Bitcoin is currently trading at $65,000 with positive indicators. A new report from Glassnode reveals that Bitcoin [BTC] holders have maintained unrealized profits despite the leading cryptocurrency experiencing narrow price fluctuations in recent weeks.

At the time of writing, BTC is priced at $65,625. Moving within a horizontal channel, the cryptocurrency has encountered resistance at $71,656 and found support at $64,825. Nonetheless, despite this “sideways price movement,” “investor profits in BTC remain high.”

According to the on-chain data provider: “BTC’s price is consolidating within a well-defined trading range. Investors, in general, are still in a favorable position, with over 87% of the circulating supply held at a profit, having a cost basis lower than the spot price.”

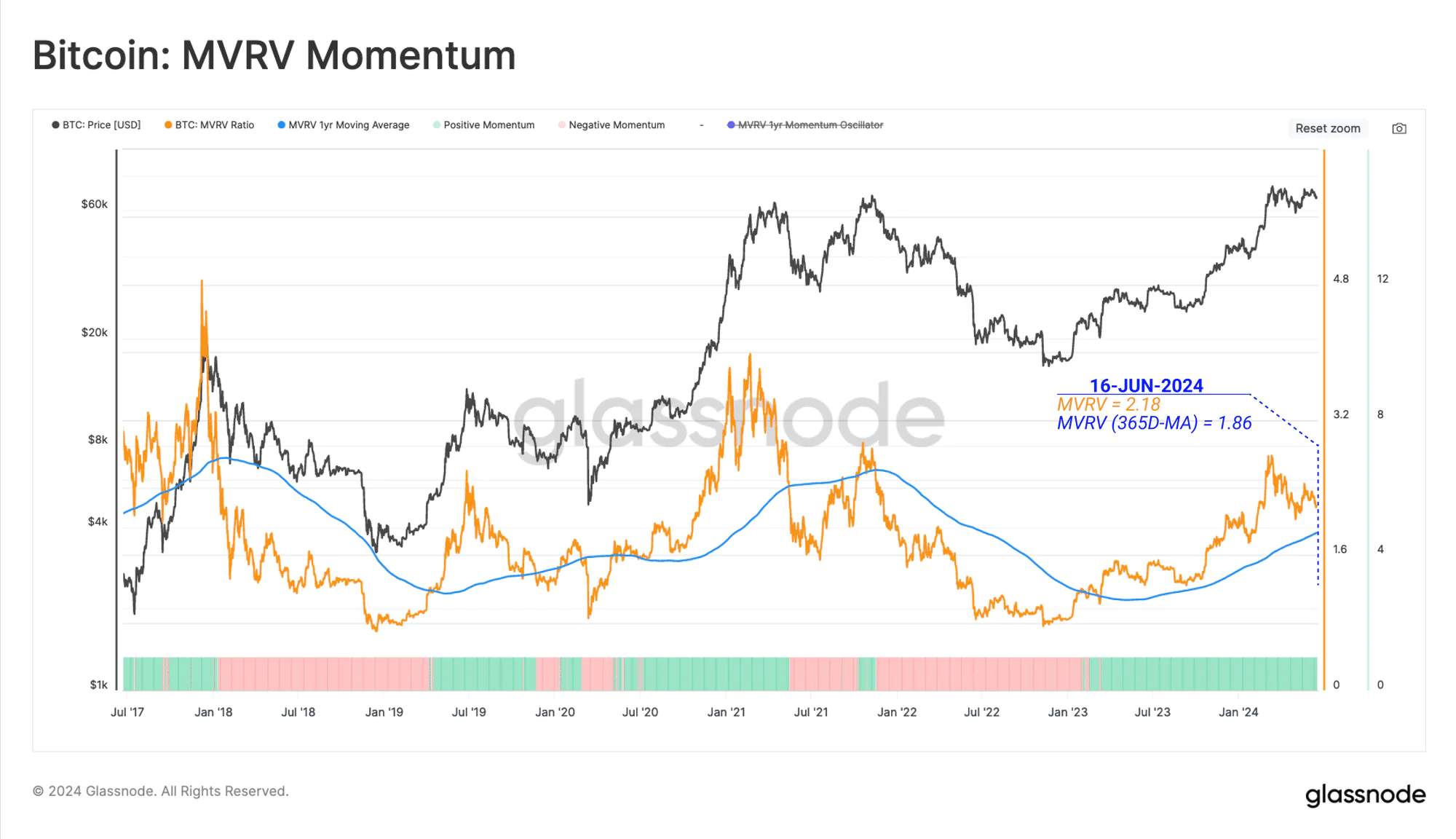

Glassnode assessed the coin’s Market Value to Realized Value (MVRV) ratio and discovered that the average circulating BTC holds an unrealized profit of over 120%. Interestingly, despite BTC holders being in profit, the volume of coins processed and transferred on the Bitcoin Network has significantly decreased since the all-time high (ATH) in March. Glassnode noted that this decline “highlights a reduction in speculative demand and increases market indecision.”

