Bitcoin shorts have thwarted another attempt to break above the threshold, maintaining pressure while buyers struggle to keep the price above $62,000. Currently, the price is hovering around $63,000, and a recovery to $70,000 may not be imminent. Some experts believe that the price will recover, while others warn that Bitcoin dominance may have peaked, signaling a risk of a price drop. Does this create an opportunity for an altcoin season?

Bitcoin dominance facing challenges

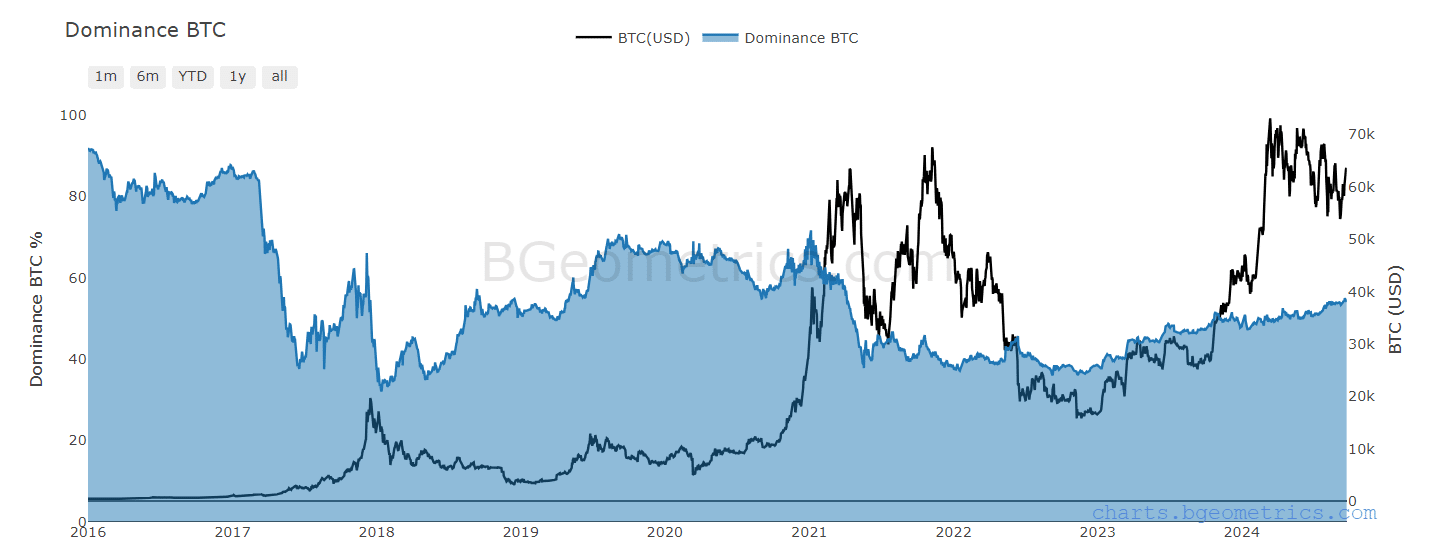

Historically, Bitcoin dominance has often played a key role in predicting market tops, reflecting Bitcoin’s large share of the cryptocurrency market. Typically, when BTC hits key resistance levels, its dominance often peaks.

However, the chart below shows a divergence when BTC hit its high of $73,000 in March. Despite the sharp price increase, BTC dominance has not changed significantly, implying a decoupling between price action and market share.

This suggests that interest in altcoins is growing, as investors tend to view them as less risky options than Bitcoin amid the volatility of the latter.

It is worth noting that the recent price action of Ethereum [ETH] has reinforced this hypothesis, as ETH has outpaced Bitcoin by more than double in the past week, rising more than 15% to $2,656 at the time of writing.

So should altcoin investors focus on key BTC resistance levels to predict the growth trend? This could be a key factor in predicting the next move of the market.

Diversification Signals Potential Market Top

According to recent data, 15 altcoins have outperformed Bitcoin over the past 90 days, with TAO topping the chart with an 80% gain against BTC. While this is only half the threshold for an altcoin season, the significant disparity is challenging Bitcoin’s dominance.

