primarily used by institutional investors, enabling them to buy or sell substantial amounts of Bitcoin without triggering drastic price fluctuations.

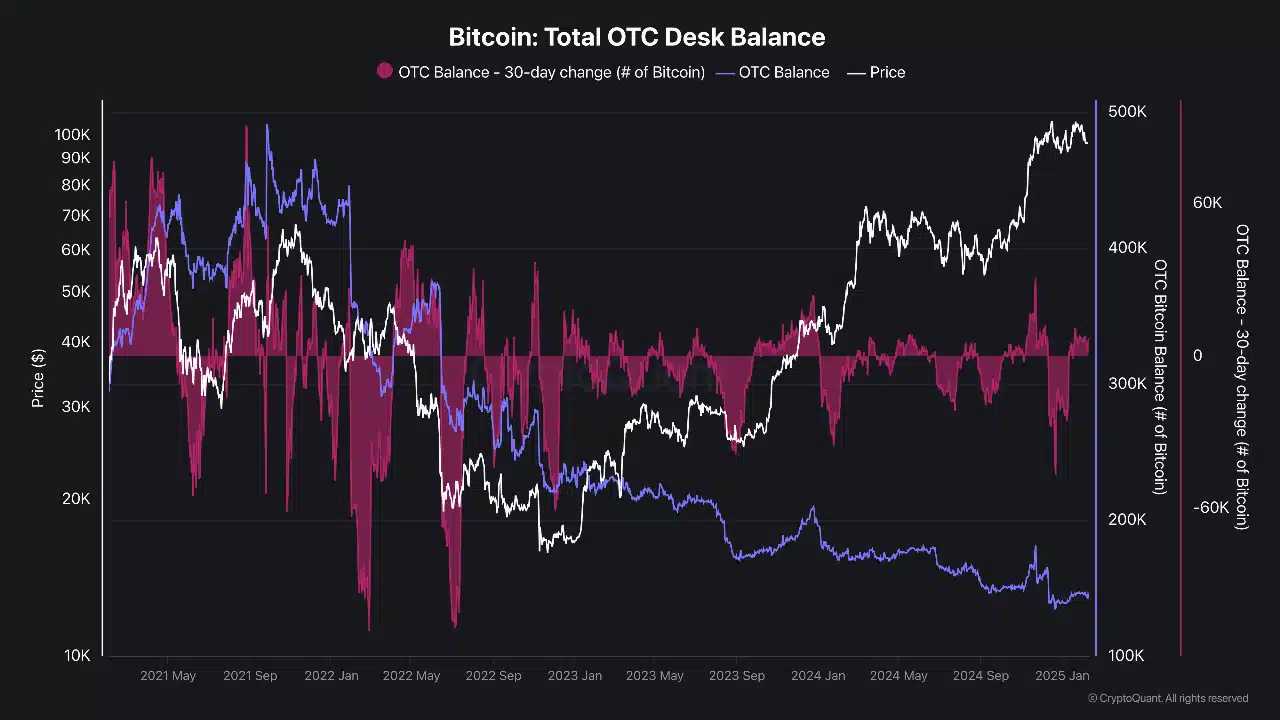

According to CryptoQuant, OTC balances stood at 480,000 BTC in September 2021. Despite Bitcoin reaching the $100,000 mark, these balances have since declined to just 146,000 BTC. This steady decline signals a sustained institutional demand, highlighting the growing reliance on OTC platforms for large transactions.

The Implications of Declining OTC Reserves

As OTC reserves shrink, the potential market impact of large Bitcoin purchases grows. With only 146,000 BTC remaining in OTC markets, future institutional acquisitions may need to take place directly on public exchanges, potentially leading to more pronounced price movements.

Meanwhile, U.S.-based exchanges currently hold nearly 1 million BTC, creating significant sell-side liquidity. Additionally, Bitcoin miners, holding around 117,000 BTC, may also choose to sell through OTC platforms, though their preferences fluctuate.

As OTC balances continue to dwindle, public exchange transactions are expected to play a larger role, increasing immediate price volatility in the market.

Whale Activity and Market Trends

Recent whale movements have been noteworthy, with over 60,000 BTC transferred in the past week. This, combined with net flow data, provides valuable insights into market trends.

According to Into The Block, an inflow of Bitcoin to exchanges typically signals selling pressure. However, recent trends indicate a shift towards accumulation, which could suggest an upcoming bullish phase.

With whales accumulating and OTC reserves declining, the market may witness heightened volatility, followed by price stabilization at higher levels as institutional demand remains strong.