Low Exchange Activity

The consolidation of BTC’s price has also led to a decrease in BTC exchange inflows. Glassnode observed that short-term holders (STH) of BTC currently send about 17,400 BTC (valued at $1.13 billion at the current market price) to exchanges daily.

These investors typically hold their coins for a relatively short period, usually under 155 days.

Their current exchange inflow represents a 68% decrease compared to the 55,000 BTC sent to exchanges by this group when the cryptocurrency reached its all-time high of $73,000 in March.

Related: ETH Drops Sharply as Whales Increase Accumulation

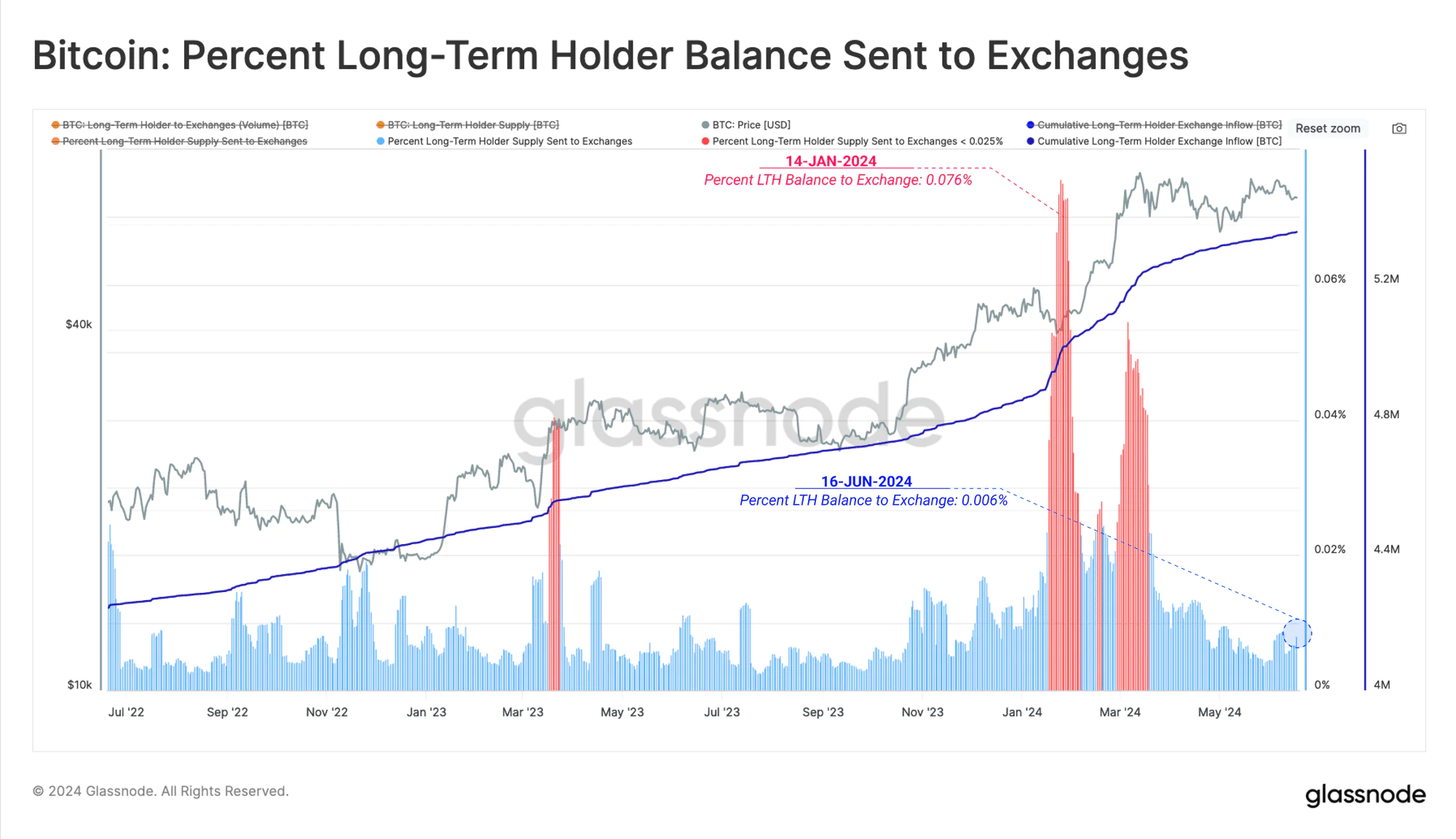

For long-term holders (LTH), “their allocation to exchanges is relatively low, with current inflows at just over 1k BTC/day.”

Glassnode stated: “LTH are sending less than 0.006% of their total holdings to exchanges, indicating that this group has reached a state of equilibrium and that higher or lower prices are needed to stimulate further action.”

The average BTC sent to exchanges generates a profit of around $5,500. This has led some long-term investors to sell and take profits.

As the market anticipates a rally to the $73,750 ATH, demand must be sufficient to alleviate selling pressure. However, it is “not substantial enough to push market prices higher.”