If this trend continues, a correction to $68,000 – the next resistance level – could be delayed, especially as Bitcoin’s dominance wanes with more altcoins entering the top 50, setting the stage for a potential altcoin season. But what are the odds?

The Market is at a Crucial Moment

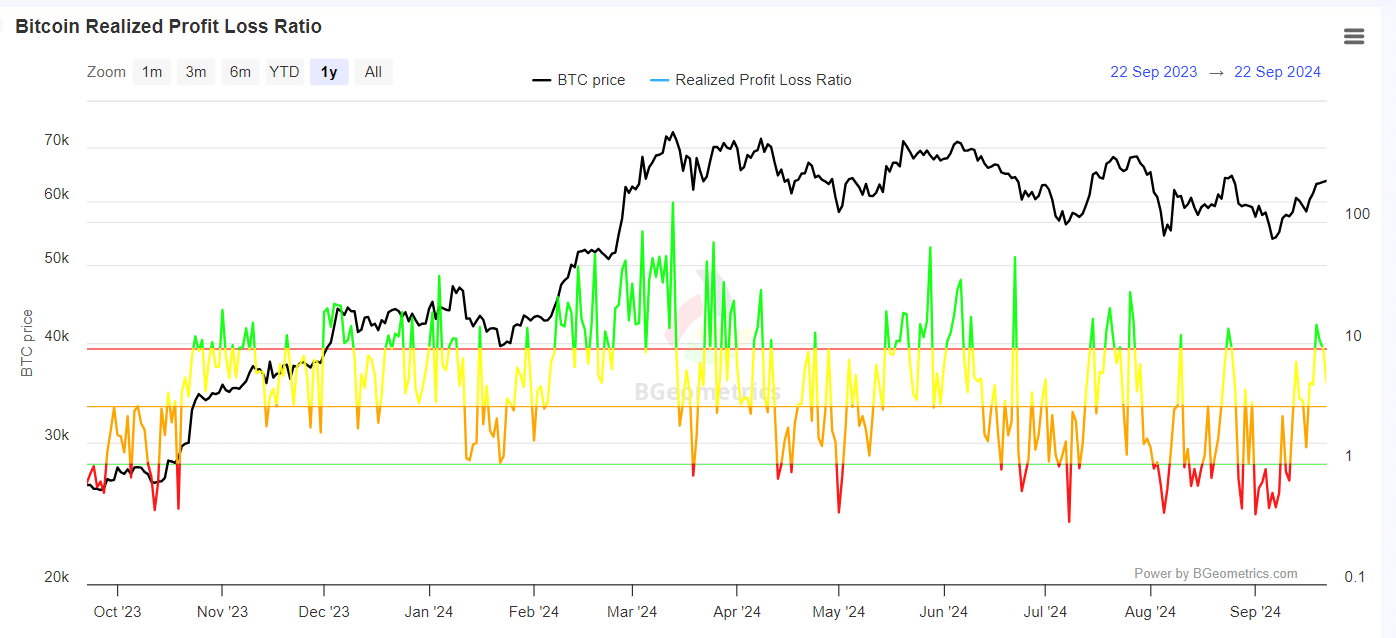

It is noteworthy that on the day Bitcoin retested $63,000, a large portion of investors booked profits, as shown by the green “wig” sign near 14.

However, as buyers failed to make a breakout and sellers gradually gained the upper hand, many investors began to take losses. If these investors lose confidence in the price correction, it could lead to panic selling, further weakening Bitcoin’s dominance.

In addition, this could also trigger a flight of assets to alternative cryptocurrencies, as investors view them as safer options.

In short, the market is at a crucial juncture. If Bitcoin’s dominance is maintained and buyers push for a breakout, the altcoin season could come to a halt, unless BTC breaks above the next resistance level at $68,000.

Conversely, if the bulls fail to hold the $64,000 price zone and BTC falls below $60,000 – which is highly likely – many altcoins could see a short-term surge. However, for an altcoin season to be truly sustainable, investor confidence in its future profit potential is key, and this is directly or indirectly related to Bitcoin dominance. Therefore, it is essential to monitor this dominance.