According to a report by James Butterfill, head of research at CoinShares, the inflows over the past week, despite the recent market conditions, suggest that many investors might view the recent dip as a “buying opportunity” rather than a sign to exit.

Fund Flow Details in Crypto

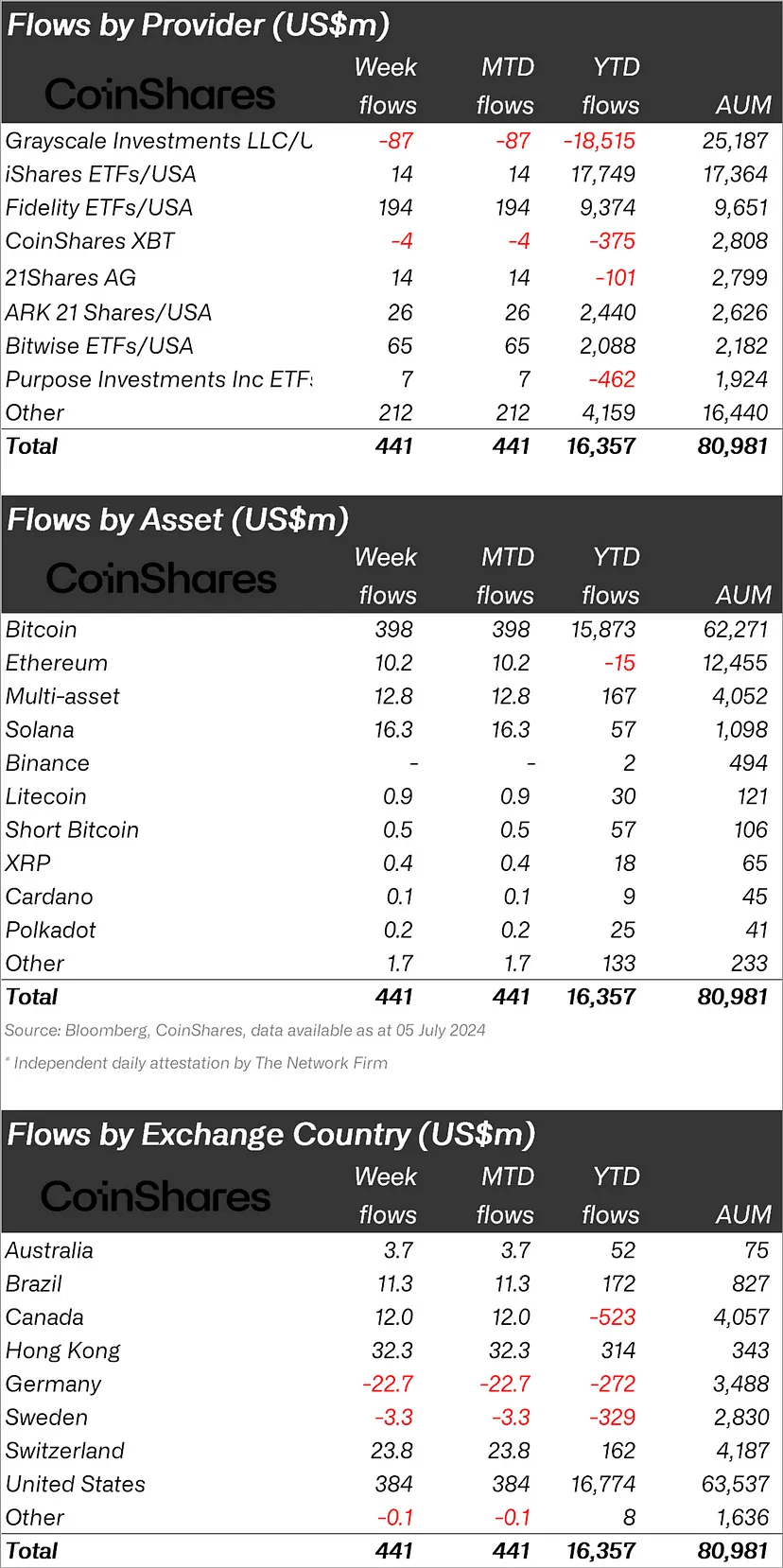

Bitcoin purchases saw widespread inflows this week, with Ethereum and other altcoins like Solana attracting considerable interest. Bitcoin led the inflows with $384 million, indicating a shift away from its usual near-total dominance.

A report from CoinShares reveals that Solana has performed exceptionally well, attracting $16 million in inflows. This brings its year-to-date (YTD) inflows to $57 million, making it the best-performing altcoin in terms of fund flows, according to James Butterfill.

Ethereum also experienced favorable adjustments with $10 million in inflows, although it remains the only major cryptocurrency still showing net outflows year-to-date.

Meanwhile, major investment firms like Ark Invest, Fidelity, and BlackRock have all noted similar trends in inflows. In the United States, Bitcoin garnered $384 million from local funds, highlighting a particularly robust market.

However, this optimism is not universal. According to Butterfill, funds based in Germany experienced net outflows of $23 million, potentially influenced by recent asset sales by the German government.

Market Performance: BTC, ETH, and SOL Show Signs of Stability

Despite the general market sentiment remaining relatively pessimistic, with several major cryptocurrencies experiencing sharp declines last week, Bitcoin, Ethereum, and Solana have shown signs of stability. Bitcoin dropped to a low of $53,000 on Friday, marking its lowest point since February. However, in the past 24 hours, Bitcoin, Ethereum, and Solana have seen modest recoveries.

Bitcoin experienced a slight increase, regaining the $56,500 level, while Ethereum rose by 2.2%, returning to the crucial $3,000 mark. The $16 million investment into Solana-based products coincides with VanEck, one of the world’s largest asset management and Bitcoin ETF providers, planning to launch a Solana-based ETF.

Related: Germany Holds $2.2 Billion in Bitcoin, Representing 10% of the Total Trading Volume

VanEck recently filed with the U.S. Securities and Exchange Commission (SEC) for approval to launch the first Spot Solana ETF, marking a significant milestone for the cryptocurrency.