Bitcoin reached a new peak of $88,000 after President Donald Trump proposed a “less stringent” tax plan set to take effect on April 2. This event has ignited a wave of optimism in the cryptocurrency market.

Previously, many macro analysts from QCP Capital and Coinbase expressed concerns about potential risks if a trade war reemerges at the beginning of Q2. However, following last week’s Federal Reserve (Fed) meeting, Bitcoin’s upward momentum not only remained steady but continued to surge, pushing the price to $88,000.

Bob Loukas, a renowned trader and analyst, stated that buyers currently hold control, and this bullish run could last for 15 weeks. He emphasized that structural and historical changes on the price chart are supporting the upward trend:

“There is no real reason for buyers to hesitate anymore — cyclical indicators are on their side. (We are currently in week 3)… If the market remains well-controlled, the rally could extend to 15 weeks.”

Sharing the same optimism, Arthur Hayes, founder of the BitMEX exchange, also believes that the Fed’s policy shift from quantitative tightening (QT) to quantitative easing (QE) is a crucial catalyst. Hayes predicts that Bitcoin could reach $110,000 and then surge to $250,000 before pulling back to retest the recent bottom of $76,000.

“Bitcoin’s price is more likely to hit $110,000 than to fall back to $76,500 in the next correction. If it reaches $110,000, it will be time to celebrate, and we won’t stop until we hit $250,000.”

While many analysts are optimistic, some experts remain cautious, suggesting that Bitcoin’s price action could be confined within a certain range in the near term. BTC trader Cryp Nuevo forecasts that Bitcoin could drop to $80,000, arguing that stop-loss hunting below the $83,000 mark will be driven by liquidity factors.

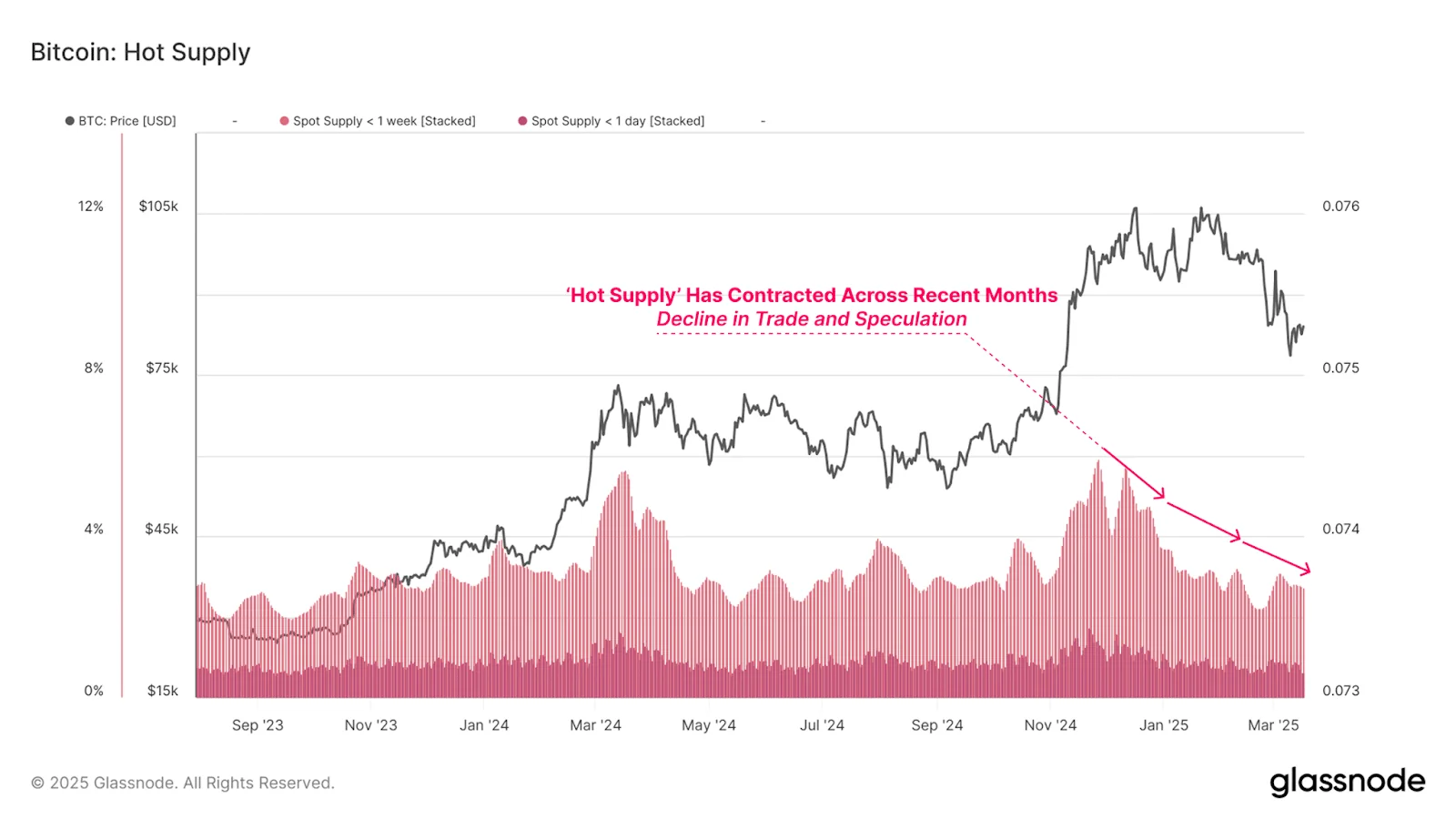

Meanwhile, Glassnode researcher VizArt warned that achieving a new all-time high (ATH) would be a “pipe dream” if Bitcoin fails to reclaim the $90,000–$93,000 price range. He shared:

“Most recent investors — those who bought between November 2024 and February 2025 — have a cost basis around $90,000–$93,000. Any recovery to this range could face selling pressure from those looking to break even. If this supply zone is not reclaimed, a new ATH will remain a distant dream.”