Raoul Pal and his views on the market situation

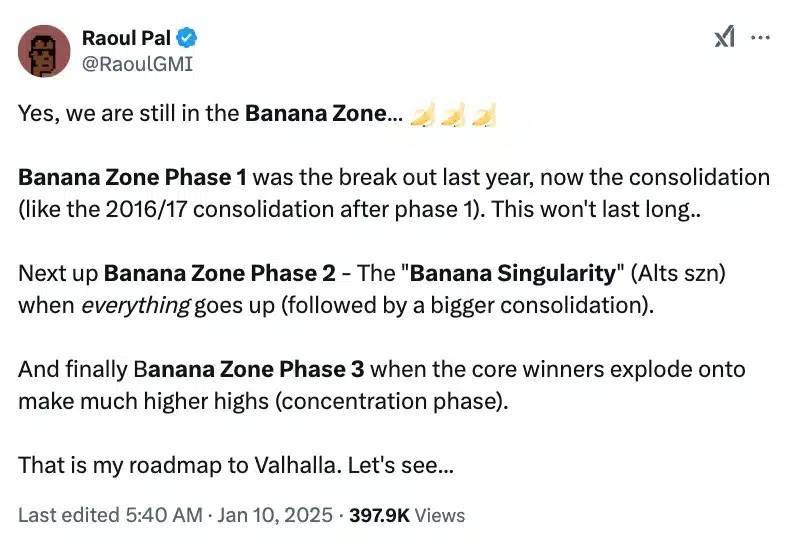

Adding a unique perspective to the discussion, Real Vision founder Raoul Pal introduced the concept of the “Banana Zone” in a recent podcast. Pal then further clarified the idea in a post on X (formerly Twitter), cryptically stating:

“We are still in the Banana Zone.”

This has sent the community into a frenzy of speculation about what it means for Bitcoin’s trajectory.

According to Pal, the concept of the “Banana Zone” describes a rapid rise in the price of a cryptocurrency where the price chart resembles a banana.

Pal further explained that the market is currently in an accumulation phase, following the “Phase 1 of the Banana Zone,” which was marked by last year’s price breakout. He compared this phase to market conditions during the crypto boom of 2016-2017.

Is Altcoin Season Nearing?

Raoul Pal believes that the current accumulation phase will not last too long, and he predicts that the market will soon move into “Phase 2 of the Banana Zone,” which he calls the “Banana Singularity” – a phase that he believes will trigger the altcoin season.

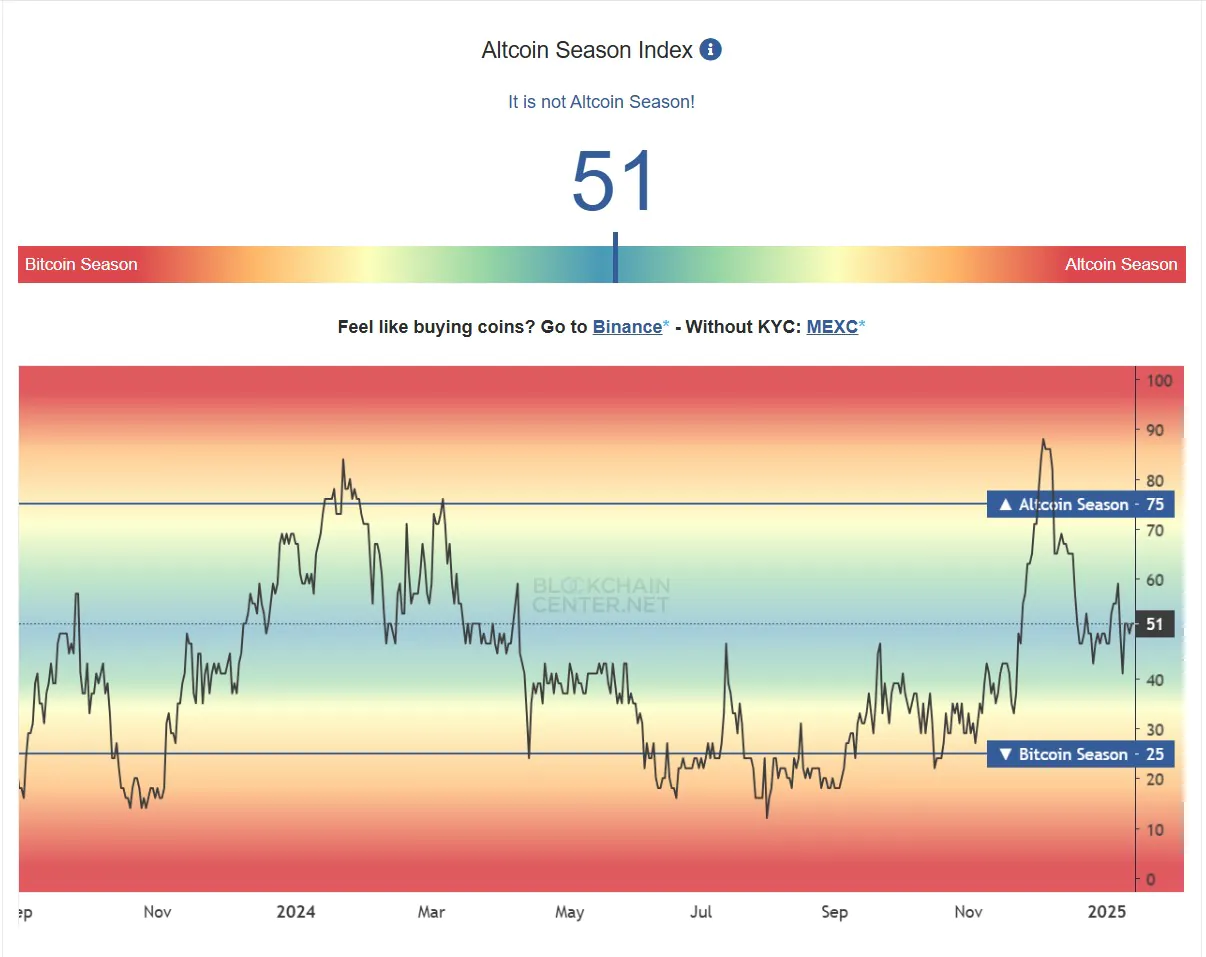

According to the latest update from BlockchainCenter.net, the altcoin season is still far away, with the index currently at 51 – a sign that it is not yet altseason.

In this phase, as Pal explained, “everything is bullish (followed by a bigger accumulation).”

Pal also believes that the market will eventually enter “Phase 3 of the Banana Zone,” which he calls the “concentration phase.” This is where major cryptocurrencies break out strongly and reach new all-time highs. This phase is expected to mark the final leg of the cycle, with select cryptocurrencies reaching new highs.

In a similar vein, an analysis based on data from IntoTheBlock revealed that 91.82% of Bitcoin holders are “in the money,” meaning they own tokens worth more than their initial purchase price.

This impressive figure reflects bullish market sentiment, further bolstering expectations for a bull run. In contrast, only 4.52% of BTC holders are “in the money,” meaning they own tokens worth less than their purchase price.

Read more: Trader Turns 90% Loss into $2.5 Million Profit with One AI Token

Given Bitcoin’s leading position in the market, this momentum suggests that the broader crypto market is likely to follow suit, with the majority of assets poised for a bull run in the near future.